The program is intended to aid businesses hit hard by pandemic-induced lockdowns, but lenders are lobbying to have the rules relaxed to help owners of stores and offices damaged by recent riots and looting.

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

Members of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

Avivah Litan, vice president and distinguished analyst at Gartner, explains the evolving role blockchain has taken during the coronavirus pandemic. Blockchain, originally developed for use with bitcoin, provides a way to bring trust and order to the chaos of the current crisis, but it's no silver bullet.

An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

The global coronavirus outbreak has up-ended daily life for many consumers, including where they shop and how they pay for things. The U.K. is no exception, as issues of health and hygiene have now been introduced as important factors when it comes to both planned and impulse shopping.

The funds will be used to support housing, job training and aid for small businesses in communities that have been disproportionately affected by the pandemic.

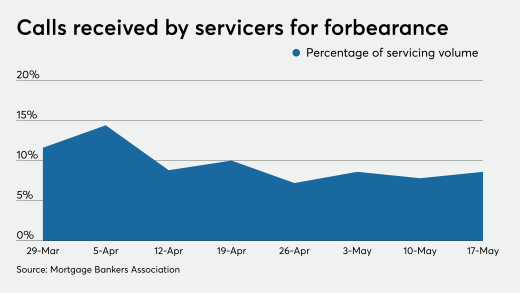

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

-

The program is intended to aid businesses hit hard by pandemic-induced lockdowns, but lenders are lobbying to have the rules relaxed to help owners of stores and offices damaged by recent riots and looting.

June 2 -

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

June 2 -

Members of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

June 2 -

Avivah Litan, vice president and distinguished analyst at Gartner, explains the evolving role blockchain has taken during the coronavirus pandemic. Blockchain, originally developed for use with bitcoin, provides a way to bring trust and order to the chaos of the current crisis, but it's no silver bullet.

June 2 -

An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

June 2

-

The global coronavirus outbreak has up-ended daily life for many consumers, including where they shop and how they pay for things. The U.K. is no exception, as issues of health and hygiene have now been introduced as important factors when it comes to both planned and impulse shopping.

June 2 -

The funds will be used to support housing, job training and aid for small businesses in communities that have been disproportionately affected by the pandemic.

June 2