Customers are more reliant than ever on digital banking tools, and institutions like OceanFirst, BBVA and M&T are thankful they had invested in teaching employees to show customers how to use them.

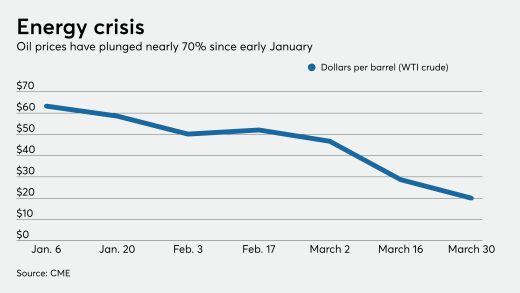

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

With branches closed and fewer opportunities for credit unions to have in-person interactions with members, the pandemic has reiterated the need for digital transformation in the industry.

The world’s largest payment companies are fighting for their own piece of the U.S. coronavirus stimulus: an assignment to help distribute some of the relief money that will be sent to millions of Americans in the coming weeks.

The ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.

The regulation established standards for investors who own less than a quarter of an institution. Banks are getting more time for implementation as they focus on effects of the COVID-19 pandemic.

The trend toward cashless is inevitable, and could be accelerated by current events. But a gradual transition is key to avoid alienating those people who depend on cash as their primary payment method.

With coronavirus driving more merchants to promote electronic payments over cash — and contactless payments over cards — many are still asking their customers to share a potentially virus-laden pen to sign a receipt or screen at the point of sale.

-

Customers are more reliant than ever on digital banking tools, and institutions like OceanFirst, BBVA and M&T are thankful they had invested in teaching employees to show customers how to use them.

March 31 -

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

March 31 -

With branches closed and fewer opportunities for credit unions to have in-person interactions with members, the pandemic has reiterated the need for digital transformation in the industry.

March 31 Ignite Sales, Inc.

Ignite Sales, Inc. -

The world’s largest payment companies are fighting for their own piece of the U.S. coronavirus stimulus: an assignment to help distribute some of the relief money that will be sent to millions of Americans in the coming weeks.

March 31 -

The ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.

March 31 -

The regulation established standards for investors who own less than a quarter of an institution. Banks are getting more time for implementation as they focus on effects of the COVID-19 pandemic.

March 31 -

The trend toward cashless is inevitable, and could be accelerated by current events. But a gradual transition is key to avoid alienating those people who depend on cash as their primary payment method.

March 31 11:FS

11:FS