-

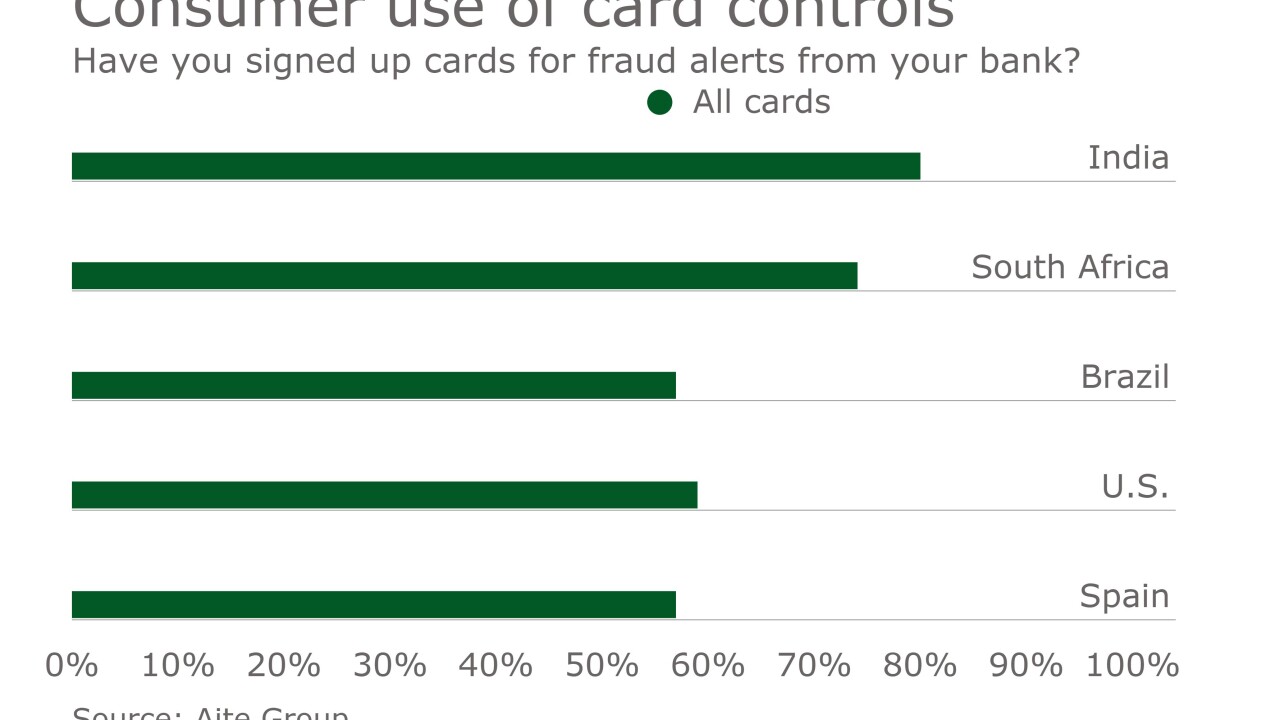

Mobile apps that allow consumers to control their payment cards are becoming more popular as banks use payment security as a way to build customer relationships.

November 22 -

A full year into the EMV migration, crooks are expected to be even more aggressive about attacking soft spots in online and mobile transactions.

November 21 -

Distinct business plans in promising areas such as smart use of consumer data, cybersecurity and content creation, according to Bank of America Merrill Lynch commercial banking executive Scott Olmsted. And that is just the beginning of his list.

November 21 -

Banks are warming to behavioral biometric software as one of an array of choices to prevent digital banking fraud.

November 18 -

Mastercard will launch its “selfie pay” system in the Asia-Pacific region next year, expanding the global reach of its biometric identity-verification service for online payments to more markets as part of a gradual worldwide rollout.

November 17 -

Behavioral biometrics has already stopped several million dollars worth of online banking fraud at National Westminster Bank in London.

November 17 -

The once-booming market for reloadable prepaid cards has seen a slowdown in new-account growth in recent years amid heavier competition and consolidation, causing longtime providers to look for ways to stand out in a crowded field.

November 15 -

As online fraud becomes more pervasive, merchants need to strengthen their defenses against would-be cyber thieves.

November 15 -

Digital payments security provider V-Key will protect the cloud-based payments network of Ant Financial Services Group (Alipay) with its virtual secure element software.

November 14 -

Any company that uses point of sale systems or technology is at risk.

November 11 CoSoSys

CoSoSys