-

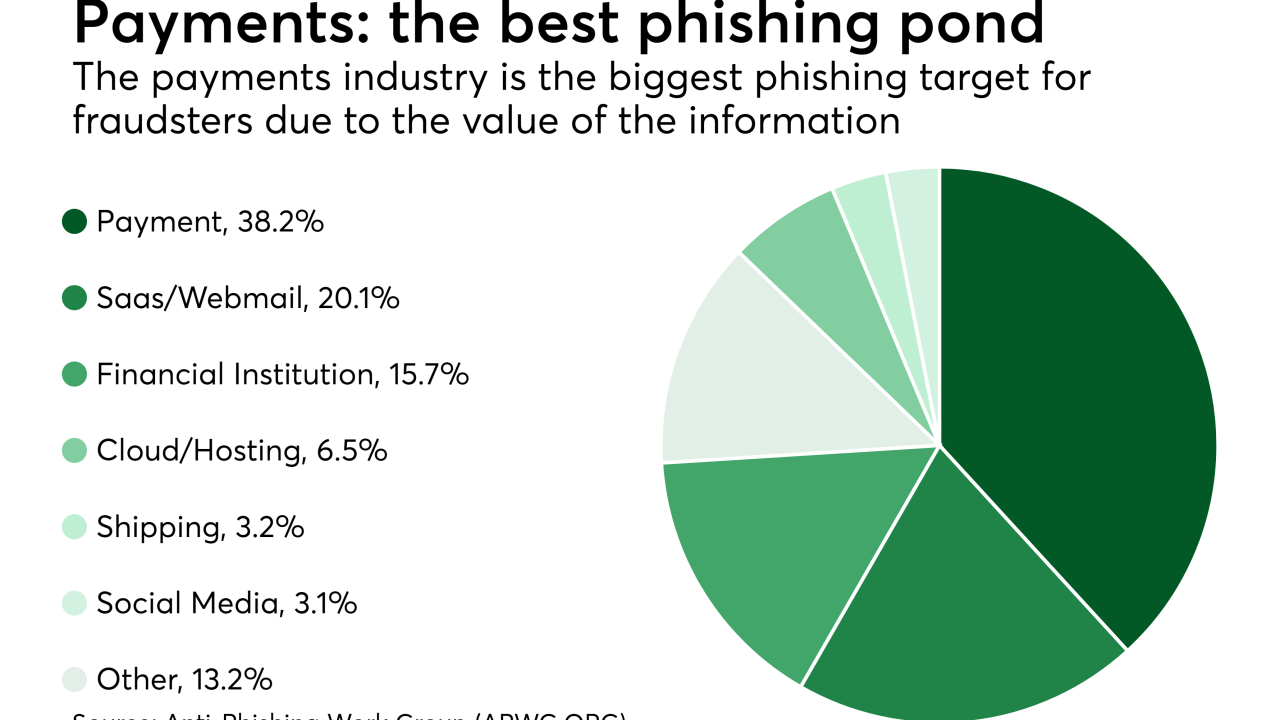

With real-time payments advancing, processors need to shore up security, according to David Worthington, vice president of payments at Rambus.

February 19 Rambus

Rambus -

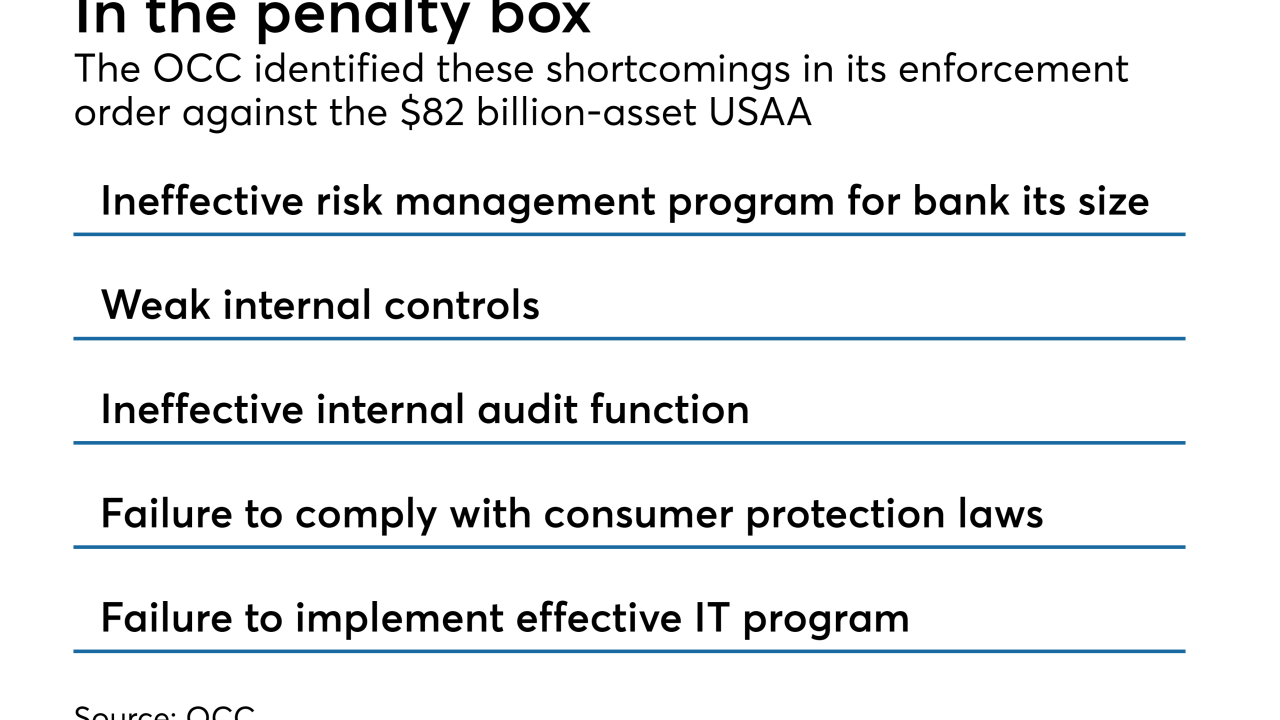

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

Banks want to encourage innovation by extending access to outside developers, but customer data remains vulnerable while in use by an application.

February 15 -

Unauthorized exposure of any type of customer data, for any period of time, is a serious issue, writes Carl Wright, chief commercial officer of AttackIQ.

February 15 AttackIQ

AttackIQ -

The Credit Union National Association and several institutions sued the fast food business after a data breach in 2016.

February 14 -

The top Republican and Democrat on the Senate Banking Committee are asking for stakeholders to weigh in on data collection issues as lawmakers consider legislative responses to recent breaches.

February 13 -

A security breach that left 24 million mortgage documents unprotected on a server is rekindling concerns about the risks posed by fourth parties.

February 13 -

The emails were disguised as being sent from BSA executives at other institutions and claimed that a member’s transfer was halted due to suspected money laundering.

February 13 -

The quest to implement a broadly accepted digital ID solution may take years, but Jumio is hoping to get headway with a new authentication service leveraging video selfies.

February 12 -

As another possible shutdown looms, concerns about furloughed workers’ credit histories have shifted the reform discussion away from data security.

February 11 -

Today phishing scams have become so elaborate that they can take a variety of forms, including a phony job interview.

February 7 -

It’s past time for every organization handling sensitive data to lock down their security, and to stop relying personally identifiable information to verify users, writes Ryan Wilk, vice president of customer success for NuData Security.

February 7 NuData Security

NuData Security -

Banks are a primary market to be pursued by Blue Hexagon, which received $31 million in venture capital.

February 5 -

Criminals are going to get smarter, but banks can implement a modern authentication solution to meet unique use cases and security requirements without sacrificing user convenience, writes Mike Byrnes, senior product manager at Entrust Datacard.

February 1 Entrust Datacard

Entrust Datacard -

Fixing the housing finance system is "the last piece of unaddressed business from the financial crisis," according to a summary of to-do items released by the Banking Committee's chairman.

January 29 -

Last year’s Dodd-Frank rollback facilitated the Chemical-TCF deal; the Fed is holding a conference this summer to discuss possible changes to the tests.

January 29 -

Criminals are getting aggressive when using mobile apps to compromise consumer accounts, and that's causing headaches for execs who bear responsibility for data security.

January 29 -

A man entered a SunTrust branch in Sebring, Fla., and shot and killed five women, four of whom were bank employees; 24 million mortgage documents exposed in data security lapse; the battle for deposits is like "a steel-cage" match; and more from this week's most-read stories.

January 25 -

The problem with bug bounties is that while it can complement vulnerability management programs, it does not offer the comprehensive coverage an enterprise requires, contends Mark Weiner, CMO of Balbix.

January 25 Balbix

Balbix -

Spring Labs is spearheading a group of prominent fintech lenders to use a blockchain-based, peer-to-peer network to share consumer information to help with ID verification on loan applications.

January 24