-

The Federal Reserve, FDIC, OCC and CFPB — increasingly under the leadership of Democratic appointees — are gearing up to regulate cryptocurrency, modernize the Community Reinvestment Act and give consumers more control of their personal data. Here's a look at the policy changes they're mulling.

January 27 -

John D. "Jerry" Hawke had already established himself as a preeminent banking lawyer when he took the helm of the Office of the Comptroller of the Currency in 1998. Hawke, who died Monday, ran the agency for six years and issued a controversial regulation shielding national banks from state regulatory oversight.

January 6 -

Industry leaders in the spotlight this year include Citi's Jane Fraser, TD's Bharat Masrani and several others who are making big moves in cryptocurrency.

January 2 -

Card networks are poised to connect to nonfungible tokens, issuers are revamping rewards, and regulators are taking greater interest in installment loans. These developments and more bear watching in the year ahead.

December 26 -

These executives are adapting to changing customer demands amid rebounding M&A and coronavirus-related challenges.

December 22 -

A clash among FDIC board members has intensified a debate about whether regulators should take a tougher look at large M&A deals. House Financial Services Chair Maxine Waters added to the frenzy by calling for a moratorium on approving big acquisitions.

December 13 -

Business and regulatory pressures were already weighing on aging executives before the onset of the pandemic led many to delay retirement plans. Now as the crisis eases, an increasing number are finally stepping down.

December 7 -

The guessing game is over about President Biden’s pick for Federal Reserve chair, but several names are in the mix for three additional vacancies on the board, including vice chair for supervision.

December 5 -

Policymakers contend the fast-growing crypto sector poses many risks for consumers, but disagreements within the blockchain industry and Congress are expected to prevent the establishment of clear rules anytime soon.

December 1 -

The home buying process has undergone significant changes. The pandemic has profoundly altered the mortgage lending market. The continuation of remote work, relocation out of key urban areas, a growing preference for online possibilities, and the deployment of artificial intelligence applications are only a few trends that are shaping the industry. Join Heidi Patalano, Editor-in-Chief of National Mortgage News and Beth O'Brien, Founder and CEO of CoreVest Finance as they discuss how lenders can stay competitive and meet the needs of home buyers in the fast evolving mortgage business.

-

President Biden's announcement that he is reappointing Jerome Powell as chair of the Federal Reserve suggests that not much will change regarding supervision, capital requirements and approval of merger applications. But the still-open position for vice chair of supervision could go to a more progressive nominee.

November 22 -

The Federal Reserve is mulling changes to a key capital measure for big banks, rulings on several merger applications and other actions. How it ultimately decides those matters will depend largely on whom President Biden appoints as head of the central bank and to other leadership positions.

November 9 -

The largest of the 2021 Best Banks to Work For, those with more than $10 billion of assets, are trying new recruiting tactics and ramping up diversity efforts.

November 9 -

As installment lending becomes more popular, regulators in the U.S., Europe and Australia are considering new restrictions or taking action against lenders.

November 4 -

Mary Mack testified last week about the cultural problems she encountered after joining the bank's consumer unit in 2016. Recalling small group meetings she held with employees, she said: "People would stand up, and they were fearful."

November 1 -

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

October 26 -

During third-quarter earnings calls, Bill Demchak of PNC raised concerns about stablecoins, while Jane Fraser of Citigroup pledged that there will be accountability for fixing her company's regulatory troubles and Jamie Dimon of JPMorgan Chase sounded downbeat about the Biden-era regulatory environment.

October 25 -

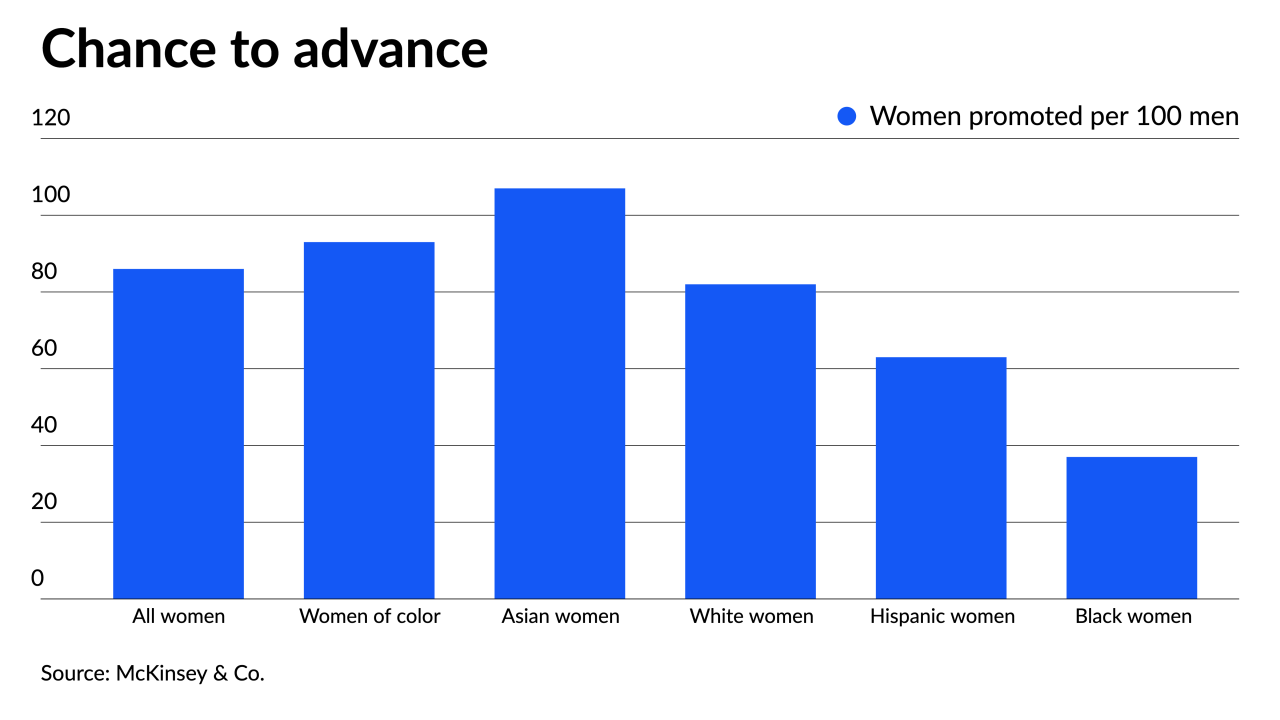

Women — especially Black and Hispanic women — remain underrepresented in banking leadership despite incremental progress because they receive less support than men do to advance beyond entry-level roles, a new McKinsey study says. Here's an overview of the findings.

October 21 -

From factoring global warming into the underwriting of government-backed loans to conducting "sensitivity analysis" of banks' ability to withstand severe weather, several government agencies are accelerating efforts to address the impact of climate change on the financial system.

October 20 -

Fintechs have led the way in installment lending, but banks, credit card issuers and payments companies are responding with products of their own. Here's an overview of what they're rolling out.

October 19