-

President Biden's announcement that he is reappointing Jerome Powell as chair of the Federal Reserve suggests that not much will change regarding supervision, capital requirements and approval of merger applications. But the still-open position for vice chair of supervision could go to a more progressive nominee.

November 22 -

The Federal Reserve is mulling changes to a key capital measure for big banks, rulings on several merger applications and other actions. How it ultimately decides those matters will depend largely on whom President Biden appoints as head of the central bank and to other leadership positions.

November 9 -

The largest of the 2021 Best Banks to Work For, those with more than $10 billion of assets, are trying new recruiting tactics and ramping up diversity efforts.

November 9 -

As installment lending becomes more popular, regulators in the U.S., Europe and Australia are considering new restrictions or taking action against lenders.

November 4 -

Mary Mack testified last week about the cultural problems she encountered after joining the bank's consumer unit in 2016. Recalling small group meetings she held with employees, she said: "People would stand up, and they were fearful."

November 1 -

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

October 26 -

During third-quarter earnings calls, Bill Demchak of PNC raised concerns about stablecoins, while Jane Fraser of Citigroup pledged that there will be accountability for fixing her company's regulatory troubles and Jamie Dimon of JPMorgan Chase sounded downbeat about the Biden-era regulatory environment.

October 25 -

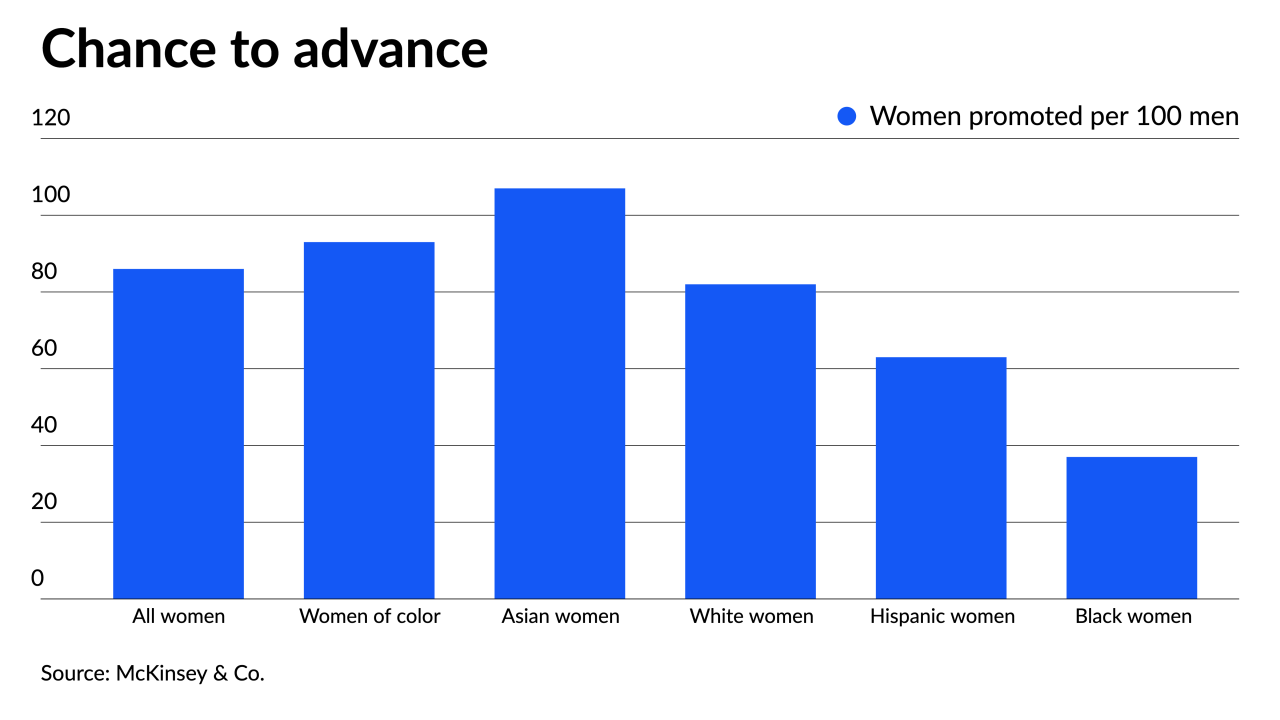

Women — especially Black and Hispanic women — remain underrepresented in banking leadership despite incremental progress because they receive less support than men do to advance beyond entry-level roles, a new McKinsey study says. Here's an overview of the findings.

October 21 -

From factoring global warming into the underwriting of government-backed loans to conducting "sensitivity analysis" of banks' ability to withstand severe weather, several government agencies are accelerating efforts to address the impact of climate change on the financial system.

October 20 -

Fintechs have led the way in installment lending, but banks, credit card issuers and payments companies are responding with products of their own. Here's an overview of what they're rolling out.

October 19 -

Join Janet King, Arizent VP of Research and Brian Elkins, Senior Director of Strategy at Monigle for a discussion of a new, prescriptive framework that helps banks and other financial institutions identify why customers choose to bank with one financial institution over another. Developed in conjunction with creative experience agency Monigle, the Humanizing Customer Experience research from American Banker draws on more than 5,000 customer responses to show what matters most in customer experience and ranks which financial institutions do it best. Join this discussion to learn more about how you can optimize your bank's approach to CX to improve customer satisfaction and earn higher net promoter scores.

-

Executives from banks, credit unions, card issuers and investment firms at American Banker's Card Forum discussed ways the public's embrace of digital transactions and credit alternatives like buy now/pay later is shaping everything from products to business strategies.

October 5 -

Rather than targeting the masses, the founders of these neobanks are narrowing their focus to serve people who may benefit from specialized products and services. The latest example: Nerve, a banking app for musicians.

September 29 -

U.S. Bancorp, M&T Bank, Citizens Financial are among the regionals that are buying smaller competitors in an effort to achieve greater scale.

September 28 -

The tech giant's high-stakes court battle with Epic Games over App Store checkout pricing has gotten most of the attention. But its policies are also facing scrutiny in the U.K., Japan, Australia and elsewhere.

September 27 -

Leadership transitions are underway at one of the largest banks in the country (Truist), the second largest credit union (State Employees Credit Union), a big energy lender (BOK Financial) and several smaller financial institutions. Here's a look at nine new, or soon-to-be leaders and the challenges that lie ahead.

September 23 -

The nation's largest bank has chosen Thought Machines' technology for its U.S. consumer bank.

September 21 -

Already in 2021, the nation's largest bank by assets has purchased more than 30 companies, including both fintechs and firms that are more removed from the financial industry. Here's a look at eight of those deals and the thinking behind them.

September 17 -

A Biden administration proposal to give the IRS access to individuals' banking data is a violation of consumer privacy, writes Sen. Mike Crapo.

September 17

-

The industry opposes expanded IRS reporting and other tax-related provisions that Congress would use to pay for the overhaul. But the bill could also boost funding for small businesses and affordable housing.

September 14