-

The bank has been working with tech companies to rewrite algorithms that can take advantage of forthcoming quantum machines sooner than originally thought, to price derivatives, calculate risk and use machine learning.

May 25 -

The banking technology provider Zeta raised $250 million from SoftBank Vision Fund II at a valuation of $1.45 billion, winning its first venture backing to help fuel its expansion.

May 24 -

Business leaders in Atlanta and San Francisco warn that the digital divide will widen if Black-owned companies can't accept online and mobile payments.

May 24 -

Figure Technologies, the blockchain-based startup co-founded by Mike Cagney, is closing its latest funding round that values the company at $3.2 billion.

May 20 -

The $1 billion bond, which follows similar issuances by Citigroup, JPMorgan Chase, Bank of America and Truist Financial, gives a big role to broker-dealers owned by minorities, women and disabled veterans.

May 19 -

Federal Reserve Vice Chair Randal Quarles has made it clear that banks failing to make the transition away from the benchmark rate could face supervisory consequences.

May 19 Treliant

Treliant -

The biggest U.S. banks criticized a pair of proposals designed to help consumers who don’t use their services.

May 18 -

Share buyback programs, shelved by many banks last year amid pressure from regulators to preserve capital, are back in vogue, with three dozen banks announcing such plans in April alone.

May 18 -

DailyPay has raised $500 million and is adding Carrick Capital Partners to its board of directors as it seeks to expand beyond earned wage access.

May 18 -

Pine Labs has raised $285 million in its latest funding round, including participation from Singapore’s sovereign fund Temasek, to continue its geographic and product expansion.

May 17 -

The company said it will increase access to affordable products, expand financial-education offerings and launch a National Unbanked Advisory Task Force.

May 17 -

The Federal Reserve Bank of Atlanta is enlisting banks, payment companies, retailers and universities to address problems that digital commerce creates for cash-reliant consumers.

May 14 -

The best-performing banks' revenue rose at nearly twice the rate of expenses thanks to mortgage refinancing and the Paycheck Protection Program.

May 14 -

The Pennsylvania company will offer commercial loans and treasury management services after hiring bankers in Dallas and Orlando.

May 12 -

The San Francisco-based technology provider raised $70 million in a Series C round this week, bringing its total funding to $114 million.

May 11 -

Despite strong payment volume and revenue, Affirm's earnings suffered due to stock compensation and an adjustment on its purchase of PayBright in January.

May 10 -

The Mojaloop Foundation's Adama Diallo and Paul Hunter argue open, affordable real-time payments systems have the potential to include all and help turn underserved women into the newly served, enabling them to become economically active.

May 10 Mojaloop Foundation

Mojaloop Foundation -

Now that Western Union has begun its deployment at the big-box retailer, where MoneyGram has long had a presence, the incumbent is watching for signs of pricing pressure.

May 7 -

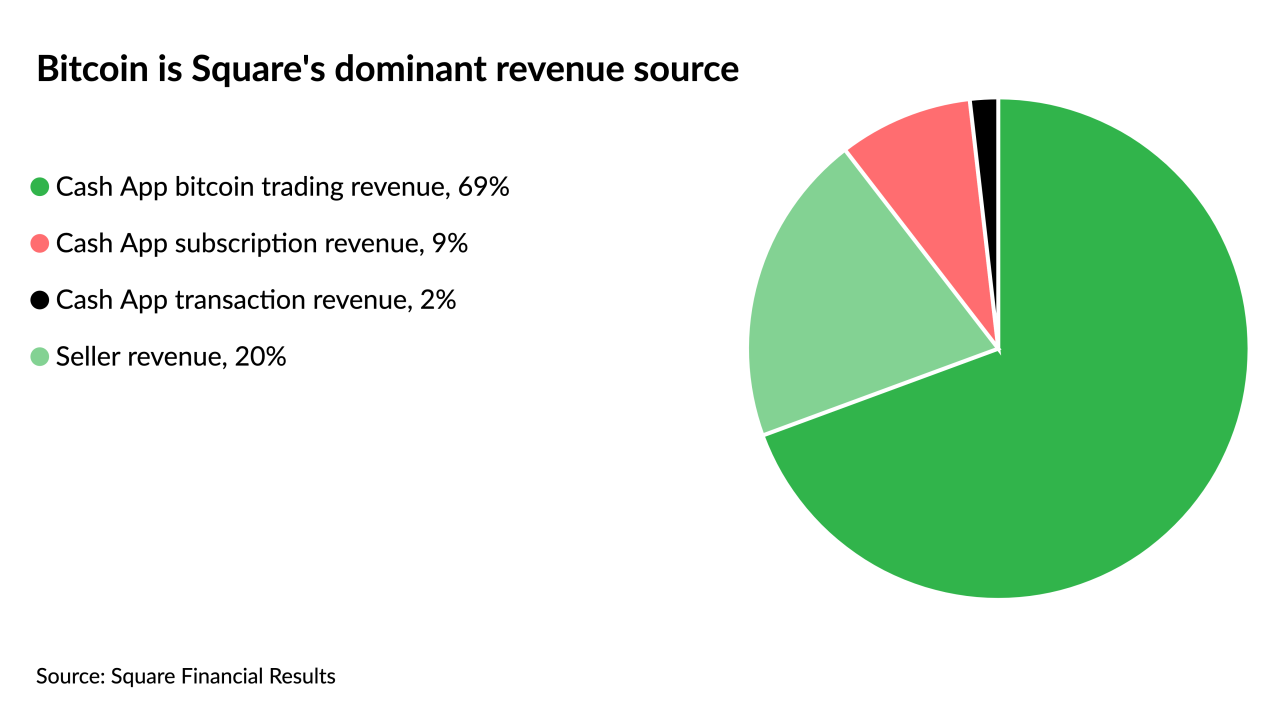

Cryptocurrency rally enabled the company's Cash App to generate the bulk of its revenue.

May 7 -

Cryptocurrency rally enabled the company's Cash App to generate the bulk of its revenue.

May 6