Threat group ShinyHunters claimed responsibility for the attack, which reportedly targeted third-party platforms rather than Betterment's own systems.

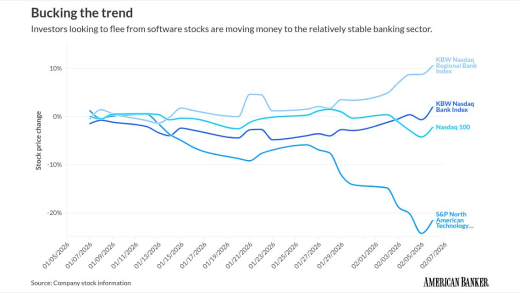

Artificial intelligence developments are stoking investor fears about software companies. Banks' limited exposure to the sector and general stability is proving attractive to investors.

Fintech and crypto groups said in comment letters to the Federal Reserve that the proposed "skinny" master account is too limited and could keep firms dependent on banks. Banking groups asked for more time to comment.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

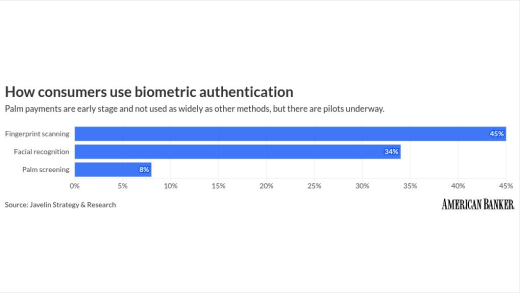

While the e-commerce giant has deemphasized the technology, banks and payment firms are testing the biometric option.

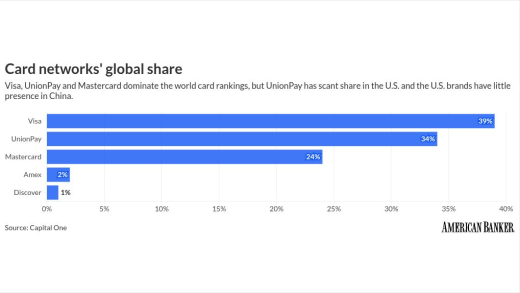

By pairing its real-time transfer app with China's UnionPay card, Visa is pursuing business in the huge country, where shifting regulations create hurdles for outside companies.

A group of Senate Democratic lawmakers warn proposed rule change would handcuff regulators from stopping risky bank behavior before it causes financial harm.

FinTech Forward, a collaboration of American Banker and BAI, brings together the research, media, and event capabilities of banking's top two professional information and education organizations.

-

Threat group ShinyHunters claimed responsibility for the attack, which reportedly targeted third-party platforms rather than Betterment's own systems.

February 6 -

American Banker's 2026 Predictions report finds that nonbank entities and check fraud are major threats to local banks in the coming months.

February 5 -

-

The crypto and payment fintechs both debuted on the stock market in late January with strong openings, then traded down ahead of a four-day partial government shutdown.

February 3 -

Prosecutors claim the Forbes 30 Under 30 honoree maintained two sets of books to hide Kalder's actual revenue of just $60,000.

February 3 -

It won't be long before bank customers can ask an AI agent to optimize their returns on idle cash. When it happens, banks' net interest income is going to come under direct threat.

February 3

-

The digital bank added two new board members and raised $123.9 million as it continues to manage regulatory costs amid its push for profitability.

February 2