Fintech

Fintech

-

Visa Inc. has agreed to buy Swedish open-banking platform Tink AB as the payment giant looks to expand beyond its card network.

June 24 - AB - Technology

Majority, a startup with a mobile app that combines a bank account with other benefits such as global remittances and international calling, began by serving the Cuban and Nigerian communities in Florida and Texas. Now it’s available in all states and will use $19 million in seed funding to accelerate its growth.

June 23 -

How technology is enabling new types of payment transmission and what this means for banking.

-

The bank's holding company, CRB Group, has acquired PeerIQ, an online lending marketplace data provider backed by the former CEOs of Morgan Stanley and Citigroup. It's said it wants more deals like this one.

June 23 -

The fintech specializes in lending to dentists, veterinarians and other solo providers looking to grow or establish their own practice.

June 22 -

Beauty shops must handle transactions for multiple employees and contractors operating under one roof. Tech companies are customizing software and transaction processing services for this niche.

June 21 -

A growing number of companies like Klarna, Sezzle and Circle let consumers split large purchases into smaller transactions paid over time. But they say they need to offer more than one product to set themselves apart and build customer loyalty.

June 18 -

Building a safer ecosystem: Why transparency, controls, and partnerships will drive next era of financial services.

-

A European Union regulation that promotes data sharing among banks and third parties is making it easier for neobanks like Tide and Monese and other companies to help small merchants track their cash flow and access credit.

June 17 -

The New Jersey bank has been informally funding startups for more than a year. Now it has established Cross River Digital Ventures, which will focus on backing fintechs the bank wants to work with or ones that it feels will benefit the broader industry.

June 17 -

KMD Partners, which makes high-interest rate loans through its CreditNinja brand, has agreed to acquire the $11.7 million-asset Liberty Bank. The purchase is likely to draw scrutiny, but the companies argue that it will help borrowers with lower credit scores qualify for less expensive loans.

June 15 -

More than 97% of venture backing goes go white-owned startups. Firms like Mendoza Ventures, Chingona Ventures and MaC Venture Capital are stepping in to support underserved entrepreneurs.

June 14 -

There’s a new unicorn in Latin America: Clip, a payments fintech in Mexico targeting small and midsize companies.

June 11 -

Derek White, former financial services head for Google Cloud, wants to take Galileo — the SoFi unit that provides tech services to challenger banks — international and into new niches outside banking.

June 10 -

Klarna Bank AB is raising fresh funds led by SoftBank Group that value the Swedish fintech startup at $45.6 billion, just months after two separate investment rounds sent the company’s valuation soaring.

June 10 -

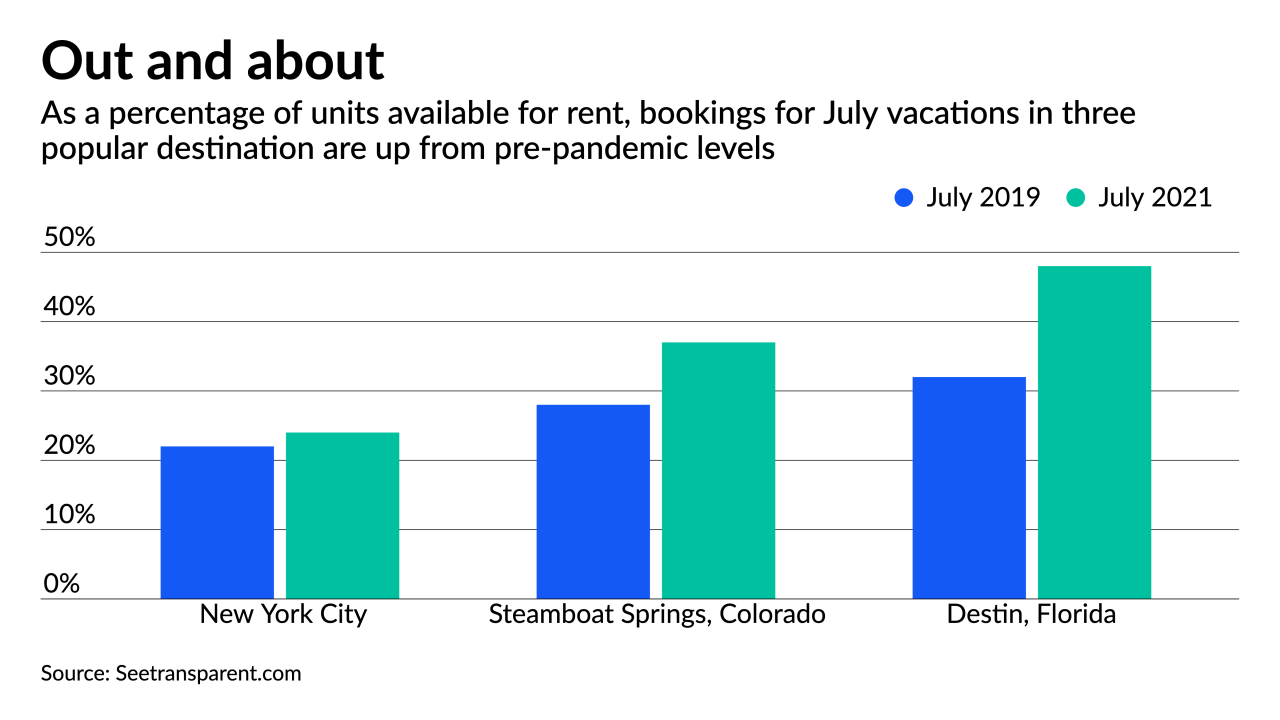

Companies like Cloudbeds, Uplift and Guesty offer technology that streamlines payment processing for suddenly busier hotels and offers new financing options for people eager to hit the road.

June 10 -

The company's payment processing platform supports the likes of Uber and Square in their ambitions to create all-in-one offerings that bundle financial and other services.

June 9 -

A new public-private network is pursuing a more comprehensive approach than other states to cultivate a strong financial technology industry by uniting banks, insurance companies, startups, government agencies, investors, universities and students.

June 9 -

The card brand has added a dedicated lane to its startup program to address the venture funding gap for race and gender. Overall, less than 3% of VC funding goes to startups with Black or Latinx founders.

June 9 -

Dave, a banking startup that’s been backed by investors including Mark Cuban and Capital One Financial, agreed to go public in a deal with a blank-check firm that values the company at $4 billion.

June 8