Fintech

Fintech

-

At a House Financial Services Committee hearing, lawmakers on both sides of the aisle questioned the widespread practice of screen scraping and agreed that consumers should have a more direct say over how their financial data is handled.

September 21 -

The company's new app bundles banking services such as payments, buy now/pay later and direct deposit. But the company plans to add features that could include stock trading, a popular offering from tech startups.

September 21 -

JPMorgan Chase bought the college financial-planning platform Frank, the latest in a string of acquisitions the largest U.S. bank has made this year to compete with both big technology firms and fintech upstarts.

September 21 -

The companies each recently rolled out new contactless checkout technology as they attempt to turn Amazon Prime and Square Cash into platforms that let consumers pay for goods, save money, take out loans at the point of sale and conduct other financial services all in one place.

September 20 -

Vendors including Akoya, Plaid and MX are trying to help banks manage and view their application programming interfaces through data portals as an alternative to scraping consumers’ login credentials.

September 20 -

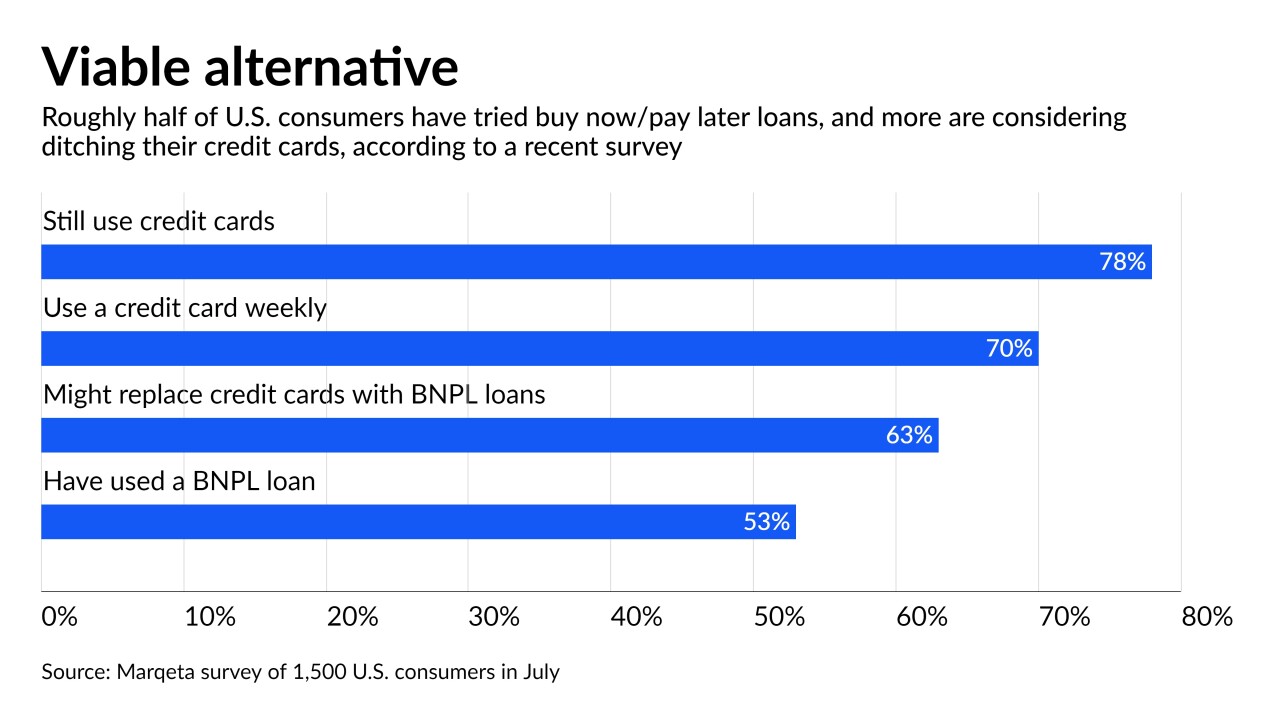

More than a third of installment borrowers are delinquent, according to new research. Fintechs and the banks that are following them into the market are willing to tolerate the credit risk — for now — because of BNPL’s rapid growth and the fee income from merchants.

September 17 -

Already in 2021, the nation's largest bank by assets has purchased more than 30 companies, including both fintechs and firms that are more removed from the financial industry. Here's a look at eight of those deals and the thinking behind them.

September 17 -

A long to-do list — from developing mortgage servicing requirements to revisiting payday lending rules — awaits Rohit Chopra, the administration’s choice to lead the consumer bureau. But it's still anyone's guess when the Senate will confirm him.

September 16 -

Executives at JPMorgan Chase, Capital One and U.S. Bancorp all spoke this week about plans to take on upstarts that offer interest-free financing on consumer purchases. The increased competition figures to result in tighter margins across the category.

September 16 -

The Cincinnati bank, which last month closed its purchase of the health care lender Provide, has raised its estimate for the unit’s 2021 loan volume.

September 16 -

Buying the point-of-sale loan provider would give Goldman Sachs access to a network of millions of consumers and thousands of merchants that the bank would have difficulty building on its own, said Stephanie Cohen, its global co-head of consumer and wealth management.

September 15 -

Rodney Hood, a member of the National Credit Union Administration's board, detailed plans, such as the formation of an Office of Innovation and Access, to foster collaboration between credit unions and the tech community.

September 15 -

Truepic, which helps companies like banks and insurers fight fraud by verifying images, raised $26 million in a funding round led by Microsoft’s M12 venture capital arm.

September 14 -

Canapi Ventures — created by former comptroller of the currency Gene Ludwig and banker Chip Mahan — and other venture capital firms say Peach Finance stood out because, unlike so many other startups, it's not focused on loan originations.

September 14 - AB - Technology

Eligible users may trade bitcoin and ether through the company's app and also use bitcoin when completing debit card purchases. More cryptocurrency options will be offered in coming months.

September 13 -

The myWalgreens app functions as a hub for the retailer's growing range of financial products. It's designed to encourage consumers to use their Walgreens card accounts for deposits and payments.

September 10 - AB - Technology

The neobank, which posted losses and burned through capital in its first year, has received a huge funding boost. That's raising questions about the depth of Varo's struggles and whether regulators and investors hold challenger banks and traditional banks to different standards.

September 9 -

Merchants will be able to offer the interest-free installment product starting in October. One of Synchrony’s retail partners, Amazon, announced a buy now/pay later partnership with Affirm last month.

September 9 -

Acting Comptroller of the Currency Michael Hsu has appeared more circumspect than his predecessors about cryptocurrencies and other types of financial technology. Regulators are still seeking to understand the risks associated with these once-esoteric products, he says.

September 9 -

Aiia brings thousands of banks to the card network's global open-banking platform.

September 7