-

Efforts to simplify business operations under incoming CEO Jane Fraser will cost a lot of money but will ultimately create a safer, more profitable company, Chief Financial Officer Mark Mason said.

February 25 -

Capital One Financial has begun to lift borrowing limits for certain customers as it seeks to restart growth in its sprawling credit card business.

February 24 -

Some in the industry are beefing up online educational offerings and enlisting social media ambassadors on college campuses to help recruit younger consumers.

February 22 -

The Office of the Comptroller of the Currency issued a prompt corrective action directive to First National Bank and Trust in January, requiring it to hire a forensic auditor and provide the OCC with access to documents and records.

February 22 -

The deal for the $63 billion-asset People's United would create a company with more than $200 billion of assets and a branch network stretching from Maine to Virginia. Buffalo, N.Y.-based M&T has not made an acquisition since buying Hudson City Bancorp in late 2015.

February 22 -

The company has agreed to pay $32 million for a bank with six branches and $256 million of assets.

February 18 -

The Houston-based lender is working with financial advisers to solicit interest from potential buyers, according to people familiar with the matter.

February 18 -

Acquiring AmeriHome would provide the fee revenue the Phoenix company seeks to compensate for low interest rates and tepid commercial loan demand. The deal also would allow it to reinvest billions of dollars of excess liquidity.

February 17 -

The Arizona company will pay $1 billion for the parent of AmeriHome Mortgage, which manages a $99 billion mortgage servicing portfolio.

February 16 -

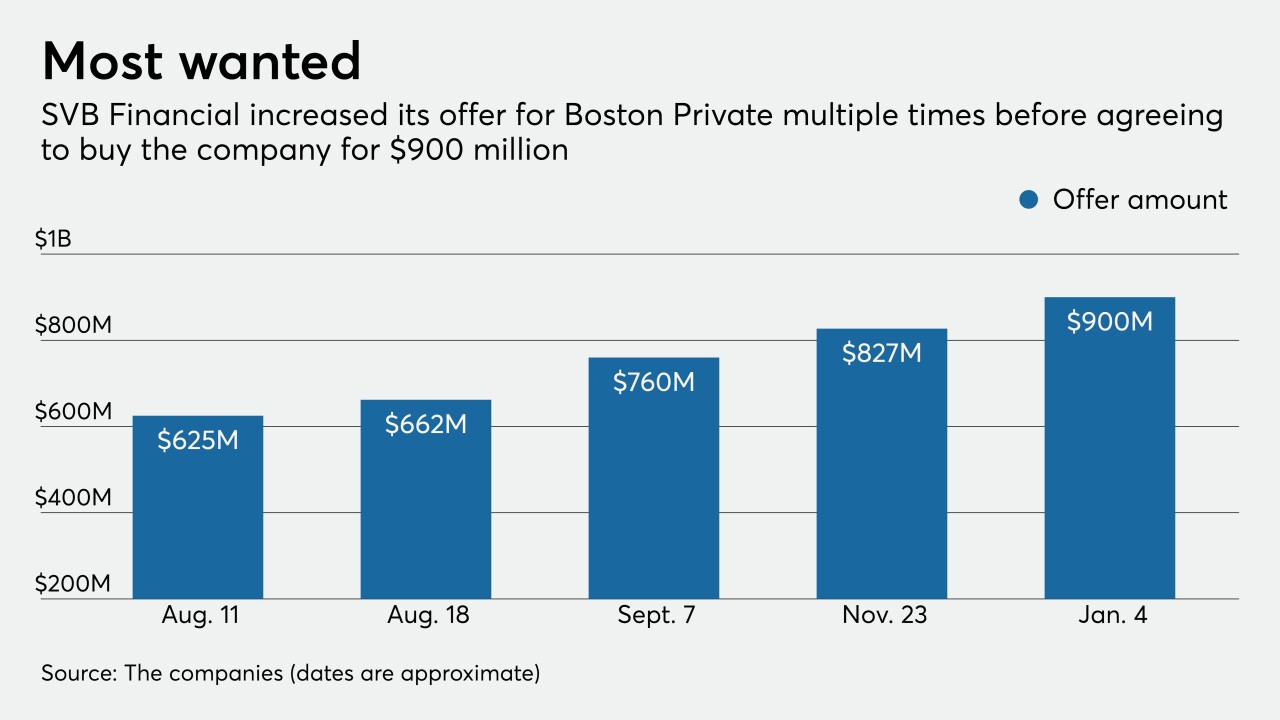

The leadership at Boston Private Financial Holdings wanted to establish a wealth management partnership with SVB Financial Group — but ended up striking a deal to sell the company to SVB instead.

February 16 -

A planned combination with Premier Federal Credit Union in Greensboro, N.C., will expand the Charlotte-based credit union's reach in the Tar Heel State.

February 16 -

A deal to merge with First General Credit Union in Norton Shores, Mich., will extend the Detroit-area institution's reach across the state.

February 12 -

A plan to make expansion easier for credit unions is getting pushback not just from bankers, but also from the regulator's current chairman and a former board member.

February 12 -

ATG Trust, which has $387 million of assets under management, handles land trusts and administers court-supervised guardianships.

February 10 -

The combined institution will hold assets of more than $335 million and serve over 20,000 members across eight counties in Oregon.

February 9 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

A recently approved TIP charter, the latest in a series of growth initiatives over the last five years, will allow the Tampa-based credit union to serve anyone working in the medical field statewide.

February 8 -

The North Carolina-based credit union, which purchased the vacant bank branch last summer, serves some members across the state line but has not had a brick-and-mortar presence there until now.

February 5 -

First Foundation is relocating its corporate headquarters to Dallas, where the tax burden is lighter and it sees more opportunity to beef up lending, add wealth management clients and pursue acquisitions of community banks.

February 5 -

The onset of COVID-19 forced the industry’s largest trade group to put its Open Your Eyes campaign on hold, but nearly a full year later it’s still struggling for industry buy-in.

February 5