-

Democrats’ investigation of President Trump has darkened the horizon for legislative activity in Washington, but prospects for a pair of bipartisan measures backed by the industry are surprisingly bright.

October 3 -

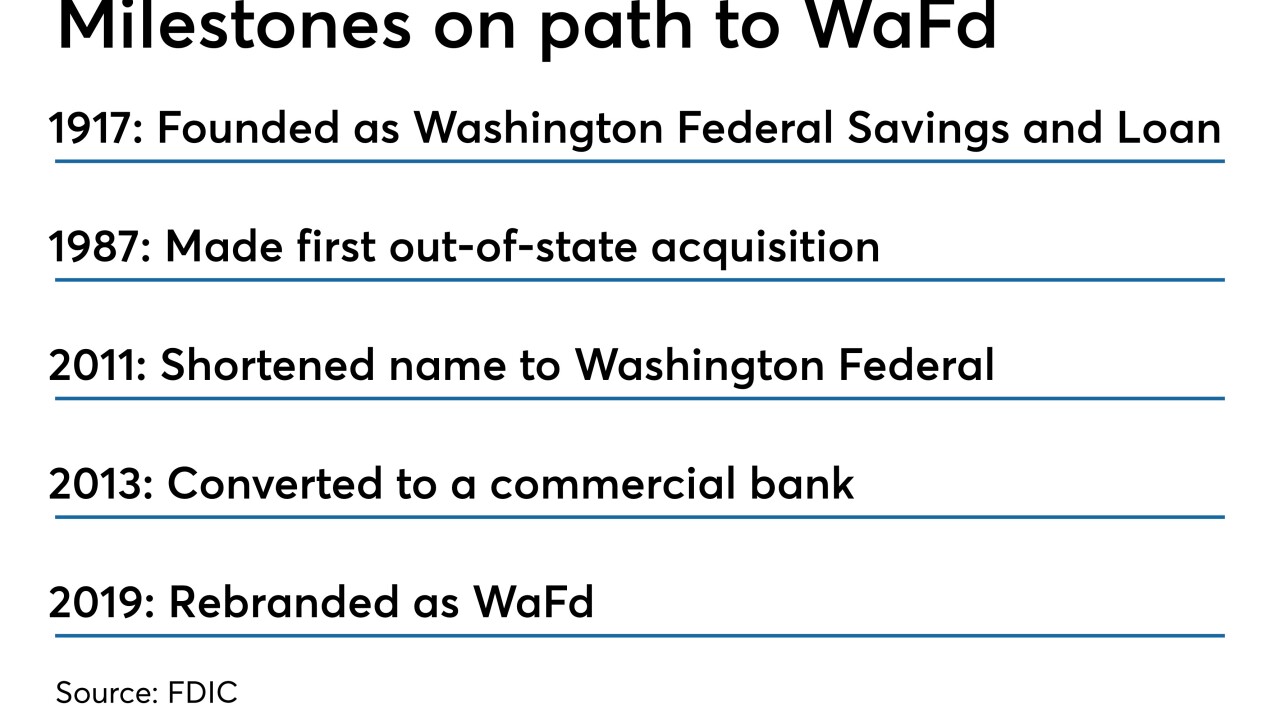

When Washington Federal last rebranded, it was to signal its shift from a savings and loan association to a commercial bank. This time around, it's to reflect geographic diversity and its desire to be viewed as a bank.

October 3 -

The West Bend, Wis.-based institution's new chief executive has been with the credit union for more than 15 years.

October 3 -

States are just beginning to regulate cryptocurrency as a credit collateral for lenders. More can be done.

October 3

-

Seeking relief from rising synthetic fraud, U.S. companies next year will be able to quickly verify whether Social Security numbers match other consumer data in government files, in a bid to thwart fraudsters from creating fake identities with stolen information and SSNs.

October 3 -

It's the latest move by Radius to extend its banking-as-a-service offering to fintech partners.

October 3 -

Riverview Credit Union in Ohio added three to its lending team while other institutions made new hires and promotions.

October 3 -

Payoneer found its niche providing technology for Amazon, Google and Facebook to deliver mass payouts to independent contractors, but the company has added options for small U.S. businesses to send payments to vendors and suppliers globally.

October 3 -

Good customer service, layered with new technology, gives community banks an advantage over big banks.

October 3

-

The information you need to start your day, from PaymentsSource and around the web. Today: Udaan's big haul; Jack Henry promotes executives; Venezuela embraces crypto; Link funds new ATMs.

October 3