-

JPMorgan Chase is funding a two-year initiative in which Commonwealth, a nonprofit, will study the impact of artificial intelligence and other technologies on the financially vulnerable.

August 18 -

Growing Oaks Federal Credit Union in Goldsby, Okla., plans to provide signature and auto loans initially and then expand into mortgages.

August 18 -

Barb Godin, the deputy chief risk officer and chief credit officer at the Birmingham, Ala., bank, is stepping down after a 45-year career in banking.

August 18 -

Willy Kelsey has worked at the Arlington, Texas-based credit union since 2005 and will oversee lending, retail operations and IT in his new role.

August 18 -

Non-card APMs are no longer an option but an absolute necessity. If they are not available, businesses face a “transaction declined” scenario where their customers will simply go elsewhere, says gaming payments expert James Ashton.

August 18 Find My UK Casino

Find My UK Casino -

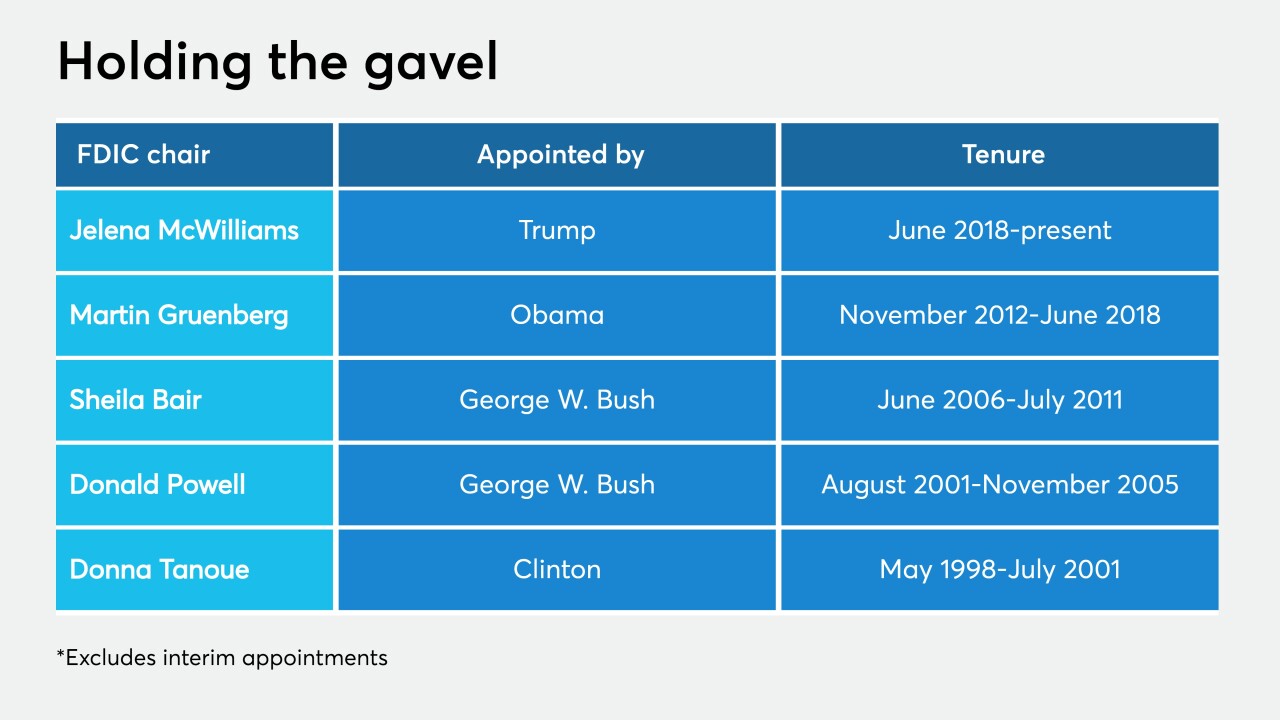

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

As the coronavirus pandemic began, PayActiv waived fees for its earned wage access (EWA) user base. Eventually those fees returned, but they did not deter adoption.

August 18 -

Crypto provides a new tool for underbanked consumers, Marc Grens of DigitalMint writes.

August 18 DigitalMint

DigitalMint -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 18 -

Cloud-based patient billing provider VisitPay is partnering with the Geisinger Health System to simplify the billing and payments process for both patients and providers.

August 18