-

The company will pay $66 million for the parent of BloomBank.

October 5 -

The Indiana company's board knew what it wanted from a potential buyer, and that helped it as it negotiated one of this year's biggest bank deals.

September 26 -

The company is looking to raise about $115 million. A portion of the proceeds would help pay for Merchants' pending purchase of Joy State Bank.

September 26 -

The Indiana company could also use proceeds from the planned stock sale to pay off debt.

September 15 -

Proposed combination of General CU, Partners 1 FCU approved by both boards, member vote next.

September 6 -

Rising taxes, declining population and the political landscape in Illinois have led several bankers to put more money and resources into nearby states.

August 1 -

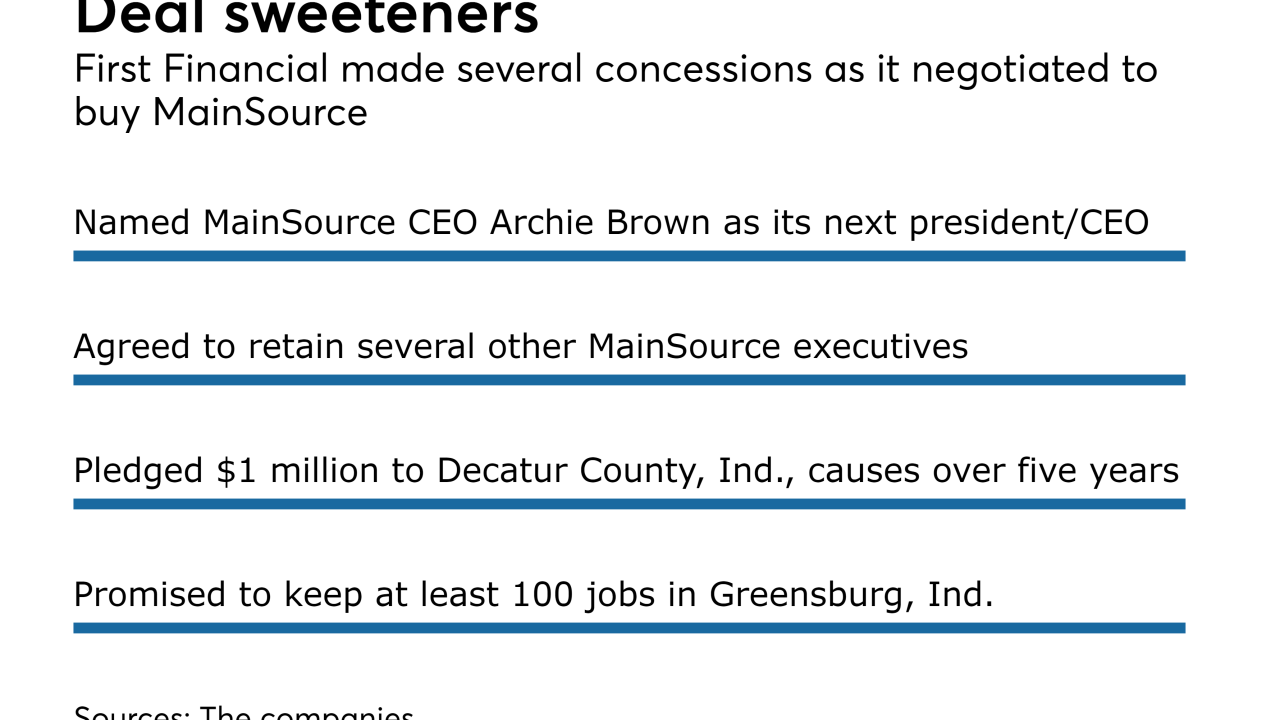

First Financial in Ohio is buying MainSource in Indiana — with a twist. MainSource's leader will become CEO.

July 26 -

The company agreed to buy MainSource Financial in Indiana for $1 billion, creating a Midwestern bank that will have more than 200 branches and $13 billion in assets.

July 26 -

While industry consolidation remains slow compared with previous years, certain regions are humming along with strong volume and improved pricing. Here’s a look at each region based on June 30 data from KBW and S&P Global Market Intelligence.

July 14 -

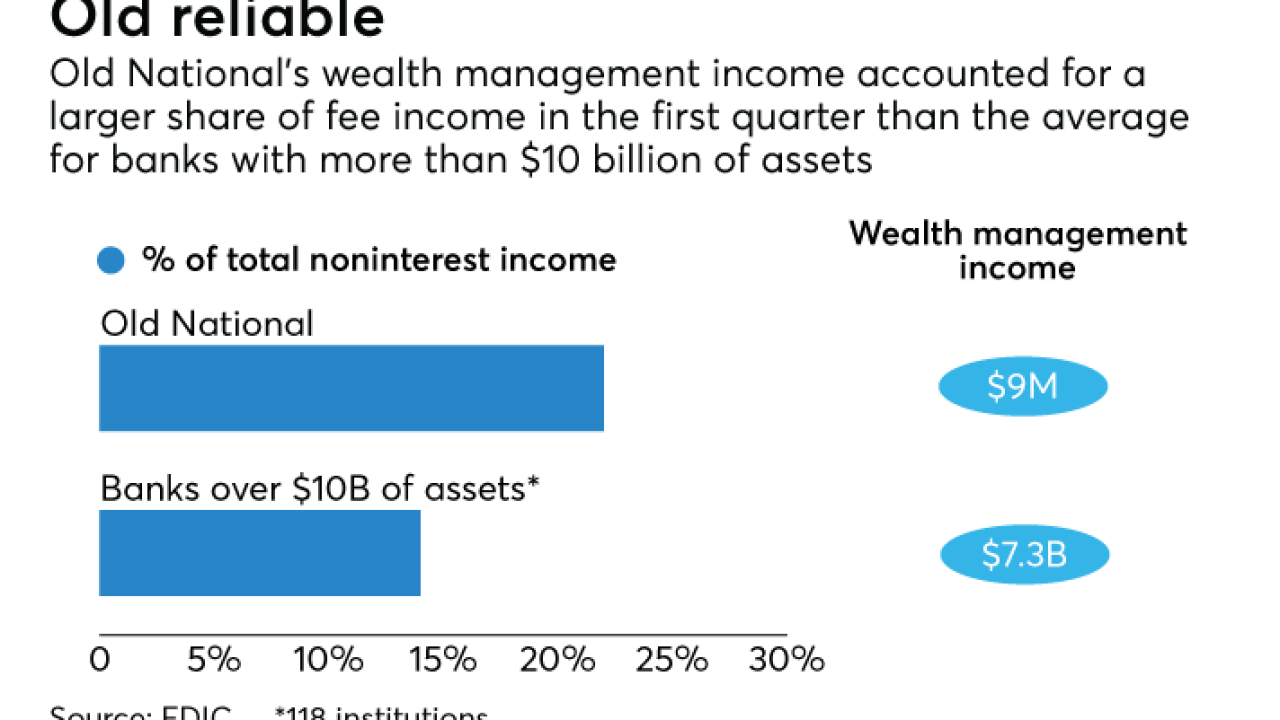

It might seem unusual for an Old National Bancorp to lure away a regional executive from the much larger Fifth Third, but not in wealth management, where competitiveness can be as much about emphasis as size.

July 3 -

The Indiana company will pay $92 million for Wolverine Bancorp

June 14 -

The $3.2 billion-asset company is making a bigger push into northern Indiana with its agreement to buy Lafayette Community Bancorp.

May 24 -

Indianapolis-based CU has operated an insurance CUSO since 2004.

April 20 -

The deal comes months after First Merchants bought a minority stake in Independent Alliance.

February 17 -

First Merchants in Muncie, Ind., has agreed to buy Arlington Bank in Upper Arlington, Ohio.

January 25 -

United Community Bancorp in Lawrenceburg, Ind., has named a new chief financial officer.

December 23 -

First Internet Bancorp in Fishers, Ind., disclosed in a regulatory filing that it is looking to raise $25 million capital through a stock offering.

December 15 -

Old National Bancorp in Evansville, Ind., has shuffled its corporate finance department, promoting four executives to new or expanded roles.

December 7 -

Mark Schroeder has led the Jasper, Ind., company to six straight years of record profit by sticking to a simple model that emphasizes relationship banking and small, strategic acquisitions.

December 6 -

Horizon Bancorp in Michigan City, Ind., has restructured its balance sheet to improve its margins and financial returns.

December 1