-

Hometown Financial, which completed three acquisitions this year, is considering branch openings for a push into the city.

October 25 -

The Massachusetts-based institution, which will forgive more than $750,000 in fees, is the latest to come to an agreement regarding overdraft claims.

October 15 -

Dorothy Savarese will remain the Massachusetts bank's chairman and CEO.

October 1 -

The Lowell, Mass.-based institution can now serve Norfolk and Suffolk counties, along with more than 150 cities across Massachusetts and New Hampshire.

October 1 -

Their challenge is creating a viable, profitable product that doesn't get flagged for being predatory.

September 26 -

The Boston company said the loan participation went into default due to potentially fraudulent activity.

September 23 - Edit License

Thurlow recognized that if she wanted to get serious about reaching the unbanked in her community, she needed to meet people where they were. That meant providing financial products they actually need and giving them access in their native language.

September 22 -

After a nine-month transition period, Lyndon Matteson has been elevated from president to president and CEO following Edward Lopes' retirement.

September 16 -

Joseph Campanelli, CEO of Needham Bank, wants to be ready to scoop up mutuals struggling with rising costs and yield curve challenges.

August 30 -

Malia Lazu, a former community organizer, is overseeing a cultural shift at the Boston company that includes a new program designed to make more loans to minorities.

August 29 -

Lisa Perrin will take over at the Massachusetts-based institution when President and CEO Karen Duffy retires.

July 30 -

The Connecticut company, which will top that asset milestone when it buys United Financial, says it could acquire more banks in coming months.

July 16 -

The Connecticut company will add heft in its home state and Massachusetts when it buys the former mutual.

July 15 -

Paramount Financial Technologies says its software can help banks answer key questions about their branch networks, including when it makes sense to expand them.

June 7 -

Provident Bancorp, one of the nation's oldest active banks, is setting the stage to become a fully stock-owned company.

June 6 -

Two recent campaigns show credit unions can still make an impact with old-school marketing, but some fear too few institutions are utilizing data in ways that can target those messages for maximum effect.

May 20 -

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

The proposed combination of Sharon Credit Union and Crescent Credit Union still needs approval from regulators and members.

April 23 -

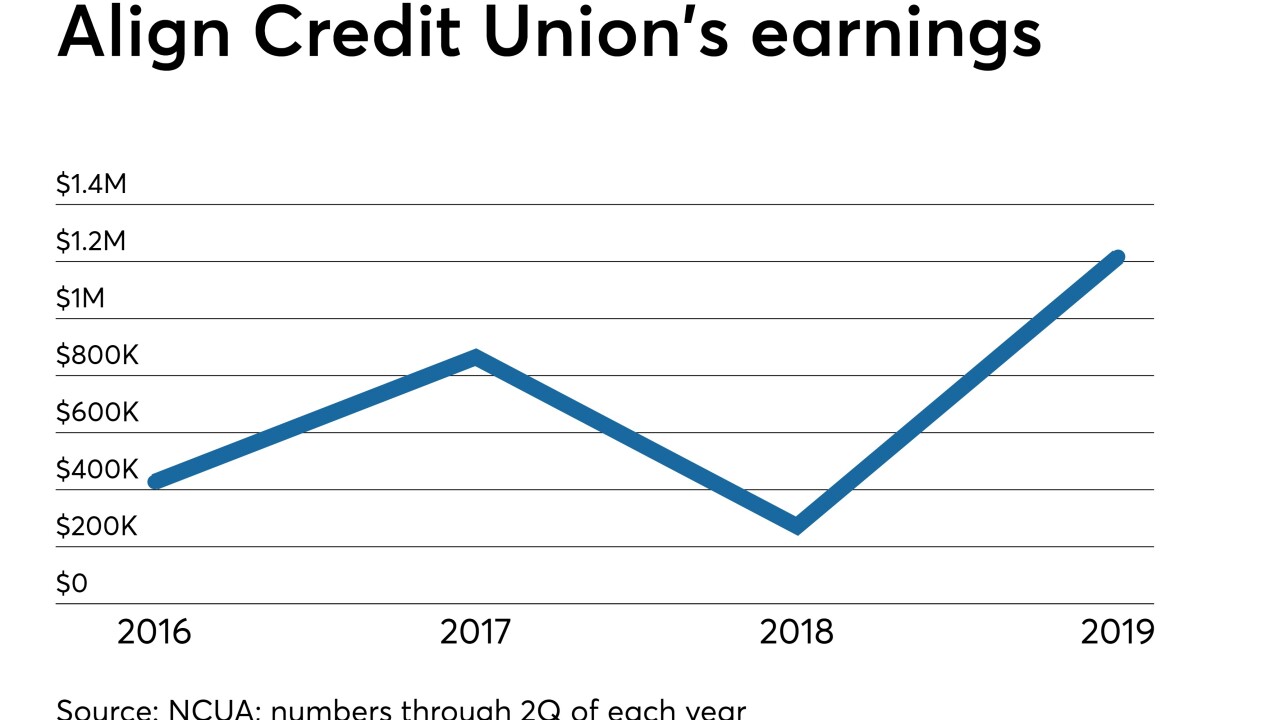

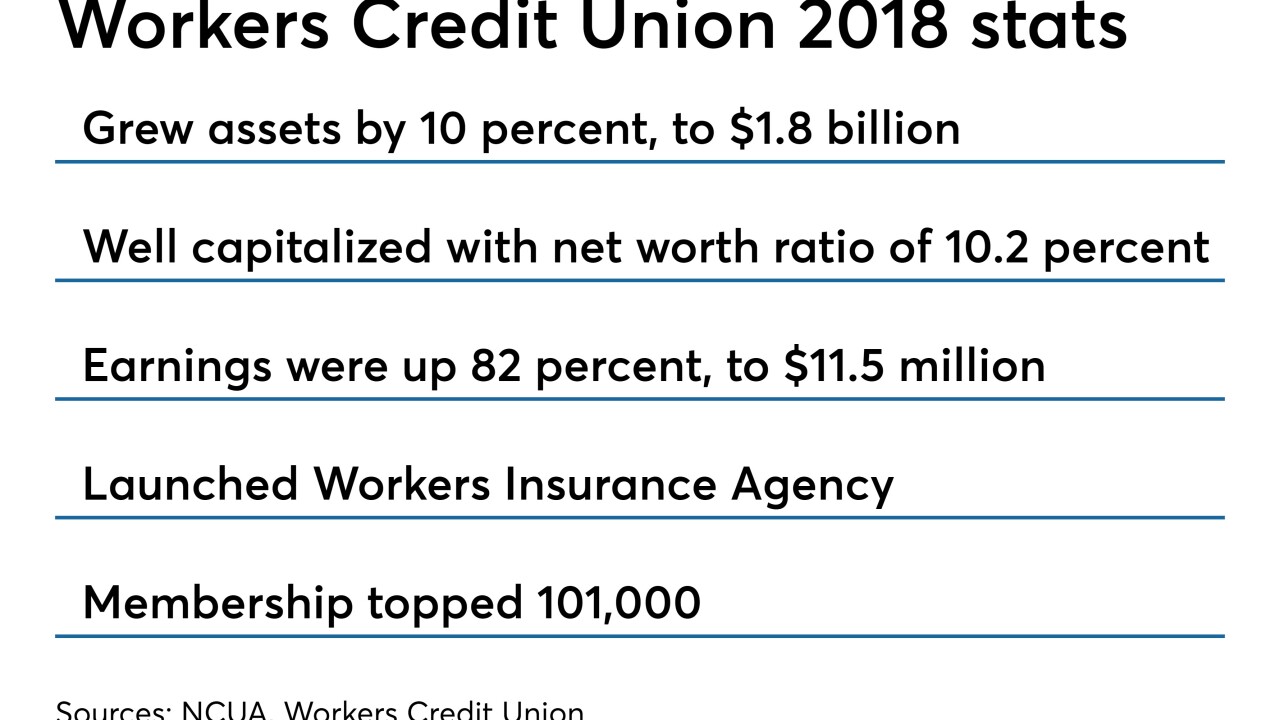

The Fitchburg, Mass.-based institution also started an insurance agency and upgraded its mobile banking last year.

April 12 -

Sloane, who died on Saturday, refused to bulk up on commercial real estate loans, a move that helped him survive two severe economic downturns.

April 9