-

Gateway Mortgage Group says its launch of a digital-only bank is scheduled for this summer.

March 14 -

Valley National will reinvent itself as Vast Bank over the next few months. The move is part of an effort to attract younger customers.

January 18 -

The Ponca City-based institution becomes the first credit union in Oklahoma to join CU*Answers.

December 13 -

The results did not include the company's purchase of CoBiz, which closed last month.

October 24 -

Governors in Arkansas, Georgia, Oklahoma, Texas and Wisconsin used International Credit Union day as an opportunity to recognize the industry.

October 19 -

Having spent 40 years in the credit union movement and the last 26 as CEO of True Sky CU, Steve Rasmussen has announced plans to retire later this year.

October 18 -

The regional bank is putting its corporate stamp on branches in the two states.

October 3 -

The Kansas company has agreed to buy three offices from MidFirst Bank.

September 24 -

Organizers of Watermark Bank aim to open early next year.

September 18 -

Bank7, which aims to raise $75 million, also has extensive dealings in the hospitality industry. The company has completed two acquisitions since 2011.

August 27 -

Gateway Mortgage's owners plan to merge the mortgage lender into Farmers Exchange Bank.

August 8 -

N.B.C. Bancshares' deal for Bank of Cushing will give it two branches an hour outside of Tulsa.

August 7 -

The deal for the Denver commercial lender joins a growing list of large acquisitions being announced in competitive urban markets.

June 18 -

Watermark Bank would focus on business banking and entrepreneurs, with technology and concierge services designed to target those customers.

May 17 -

The $70 million-asset credit union is scheduled for conversion by the end of this year.

April 3 -

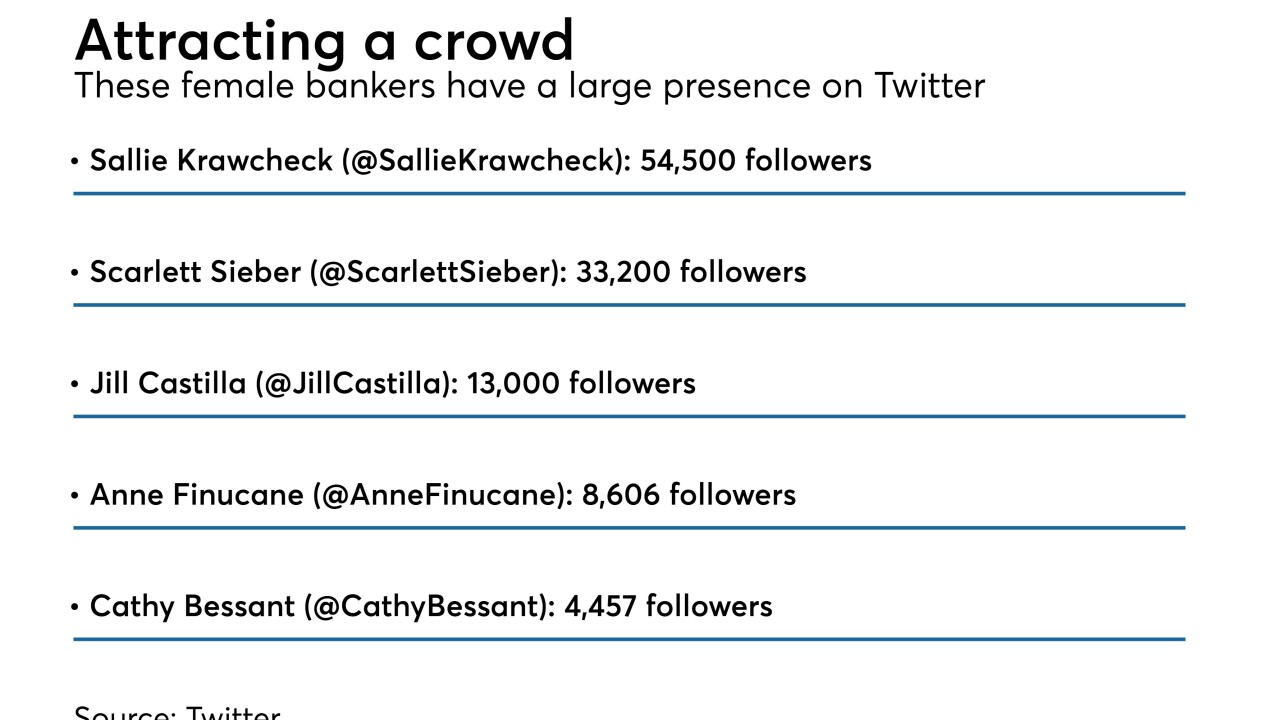

Natalie Bartholomew, a banker in Oklahoma, has launched a blog designed to promote women's issues and tout her peers' accomplishments.

March 2 -

The partnership aims to increase efficiencies and reduce expenses for the three-state league.

January 11 -

The $590 million-asset credit union has returned $4 million to members over the past 17 years.

January 8 -

The company will add $370 million in assets after buying the parent companies for First Bank & Trust and First Bank of Chandler.

September 8 -

Southwest Bancorp, frustrated with a lethargic stock price, opted to find a buyer last summer. It was holding talks with Simmons First when the post-election run-up in bank stocks gave its shares an unexpected lift. Did it do the right thing by proceeding?

July 28