-

Gateway Mortgage's owners plan to merge the mortgage lender into Farmers Exchange Bank.

August 8 -

N.B.C. Bancshares' deal for Bank of Cushing will give it two branches an hour outside of Tulsa.

August 7 -

The deal for the Denver commercial lender joins a growing list of large acquisitions being announced in competitive urban markets.

June 18 -

Watermark Bank would focus on business banking and entrepreneurs, with technology and concierge services designed to target those customers.

May 17 -

The $70 million-asset credit union is scheduled for conversion by the end of this year.

April 3 -

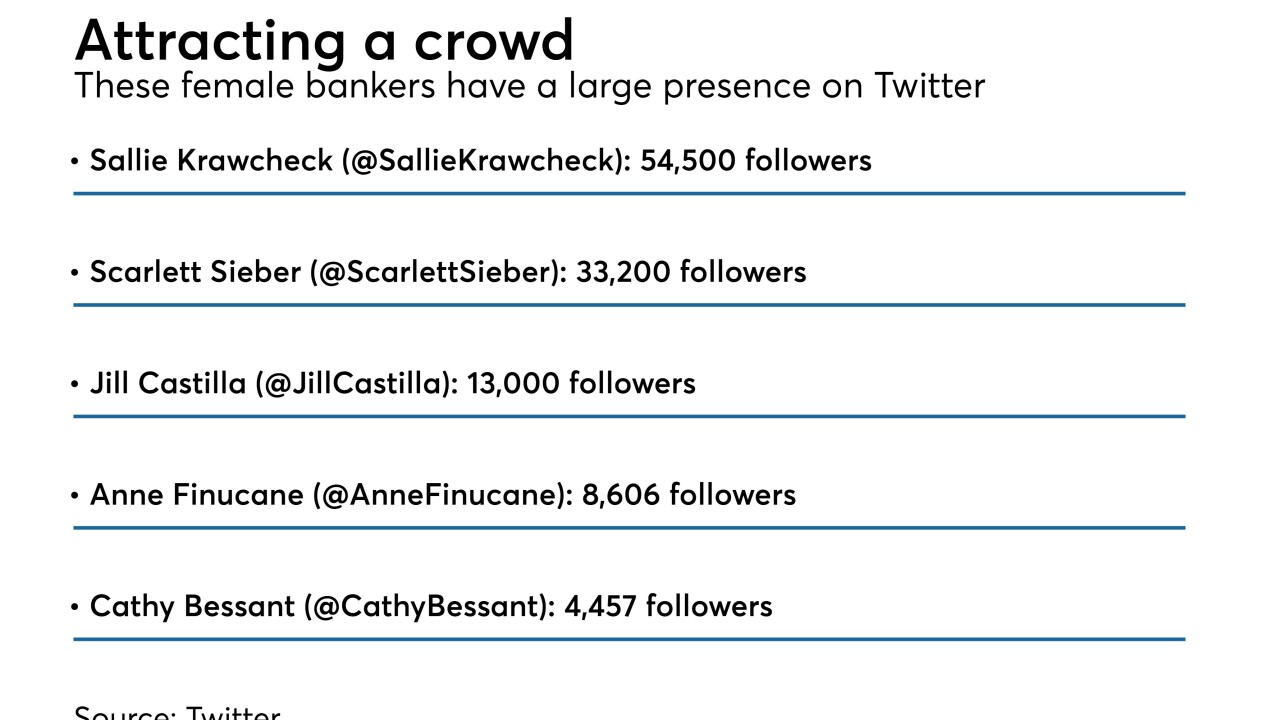

Natalie Bartholomew, a banker in Oklahoma, has launched a blog designed to promote women's issues and tout her peers' accomplishments.

March 2 -

The partnership aims to increase efficiencies and reduce expenses for the three-state league.

January 11 -

The $590 million-asset credit union has returned $4 million to members over the past 17 years.

January 8 -

The company will add $370 million in assets after buying the parent companies for First Bank & Trust and First Bank of Chandler.

September 8 -

Southwest Bancorp, frustrated with a lethargic stock price, opted to find a buyer last summer. It was holding talks with Simmons First when the post-election run-up in bank stocks gave its shares an unexpected lift. Did it do the right thing by proceeding?

July 28 -

The company will gain more than $500 million in assets after buying Eastman National and Cache Holdings.

July 17 -

Under Steven Bradshaw, the Oklahoma bank is engaging employees as never before by investing heavily in training and development. Don't think customers haven't noticed.

June 27 -

Oil prices are dropping again, but some lenders think now is the time to recommit to energy lending as long as they underwrite them a certain way for certain borrowers in certain regions.

June 20 -

Gov. Mary Fallin, a Republican, sided with consumer advocates over payday lenders in a fight that is playing out in numerous states.

May 5 -

The Oklahoma company did not disclose how many shares it could sell or how much it could raise.

January 24 -

Bankers got what they asked for when the Federal Open Market Committee raised the federal funds rate by 25 basis points this week, but some banks could face near-term pain as securities portfolios lose value and certain hedging strategies backfire. Moreover, the rate hike won't have a meaningful impact on net interest margins until loan demand picks up.

December 15 -

The president of the Kansas City Federal Reserve Bank is best known for her dissenting votes on monetary policy, but that's not the only way she stands out. Her background as a farmer and former bank examiner gives her a unique perspective among Fed officials.

October 30 -

As banks grow and their business models become more complex, some find that adding a general counsel to the staff makes sense. Bank SNB in Stillwater, Okla., says hiring one allowed it to reduce its legal fees by 80%. Here are the pros and cons.

October 30 - Oklahoma

BOK Financial's third-quarter profit fell slightly as higher legal and other costs offset growth in loans and fee income.

October 26 -

Groups in North Carolina, Pennsylvania and elsewhere are stepping up efforts to create programs and conferences dedicated to younger bankers, including millennials.

September 12