-

President and CEO Bob Corwin plans to retire by this summer, having led the Clackamas, Ore.-based credit union for seven years.

January 24 -

Justin Olson will take the helm from CEO Jim Lumpkin, who led the $90 billion-asset USAgencies for more than two decades.

January 17 -

Incoming CEO Clint Stein said the Tacoma, Wash., company is ready to revisit deals after spending three years updating its digital platforms.

December 26 -

Member business lending growth has fluctuated in recent years but growth overall is slowing even as balances continue to rise. The long run of success could prove to be a problem when the economy finally turns south.

November 14 -

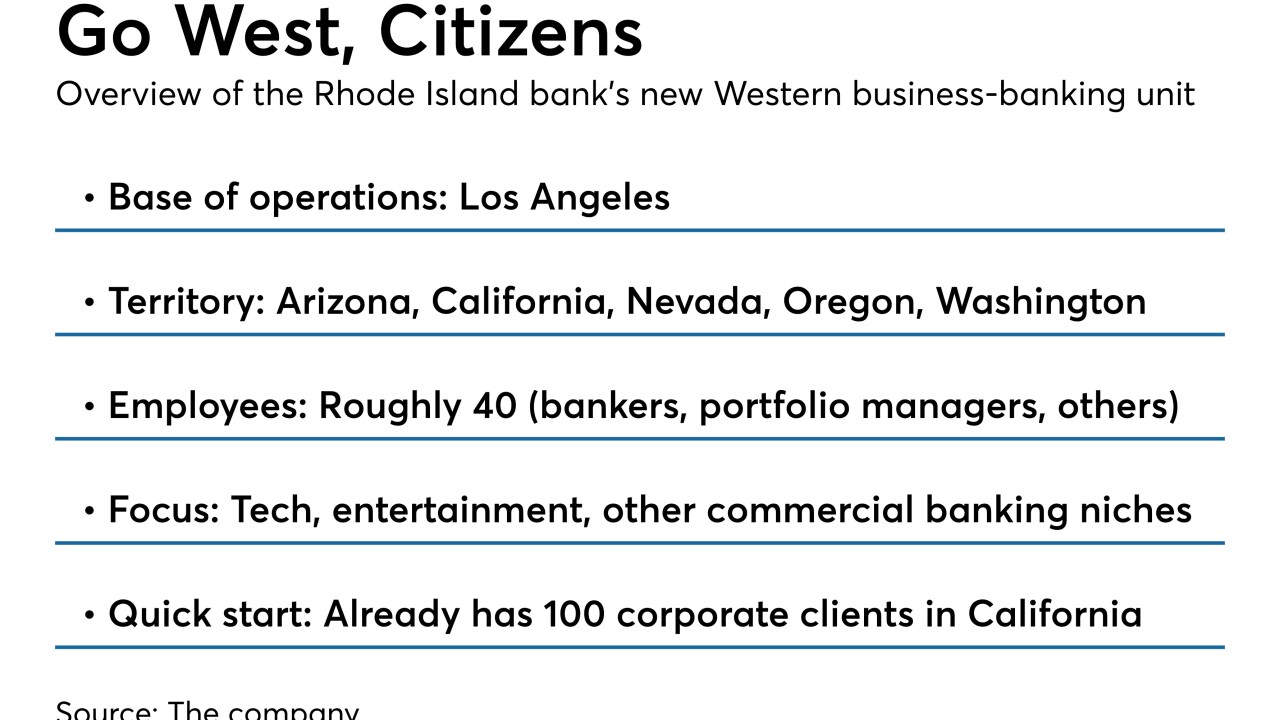

The Providence, R.I., bank recently installed a new regional head in California to oversee a commercial banking expansion into five western states. The bank says it’s trying to craft a successful growth strategy while reassuring investors it isn’t overreaching.

October 9 -

JWTT, created by former Wedbush Securities bankers, says it will use its connections to court business from other investment banks that were recently sold.

September 19 -

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

Jim Lumpkin, president and CEO of the Portland, Ore.-based institution, is planning to retire in the first quarter of 2020.

July 11 -

Seed, a San Francisco startup, has developed a platform that lets small businesses quickly open accounts online. That's an important feature for Cross River as it courts more fintech clients.

June 24 -

Columbia Banking CEO Hadley Robbins says he's confident the bank can grow on its own as the number of buyout targets in the Pacific Northwest dwindles.

April 22 -

The venture, which will do business as CU APPS, will offer mobile apps for other credit unions.

April 10 -

Credit unions clinging to an outdated name that no longer reflects the institution's current field of membership could be doing themselves more harm than good, experts say. But it's a fine line between honoring the past and preparing for tomorrow.

March 21 -

Lynn Calvert will lead the institution on an interim basis after Robert E. Dempsey recently passed away.

February 25 -

A MAPS Credit Union executive told the House Financial Services Committee her institution is proof credit unions and banks can safely serve the legal weed space.

February 13 -

Earlier this year CUNA announced a new push to better educate consumers about credit unions. The Northwest Credit Union Association is asking its members to contribute to the effort.

December 21 -

Banks were reluctant to offer services to an industry that had a hazy legal status. That’s about to change.

December 19 -

The Oregon-based institution deposited the bonus in members’ high-yield accounts Wednesday.

December 6 -

The bank will still use GoTo, an app consumers can use to communicate with a personal banker, but no longer own the Pivotus subsidiary that created it.

October 22 -

Tory Nixon, who became Umpqua's chief banking officer this spring, is trying to drive more customers to use mobile banking (only 15% do so now industrywide) without alienating them in the process.

August 3 -

Oregon-based credit union says it was successful in lending, deposits, memberships.

July 26