-

The regtech firm Arachnys, which recently raised $10 million from QED Investors and others, draws from a collection of 23,000 data sources to help banks protect themselves from money launderers and other criminals.

October 15 -

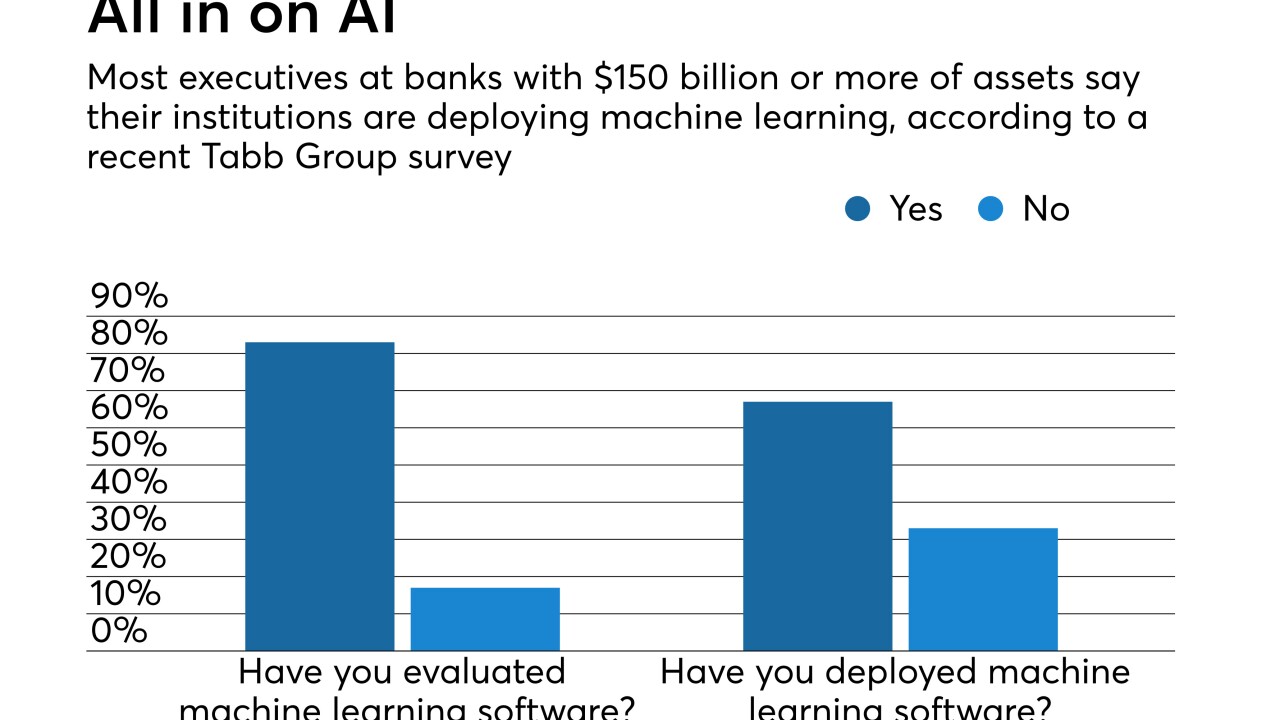

Some mortgage lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 5 -

To personalize products and services, banks are now tracking all sorts of alternative data sources, even the manner in which customers type in mobile banking apps.

October 3 -

Executives at Wells Fargo, BBVA Compass, ATB and Banco Popular share some of the pain points they've encountered as they've implemented artificial intelligence, and how they overcame them.

October 2 -

AI-powered assistants will change the customer experience for the better, but first they must achieve a more human level of service, executives said during a discussion at Finovate.

September 28 -

An all-virtual future remains far off, as conversational programs still aren’t capturing the nuance of speech and chatbots have disappointed many customers.

September 27 -

The subprime auto lender Prestige Financial Services used machine learning to make more effective lending decisions than its former model.

September 27 -

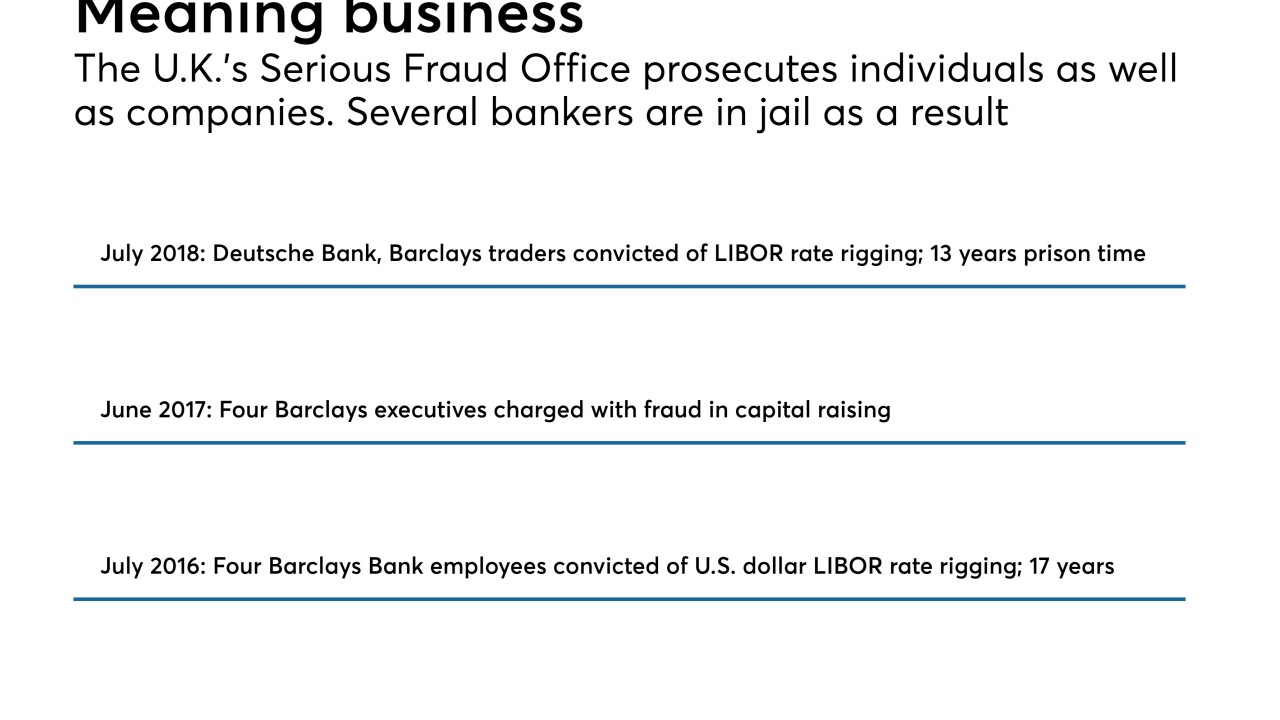

The U.K.'s Serious Fraud Office employs software that can read discovery documents about 2,000 times faster than human lawyers and can find previously unknown patterns between people, enabling quicker investigations and penalties.

September 17 -

A recent editing snafu illustrates an important lesson for credit unions using AI and machine learning.

August 27 Credit Union Journal

Credit Union Journal -

The forum, which is best known for its annual Davos economic conference, offers insights on what many get wrong about artificial intelligence and how banks should be thinking about using it.

August 26 -

Citigroup was so impressed after a two-year test drive of software from the AI vendor Anaconda it decided to invest in the firm.

August 20 -

Bci Miami is one of the first banks in the U.S. to publicly acknowledge using AI this way, when many still consider the technology to be new, risky and unsanctioned by regulators.

August 9 -

Voice assistants impress at tech demos, but new research shows bank customers aren't ready to ask a speaker about their accounts just yet.

August 8 -

Readers weigh in on Mulvaney's plans to shake up the CFPB, respond to banks chasing hot tech trends, applaud fintech-bank partnerships and more.

July 12 -

It will be the third collaboration together for the new CEO and CTO at Pivotus Ventures.

July 12 -

The rise of AI, high-frequency trading and other complex activities is all the more reason for policymakers and financial executives to sharpen their understanding of science, technology, engineering and math.

July 9 Financial InterGroup Advisors

Financial InterGroup Advisors -

Digital Federal Credit Union developed a platform to accelerate fintech development that helps to bake in a valuable partnership between groups that might otherwise be competing with each other.

June 29 -

First Horizon is using artificial intelligence software to analyze employee feedback on workplace surveys.

June 27 -

Reconciling accounts, predicting market turns and their effects on portfolios, and even answering client faxes (yes, faxes) can all be done better with artificial intelligence, the custody bank says. Experts describe it as a cutting-edge program.

June 18 -

Opening internet cafes and investing in new technology are part of an effort to provide nimble, efficient services, the bank's CFO said in a strategy talk.

June 14