For years Fulton Financial has made a conscious effort to achieve greater gender diversity in its leadership ranks.

The rationale: The more inclusive the company is, the better it will be able to attract and retain top-performing employees who will drive successful strategies, which will lead to more growth.

Currently, 60% of the Lancaster, Pennsylvania-based company's 10-member executive management team are women, and nearly one-third of its 13-director board is female.

"It certainly didn't just happen," President and Chief Operating Officer Curt Myers said in an interview. "It's been very strategic, and it's had a significant positive impact on the company."

The percentage of women on Fulton's executive management team in 2021 — nearly 55% — was the highest in a recent DBRS Morningstar report that examined the number of women in top leadership roles at 28 large and regional U.S. banks. The report looked at the banks' executive management teams and their boards of directors.

Guess what? There's a lot of room for improvement.

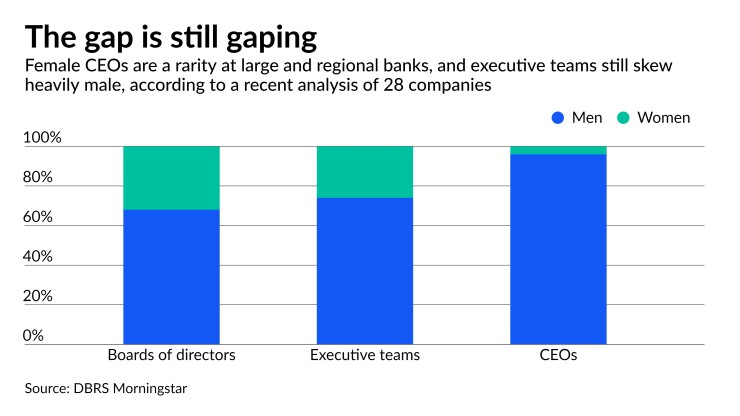

Among the 28 banks — which run the gamut from JPMorgan Chase and Citigroup to smaller regionals such as Bank of Hawaii — women on average made up 26% of executive management teams last year and 32% of boards of directors, according to the report.

While those percentages were higher than in 2014, when women comprised 18% of executive management teams and 22% of the boards at the same 28 companies, there's more work to do to reach gender parity, said DBRS Morningstar analyst Maria-Gabriella Khoury.

"The results show a trend that's, I'll call it 'global,' unfortunately," Khoury said in an interview.

Earlier this year, DBRS Morningstar conducted similar studies of the European and Canadian banks it covers. Among 43 banks in Europe, women represented on average 26% of executive management teams in 2021, the same as in the U.S., and 37% of board member seats, a DBRS Morningstar report showed. At Canada's six big banks, the percentages were slightly higher. Women made up 32% of top management and 43% of the boards, DBRS found.

More diversity overall — in gender, race, religion and experience — has potential benefits for corporations when it comes to financial performance, some

Last fall, a study by Moody's Investors Service

While a formal correlation between diversity and credit performance has not been established, higher-rated banks tend to have more female representation in leadership, at least among the banks studied by DBRS, Khoury noted.

In the U.S., some banks are doing better than others. At Citigroup, where CEO Jane Fraser is the first and only woman to lead a Wall Street bank, the 15-person board of directors last year included eight women, or 53% of the board, the DBRS report showed. That's the highest percentage of women holding board seats among the 28 banks that DBRS examined.

On the executive management front, however, female representation is lower. Including Fraser, who became

At the board level, women in 2021 made up 40% or more of the directors at Goldman Sachs, JPMorgan Chase and U.S. Bancorp, the study found. And they comprised 40% or more of the management teams at American Express, Bank of Hawaii and Comerica.

Some banks say they are planning to do better. Last year, the five-person executive team at New York Community Bancorp in Hicksville, New York, included zero females and just one woman on the board — both of which were unchanged from 2014, DBRS found.

But when the $63 billion-asset company

Cangemi has focused on diversity, equity and inclusion issues since he was

New York Community's shareholders "can expect" that both the management team and the board of directors "will profile dramatically differently than they currently do, and be more diverse, more inclusive and more in line" with companies in the report that have higher gender diversity, the company spokesperson said.

Some of the momentum at individual banks in favor of greater diversity is being driven by activist investors who are paying more attention to environmental, social and governance issues, Khoury said.

"It's that investor activism that will really shape how fast diversity is going to be adopted by major institutions," she said.

Fulton does not set targets for the number of women in leadership roles, according to Bernadette Taylor, chief human resources officer. But the company, which has 3,300 employees, does use "a very broad array of tools" to find, keep and promote diverse talent, she said.

Company-wide, 67% of the workforce is female, Taylor said.

"From my standpoint, being diverse enables us to attract the best talent and retain the best talent, and if [employees] see someone who looks like them, they know they can feel included and belong and be their best," Taylor said.

Myers, who will

"When you have diversity, your team makes better decisions and gets better outcomes," he said. "We feel better about the decisions we're making and the direction we're moving" with a variety of voices in the mix.