-

The company paid roughly $939,000 to repurchase a warrant that would have allowed the Treasury Department to buy about 543,300 shares of BNC's common stock at $8.63 per share, BNC said in a regulatory filing Thursday.

September 21 -

BNC Bancorp in High Point, N.C., has agreed to buy Randolph Bank & Trust in Asheboro, N.C.

May 31 -

Higher interest income and wider margins lifted BNC Bancorp (BNCN) in the first quarter.

April 29 -

BNC Bancorp (BNCN) in High Point, N.C., is remaking its executive staff with a half-dozen new appointments.

April 12 -

The more than $500 million that investors pumped into banks in the Tar Heel State has turned marginal players into consolidators, provided a way to absorb failures and instilled new discipline.

June 14

In bank M&A, it's all about when to hit the gas and when to tap the brakes.

BNC Bancorp (BNCN) in High Point, N.C., has proven to be a model driver in tough times.

With the

"Had they not gone on the offensive, they may have been stuck with problem assets," says Christopher Marinac, an analyst at FIG Partners. "But they pulled their socks up and decided to get serious about making something out of their franchise."

Yet, with a new chief executive in place, BNC seems poised to shift its focus to integration rather than more acquisitions.

"Overall, they are in the core markets that they want to be in," says Kevin Fitzsimmons, an analyst at Sandler O'Neill. "They have enough on their plate, so now is the time to integrate and get everything playing on the same script. That's something we'll all be watching."

That approach is OK with BNC's big backer, Aquiline Capital Partners, which has

"They've done a great job executing on a multifaceted plan," says Ken Thompson, a former Wachovia chief executive

Following Aquiline's initial investment, W. Swope Montgomery,

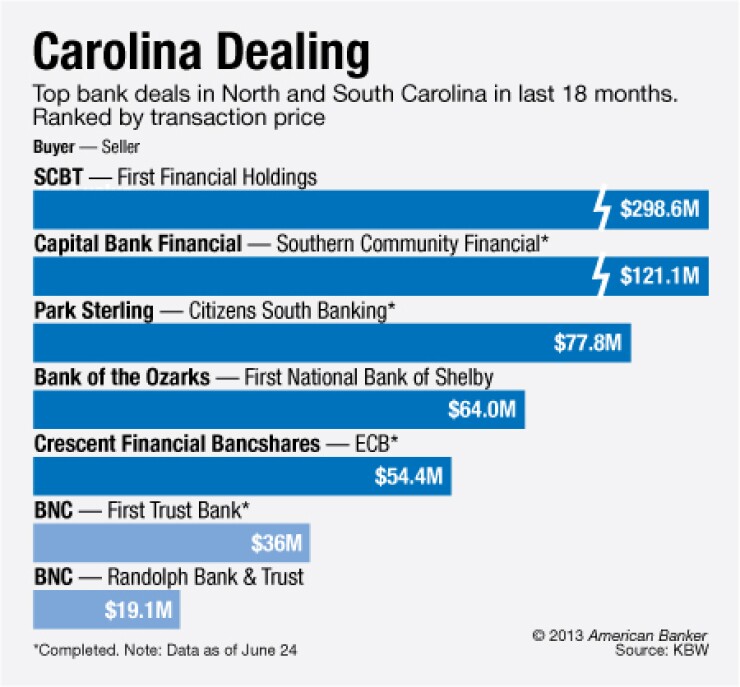

Most of the deals have been small, including last month's

A preference for smaller acquisitions will likely remain the norm under Richard Callicutt 2nd, who succeeded Montgomery in June, Fitzsimmons says. "I think they'll still look at deals, but they'll be bite-size, and they won't have to spend so much," he says.

Acquisitions have contributed to "messy" earnings and taking a break from deals would provide "a clear view on their earnings power," Fitzsimmons says. "The goal at BNC is higher and cleaner core earnings."

The expectation is that BNC can earn roughly $1 a share in 2014, compared with 60 cents this year, Marinac says. Many of BNC's deals are designed to reclaim any lost tangible book value within a year, Marinac says, adding that smaller deals, compared with transformational ones, are "less risky and less disruptive to tangible book."

Efforts to reach Callicutt were unsuccessful.

BNC's management team has been doing more than just lining up acquisitions. The company used debt, rather than another dilutive capital raise, to

"They are one of the few companies where I have the margin ramping up in 2014," Fitzsimmons says. "That's a good thing to have at a time when other banks are seeing their margins go down. They've also been pretty successful growing loans, which is hard to do."

For Thompson, the decision to take advantage of low borrowing rates to buy back the Tarp shares stands out. "It was their idea," he says of the debt strategy. "They brought it to us. We liked it and it made sense. That's just the genius of this management team."

BNC could certainly buy more banks, but there is no imperative to do so, Thompson says. "There are still a lot of banks in North Carolina and South Carolina," he says. "They can do more deals, but only if they are good for shareholders and if they have the capacity to integrate them."

Regulation and competition remain the biggest challenges for BNC, as well as for other banks, Thompson says. "The economy, while picking up some steam, is still in slow-growth mode," he says. "Pricing for loans is very competitive, but they've responded very well to that and they're doing a very good job of managing expenses."

BNC has solid capital. Its common stock has appreciated 14% above the $10 a share that Aquiline paid in 2010. The private-equity firm, which invested another $25 million last year as part of a larger private placement of preferred stock, has no immediate plans to unwind those investments.

"Our fund has a life to it, and we have to return capital to our investors," Thompson says. "It usually involves a five- to seven-year period but we can extend that. If we got our capital back from BNC we would have to reinvest it at a better return. Right now, we're happy with how our investment is compounding at Bank of North Carolina."