-

Financial markets took a tumble Monday morning after Federal Reserve Chair Jerome Powell announced that he was the subject of a Justice Department inquiry concerning the central bank's headquarters renovation. Lawmakers and former Fed officials decried the move as political intimidation.

January 13 -

The U.K. payments processor announced its acquisition of an alternative merchant acquirer license from the state of Georgia as part of its U.S. expansion.

January 12 -

The 6-2 vote represents a win for the megabank, which has been fighting a nationwide push to organize its workers. Some 28 branches have voted in favor of unionization, while three have rejected unionization.

January 12 -

A report from the Cato Institute, a libertarian think tank, released Thursday found that most sudden account closures were spurred by supervisory pressure rather than political or religious bias on the part of the banks, a finding that is at odds with the White House's framing of the issue.

January 12 -

The Trump administration's decision to launch a criminal investigation of the Federal Reserve chair is a blatant abuse of power that threatens to undermine confidence in the financial stability of the U.S.

January 12

-

Following President Trump's aggressive bank deregulation agenda, the FDIC and OCC, and occasionally the increasingly politicized Fed, are in a race to slash compliance requirements. Bankers should remember that the pendulum can always swing back.

January 12 K.H. Thomas Associates

K.H. Thomas Associates -

New research from American Banker details how the 50 largest U.S. banks by U.S. assets are using stablecoins, cryptocurrencies and other distributed ledger technology.

January 12 -

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

Universal Commerce Protocol is an open standard that establishes a common language for AI agents and systems to work together, and will allow consumers to purchase products from retailers directly through Google's AI Mode in the browser or the Gemini app.

January 11 -

Jelena McWilliams, former chair of the FDIC, is joining data sharing fintech Plaid as its new president of corporate and external affairs.

January 9 -

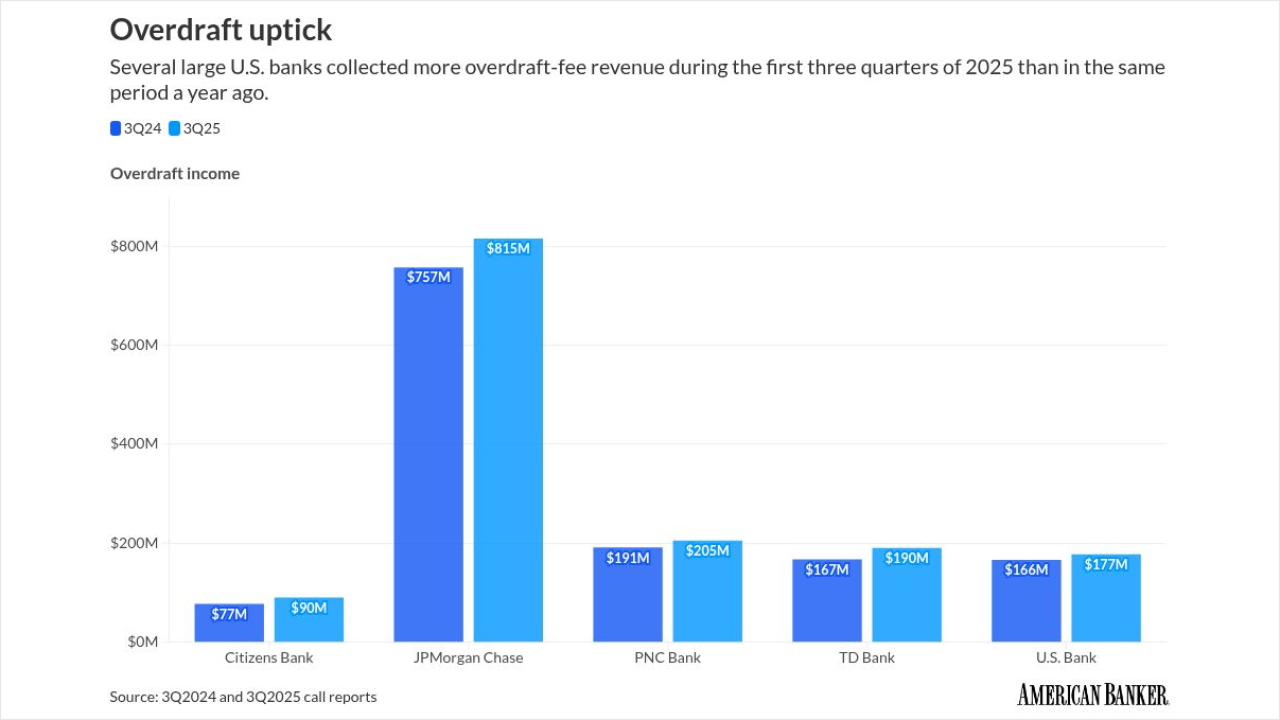

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

As the Federal Reserve's quantitative tightening efforts fade into history, the major engine of economic growth in the U.S. will be bank lending. Regulators should keep a close eye on where those dollars are going.

January 9

-

Employers added 50,000 jobs in December, with gains in service industries while broader sectors remained mostly flat, supporting the Fed's cautious stance on further rate cuts.

January 9 -

The proposed rule codifies the ability for trust companies to conduct non-fiduciary activities, something banks say Congress never intended, but that OCC says has long been the case.

January 8 -

The Federal Reserve will resume accepting pennies from banks and credit unions at all commercial coin distribution locations beginning Jan. 14. The central bank had ceased accepting pennies at some distribution centers late last year, but bankers praised Thursday's reversal.

January 8 -

The bank fired a manager for originating suspicious loans but later asked the SBA to forgive them, prosecutors say. The case ended in a $7.7 million settlement.

January 8 -

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8 -

The deal ends more than a year of speculation of who would take over Apple's coveted credit card portfolio.

January 7 -

The bank is investing in Ubyx to help traditional financial institutions settle stablecoin payments and compete with nonbank fintechs.

January 7 -

The company's asset and wealth management business is completely cutting ties with proxy advisors, opting to build its own research and public company voting system. JPMorgan is the first bank to stop using firms such as Glass Lewis and ISS.

January 7