-

The online bank will consolidate all of its Charlotte-area employees into a new office tower, but its headquarters will remain in Detroit.

September 20 -

The Detroit lender developed rotational training programs in auto finance, accounting and technology to help attract and keep promising employees, especially millennials, who had a tendency to bolt.

September 11 -

The commitments were the residue of restrictions that were placed on Ally in the wake of government bailouts in 2008 and 2009.

August 22 -

The Detroit company is capitalizing on other banks' retreat from the auto sector.

July 27 -

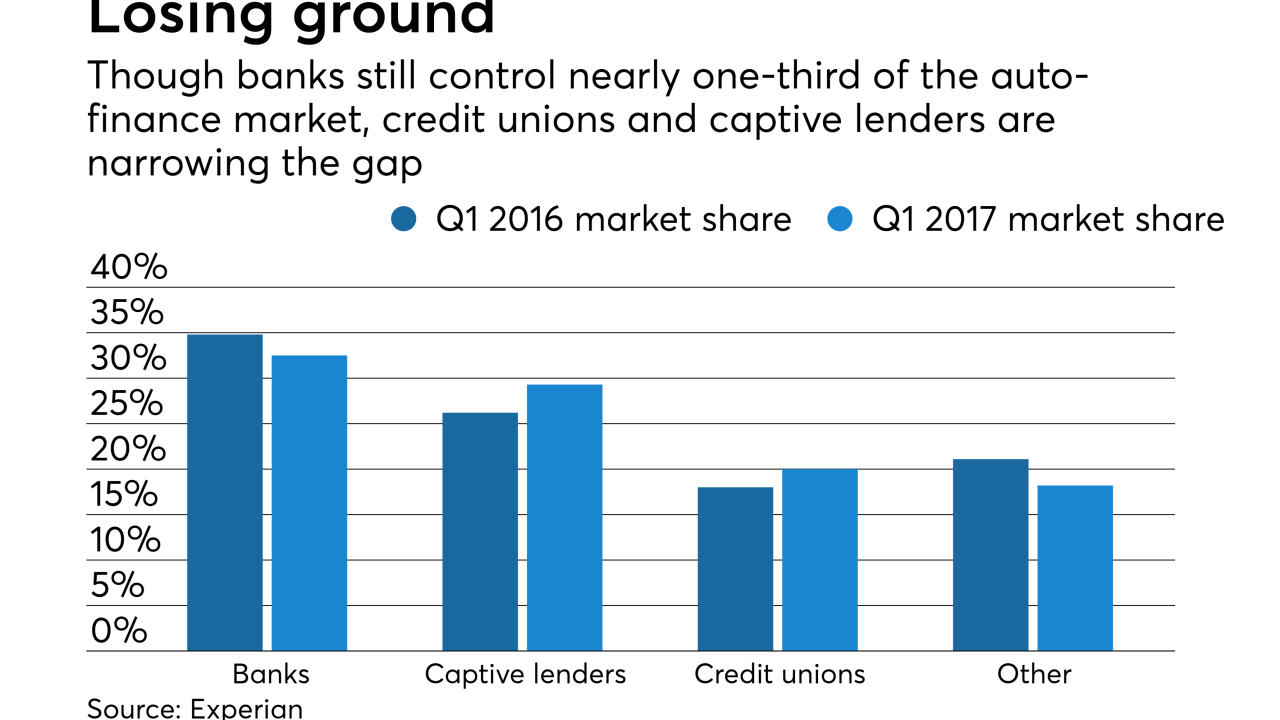

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 8 -

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 7 -

The weakening car-loan market poses a big challenge for the Detroit-based lender, but it also could also present an opportunity, since other big banks are sharply reducing their exposure.

April 27 -

In a further illustration of weakness in the auto sector, Ally Financial said Tuesday that its 2017 profits will likely be dinged by rising delinquencies on subprime auto loans, as well as by falling used-car prices.

March 21 -

Issuers are using mobile technology to bolster plastic cards, adding new features and controls for consumers.

March 3 -

The $163.7 billion-asset auto lender reported net income of $248 million, down 5.7% as a result of an increased loan-loss provision and noninterest expenses.

January 31