-

John Collins comes to the credit union industry after spending 20 years in a variety of roles at the national bank, including helping integrate two acquisitions.

August 26 -

A year-old data breach, which earned the company an $80 million OCC penalty this week, continues to offer lessons to banks as they put more sensitive information in the hands of cloud vendors.

August 7 -

Regulators found fault with the bank’s cloud migration efforts in the years that preceded a 2019 hacking incident.

August 6 -

“We do not yet know when we’ll return to a more traditional operating model,” a company spokesperson said.

August 5 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

Since March, issuers have tightened their criteria for opening new accounts and closed millions of existing ones in hopes of avoiding waves of defaults.

May 29 -

The lender’s offices in the U.S., Canada and the U.K. will remain shut to all nonessential staff at least through the Labor Day holiday on Sept. 7, CEO Richard Fairbank wrote in an internal memo.

May 5 -

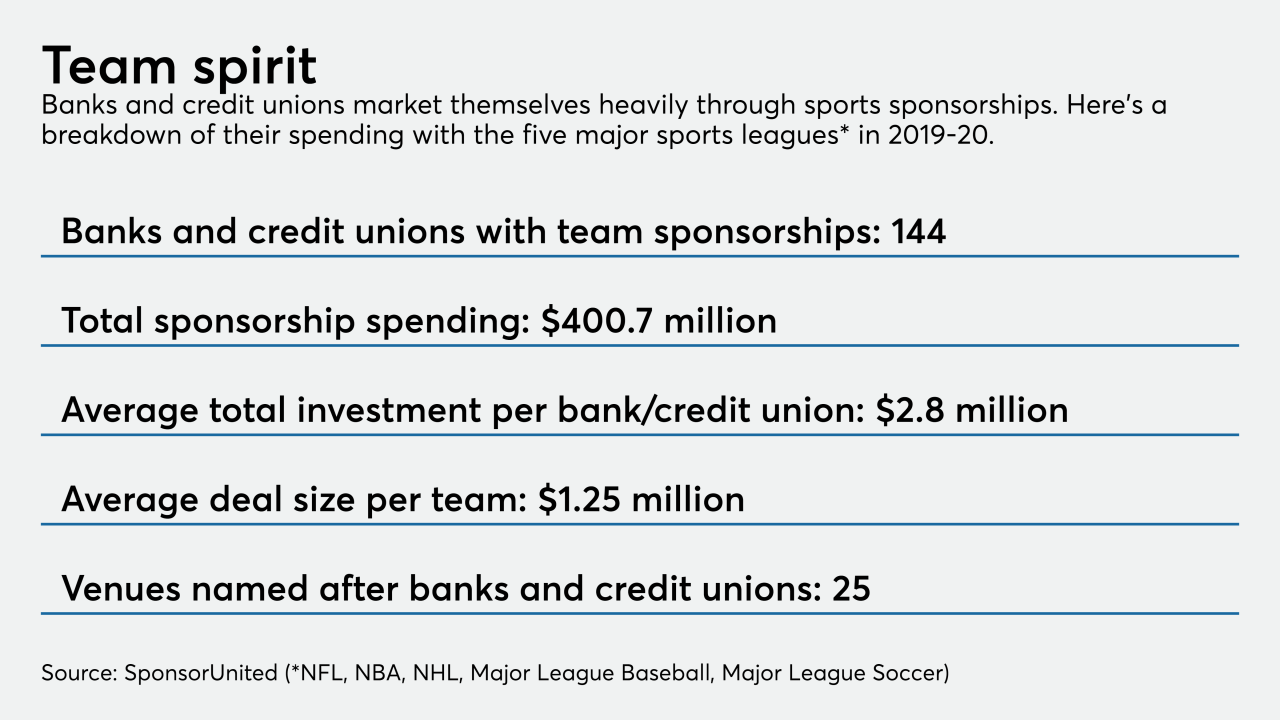

Many banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

May 3 -

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

April 29 -

The company reported a loss of $1.3 billion in the first quarter after setting aside more than $5.4 billion for potential loan losses.

April 24 -

Reluctant to cancel what have become pipelines for developing talent, banks are delaying start dates or moving programs entirely online.

April 13 -

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

April 8 -

About 1,000 interns were notified of the change this week. They will still receive the pay and housing funds outlined in their original offer letters.

April 2 -

Capital One Financial Corp. requested that its employees work from home if they can, joining other companies in trying to stem the spread of the deadly coronavirus.

March 11 -

Gill Haus oversaw efforts to transform Capital One from a bank to a software company by upgrading legacy technologies, moving systems to the cloud and experimenting with different ways of using data.

February 28 -

It might sound like a risky strategy at a time when millions of Americans are drowning in debt, but that's exactly what big banks have been doing lately.

January 23 -

TD Bank claimed the top spot in J.D. Power’s national bank satisfaction survey, but Wells Fargo showed the greatest year-over-year improvement.

December 12 -

The average price of a previously owned car has fallen in two consecutive months, and if the trend continues, lenders could see losses mount, Richard Fairbank said this week.

December 12 -

The ruling by a three-judge panel means the president will lose control of his long-secret business and personal records at the two banks unless the full court reconsiders or the U.S. Supreme Court blocks the decision.

December 3 -

Bank of the West intends to stop making indirect auto loans and will instead focus on financing purchases of boats and recreational vehicles. It’s just the latest example of a regional bank pouring more resources into the powersports sector.

November 14