-

Attorney General-nominee William Barr signaled this week he was not likely to crack down on financial institutions serving pot businesses, but even if he is confirmed and sticks with his assurance, the situation is far from resolved

January 17 -

Attorney General-nominee William Barr signaled this week he was not likely to crack down on financial institutions serving pot businesses, but even if he is confirmed and sticks with his assurance, the situation is far from resolved

January 17 -

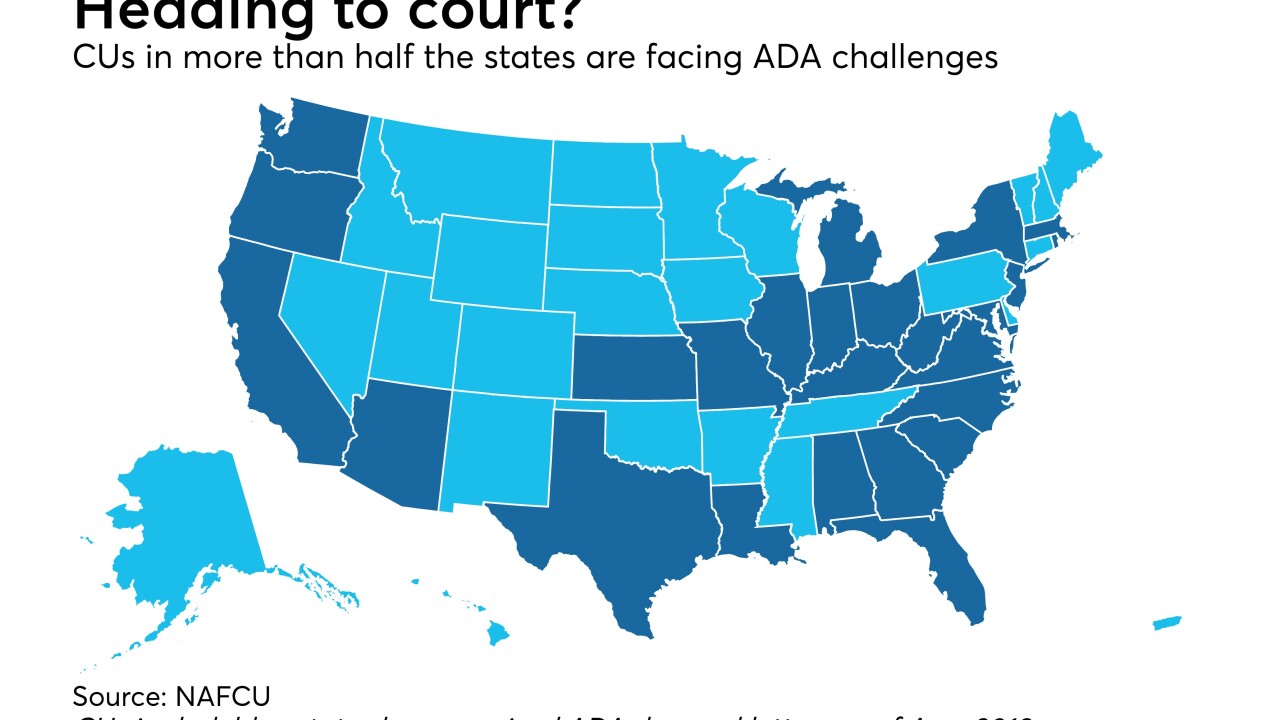

The industry spent a good portion of 2018 fighting ADA and overdraft lawsuits, and experts say despite some progress, next year could hold more of the same.

December 20 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

Danish lawmakers say that the probe currently focused on Danske Bank should be expanded to include more firms.

November 29 -

The Federal Savings Bank is trying to persuade a judge to look beyond its CEO's alleged complicity in a fraud perpetrated by President Trump's former campaign chair.

November 29 -

The French bank was hit with the fine after it was found to have unsafe practices that violated sanctions against Cuba and other sanctioned countries.

November 19 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 16 American Banker

American Banker -

UBS Group sold tens of billions of dollars' worth of residential mortgage-backed securities by "knowingly and repeatedly" making false and fraudulent statements to investors about the loans backing those trusts, the U.S. Justice Department said in a civil suit filed Thursday.

November 8 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 8 American Banker

American Banker -

Readers consider to new evidence regarding Operation Choke Point, debate the impact of Democrats taking control of the House in November, respond to concerns about weakening the Volcker Rule and more.

October 25 -

New court documents underscore the damage inflicted by the Obama administration’s de-risking initiative, argues Rep. Blaine Luetkemeyer.

October 24

-

American Express Co. said the U.S. Department of Justice and several regulators have sought information on its foreign-exchange international payments business.

October 23 -

The former EVP/chief information officer has been interim CEO since May, following Pete Sainato taking the helm at Transportation Federal Credit Union.

September 20 -

Investigators have sought more information from the bank in recent weeks about whether management pressured workers to improperly change documents in order to meet a regulatory deadline, according to a news report.

September 6 -

Readers react to Wells Fargo's latest penalty, weigh in on the Vatican's criticism of credit default swaps and opine on the long tail of the financial crisis.

August 2 -

The agreement was likely the last of the big cases to be cleared by the Justice Department, and Wells paid less than its peers did to resolve the lingering mortgage probes stemming from the meltdown.

August 1 -

Several firms are touting tools to help financial institutions bank legal marijuana-related businesses, an industry expected to yield $10 billion in retail sales this year.

July 24 -

A letter from 19 state attorneys general calls on the Department of Justice to issue regulations that "provide needed clarity" for institutions targeted in ADA-related law suits.

July 24 -

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

July 6