Fifth Third Bancorp

Fifth Third Bancorp

Fifth Third Bancorp is a diversified financial-services company headquartered in Cincinnati. The company has over $200 billion in assets and operates numerous full-service banking centers and ATMs throughout Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia, and North Carolina.

-

As Fifth Third's chief administrative officer, Teresa Tanner has overseen big changes in employee benefits and led the process to relaunch the bank's brand.

September 25 -

The Cincinnati bank says its investment unit is taking an equity stake in NRT Sightline to provide a wide range of banking and payments services to casino operators.

September 20 -

The Cincinnati company has agreed to acquire Epic Insurance Solutions in Louisville, Ky., as it continues to build out its fee-based lines of business.

September 15 -

Flush with cash, many commercial firms are also opting to pay down debt rather than take on new loans, and those seeking financing aren’t always turning to banks to meet their needs.

September 15 -

The regional bank will record a pretax gain of about $1 billion as it continues to shed its stake in the payment processor Vantiv.

August 8 -

The Trump administration is considering nominating Jelena McWilliams, Fifth Third Bancorp's top lawyer, to lead the Federal Deposit Insurance Corp., people familiar with the matter said.

July 28 -

Auto risks mounting. Mortgage market tightening. Are there any good risks these days in consumer lending? Regional bank executives insist partnerships with online lenders, unsecured personal loans and other niche efforts can work if done properly.

July 21 -

The Cincinnati company reaped the benefit of the latest round of interest rate hikes, as a higher net interest margin and lower costs helped overcome the drop in lending.

July 21 -

Revenue growth in its merchant payments business is expected to be tepid in the foreseeable future. The Minneapolis company says it is looking to ramp up innovation to stay competitive in a business that has been upended by fintech firms and online shopping.

July 19 -

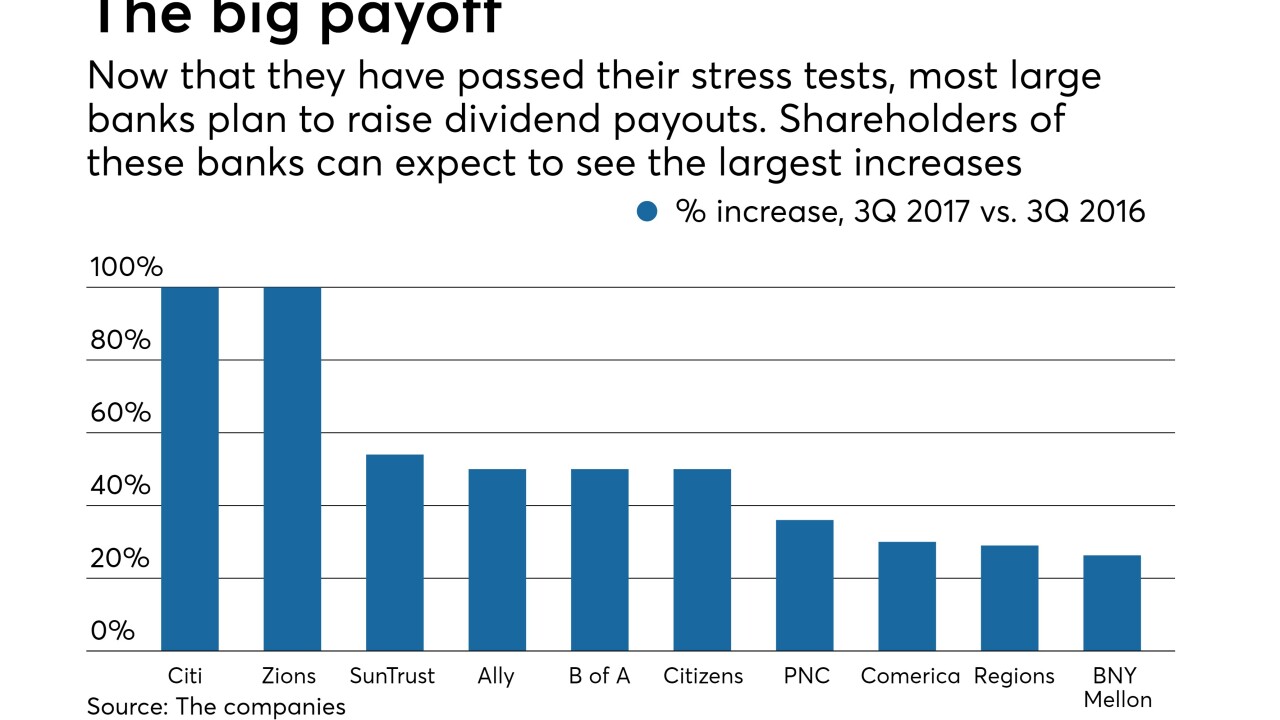

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29