-

After a nearly $100,000 loss in 2018, $30 million-asset Alliance Blackstone Valley Federal Credit Union is set to merge into Rhode Island CU and its network of branches across the state.

January 28 -

In 2017, the National Credit Union Administration board approved provisions to make mergers more transparent. But one of those changes has become a casualty of the government closure.

January 25 -

The $1.9 billion-asset Schools Financial Credit Union has plans to merge into SchoolsFirst, which is already the largest credit union in California.

January 23 -

A recent high-profile news story doesn't paint the National Credit Union Administration chairman in a good light, but some in the industry say it could also lead to positive changes on the board.

January 23 -

Coast-Tel Federal Credit Union is merging into Bay Federal Credit Union on Feb. 1 with the integration expected to be completed by midyear.

January 18 -

During the National Credit Union Administration's monthly meeting on Thursday, Chairman J. Mark McWatters noted that the agency was making progress on hiring more women and minorities.

January 17 -

Sen. Elizabeth Warren questioned the five largest U.S. retail banks in a letter on what they are doing to reduce the impact of the government shutdown on customers.

January 16 -

CUNA and NAFCU both issued letters to the National Credit Union Administration suggesting ways federal credit union bylaws could be amended.

January 15 -

Despite the ongoing federal work stoppage, some scheduled activities are still taking place this week in Washington.

January 14 -

The banking industry is unduly worried that recent credit union deals could open the door for anyone to join.

January 9 America's Credit Unions

America's Credit Unions -

The banking industry is unduly worried that recent credit union deals could open the door for anyone to join.

January 9 America's Credit Unions

America's Credit Unions -

Now the third-longest shutdown in history, there are few signs the government will reopen anytime soon, and that's causing problems for lenders.

January 7 -

An “emergency merger” with the troubled Progressive Credit Union gives PenFed — already the nation’s third-largest credit union — the ability to welcome any potential member nationwide.

January 4 -

An “emergency merger” with troubled Progressive Credit Union gives PenFed – already the nation’s third-largest credit union – the ability to welcome any potential member nationwide.

January 4 -

Two former credit union employees were banned as the result of theft and other claims from the NCUA board.

December 31 -

As the U.S. undergoes a dramatic demographic shift, credit unions must be proactive to ensure their employees represent the communities they serve.

December 21 National Credit Union Administration

National Credit Union Administration -

The move is sure to draw criticism from bankers because it would allow credit unions to compete for backing from private investors.

December 19 -

Recent data from NCUA showed a lot of positives for the industry, but it also revealed some potentially worrisome trends.

December 18 -

The move is sure to draw criticism from bankers because it would allow credit unions to compete for backing from private investors.

December 18 -

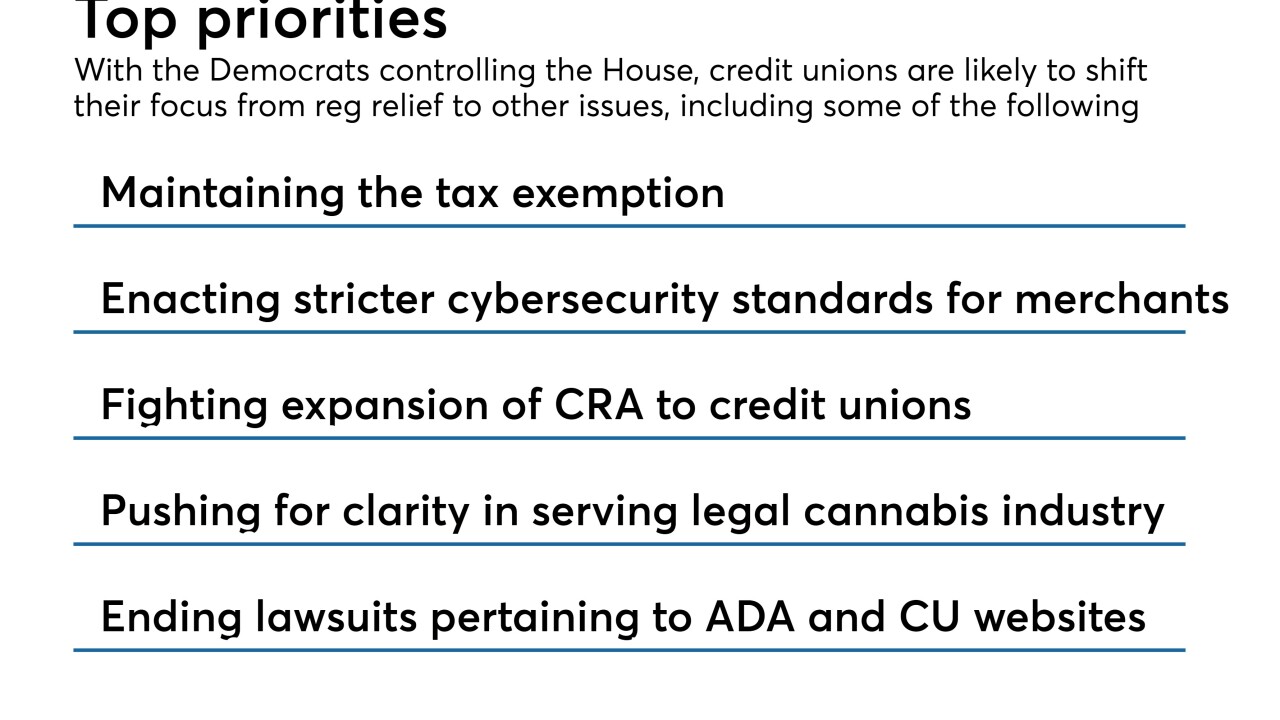

With control of the House changing hands in January, credit unions are set to shift their focus from regulatory relief to cybersecurity and fighting CRA.

December 18