Synovus Financial

Synovus Financial

Synovus Financial operates dozens of community banks throughout Georgia, Alabama, Florida, Tennessee, and South Carolina. Concentrating on commercial loans and commercial real estate, the bank uses its small-town image to establish strong relationships with its small-business customers.

-

Banks are capitalizing on changing consumer habits - and satisfying a pressing need to diversify their loan portfolios - with a spate of instant point-of-sale loans for everything from iPhones to home improvements.

February 7 -

The Super Bowl reminds that firms often have one shot to make a good impression with their advertising. Here are some of the best and worst ads from financial companies.

February 4 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24 -

Net interest income climbed nearly 16%,, though overall profits declined as the Columbus, Ga., company paid down debt and took a one-time charge related to the new tax reform law.

January 23 -

This year has been very good to regional banks, bitcoin investors and several bank CEOs who pulled off big deals or successfully refined business models.

December 19 -

The British banking giant has been testing its new online lending platform with a handful of its U.S. customers and plans to roll it out in full force next year. It's all part of a broader effort to expand its U.S. consumer business beyond credit cards.

November 21 -

Flush with capital and facing stiff competition for customers, many regional banks appear to be mulling acquisitions to accelerate growth.

October 20 -

Third-quarter profits at the Georgia bank rose 52% thanks to doubled-digit growth in consumer lending and the sale of credit card assets it had obtained from the retailer Cabela's.

October 17 -

A change in the formula that banks use to calculate borrowers’ debt-to-income ratios, announced by Fannie Mae in April, appears to be spurring more lending.

October 6 -

Synovus is widely regarded as one of the industry’s most admired companies, and it is up to Liz Wolverton to ensure that it does not rest on its laurels.

September 25 -

CIBC's Victor Dodig has big plans for the U.S., but other bank execs speaking at an investor conference Monday warned of risks in certain sectors.

September 11 -

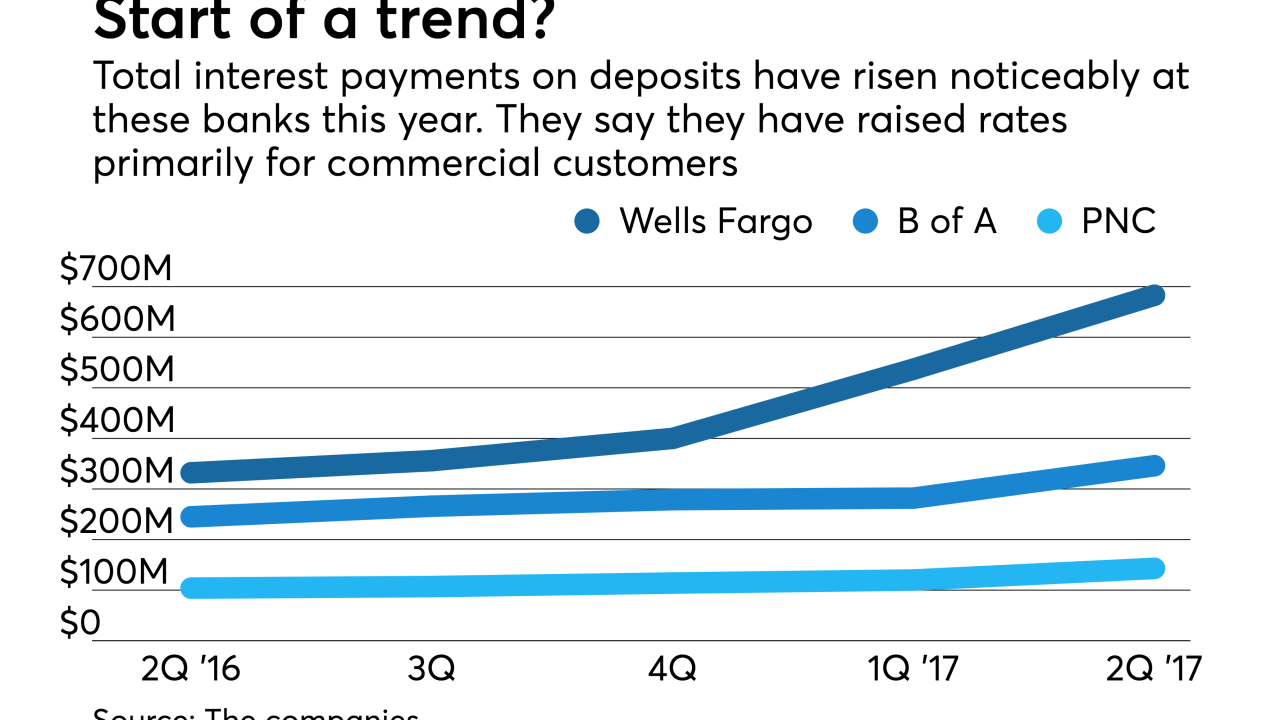

Now that the Federal Reserve has raised short-term rates four times in the past 18 months, all eyes are on deposit costs as banks seek to keep pricing low and fatten margins. But that effort is complicated by the fact that banks must prepare for the unwinding of the Fed's balance sheet and consumers' rapid adoption of mobile deposits.

July 21 -

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

As you'll see from this list, regional banks are doing a better job bolstering their reputations than the big banks are, according to the 2017 American Banker/Reputation Institute Survey of Bank Reputations.

July 6 -

Wells Fargo aside, the industry overall should be pleased with the results of our annual survey of bank reputations. One key insight: Displaying strong ethics is an effective way to improve what people think of your bank.

June 27 -

Even as units of a larger holding company, local banks fight the perception that they can’t provide sophisticated services like corporate or private banking. Executives say that unifying the brand will help Synovus better compete against larger players.

May 3 -

The hand-wringing over business lending has overshadowed the fact that consumer lending — particularly for regional banks — has become a strong and steady engine of growth.

April 18 -

The Columbus, Ga., company also announced late Monday that it is buying the credit card assets and brokered deposits of the retailer Cabela's and will then sell the card portfolio to Capital One.

April 18 -

Bank earnings could be hurt this year as big retailers close stores and file for bankruptcy. The situation has sparked a debate about how much CRE and C&I books will suffer just as lenders were putting other commercial woes behind them.

April 11 -

Three midsize banks projected increases in loans this year in the latest round of earnings discussions, but their levels of optimism varied, and their commercial lending strategies in some cases conflicted.

January 17