Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The former SoFi CEO raises funds for his new venture despite recent admissions about dating employees; female employee says Mel Watt harassed her.

July 30 -

The retailer is ending its nearly two-decade credit card relationship with Synchrony Financial; Mulvaney says the bureau will first negotiate, not sue, to settle disputes.

July 27 -

Wells Fargo is considering a sale of commercial real estate broker Eastdil Secured, according to a person briefed on the matter.

July 26 -

The OCC has terminated a 22-month-old consent order that stemmed from allegations that the bank unlawfully repossessed cars of members of the U.S. military.

July 24 -

The online lender hires Ronnie Momen from GreenSky as its chief lending officer; aggregators back Capital One in dispute with Plaid; bank CEO who gave mortgage to Paul Manafort uses fire-and-hire maneuver to reap windfall at taxpayer expense; and more from this week's most-read stories.

July 20 -

Kathy Kraninger emerges “unscathed” in testy Senate confirmation hearing; the bank is reportedly refunding money it charged customers for add-on services.

July 20 -

The bank had numerous warnings that there could be severe regulatory consequences related to deceptively advertised add-on products. It is paying the price for failing to do more in response.

July 19 -

The recent decision involved sales taxes, but Wells Fargo recorded a net expense of $481 million under the assumption that it will also lead to higher state income taxes. Other banks may have to follow suit.

July 18 -

Bank of America’s consumer loans grew a lot. But its rivals? Not so much. The mixed results raise questions about whether BofA’s performance is a leading or trailing indicator, and if credit quality is going to be more of a problem industrywide.

July 16 -

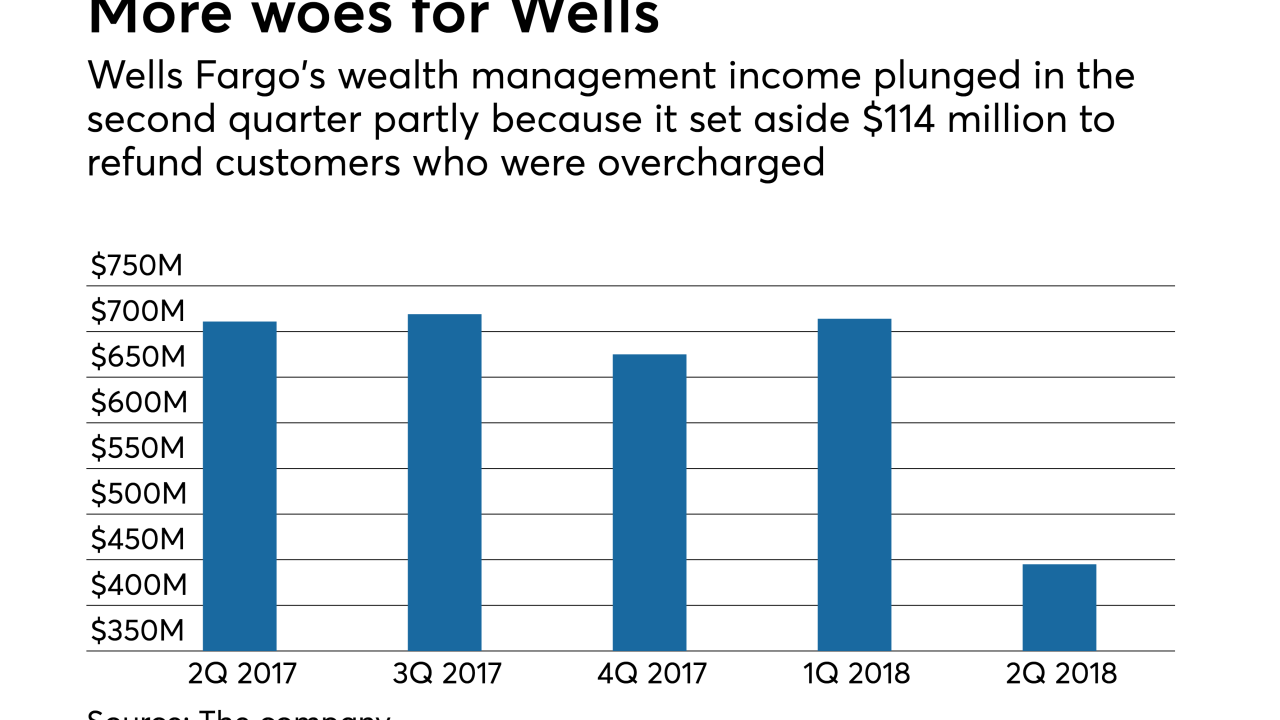

The unit’s profits plunged in the second quarter as the company contended with the fallout from overcharging wealth management clients. Was it a one-off or the beginning of a long-term problem?

July 13 -

Mortgage fees at the nation’s biggest home lender declined by a third in the three months ended June 30 to the lowest in more than five years.

July 13 -

The change in store card branding would be a big blow to Synchrony; “equivalence” with EU rules “falls far short” of U.S. banks’ hopes.

July 13 -

Flagstar Bank, which is in the process of buying more than 50 branches from Wells Fargo, has hired Ryan Goldberg as a director of retail banking.

July 10 -

A first-in-the-nation ordinance, passed by the city council in the wake of the Wells Fargo scandal, would require banks that want the city’s business to reveal if they have sales quotas for employees. It remains to be seen, though, whether Mayor Eric Garcetti will sign the measure into law.

July 3 -

"Banks should be investing in innovation in this area or risk getting left behind," a fintech CEO warns.

July 3 -

Turnover of chief risk officers is on the rise as CEOs look to add executives whose experience goes far beyond assessing credit risk. Sometimes they are promoting from within, but often they are poaching talent from rival banks.

July 2 -

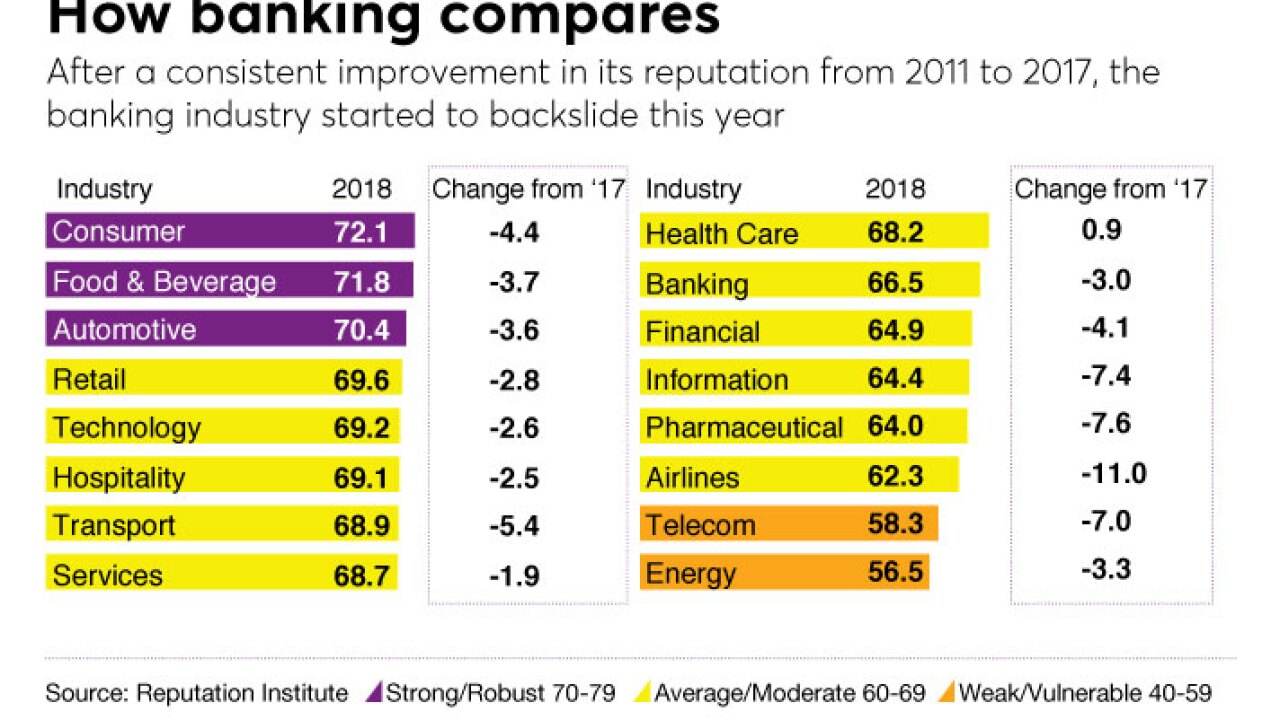

USAA reigns, Wells Fargo, well, doesn't. Here's a look at the highs and lows in this year's survey, as well as the trends that drove the results.

July 1 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

The 13-term California Democrat is in line to chair the Financial Services Committee if her party wrests control of the House in the November election.

June 26 -

The rents are steep and they don't generate much revenue, but some banks believe that airport branches still have a role to play in their retail strategies — particularly as advice centers.

June 26