-

With the future of payday lending in flux, the Office of the Comptroller of the Currency has the ability to help provide consumers with a better credit option.

May 23 The Pew Charitable Trusts

The Pew Charitable Trusts -

Fintech still has a ways to go to change the financial world, but it already offers solutions to income insecurity that can be truly transformational right now.

May 17

-

Gov. Mary Fallin, a Republican, sided with consumer advocates over payday lenders in a fight that is playing out in numerous states.

May 5 -

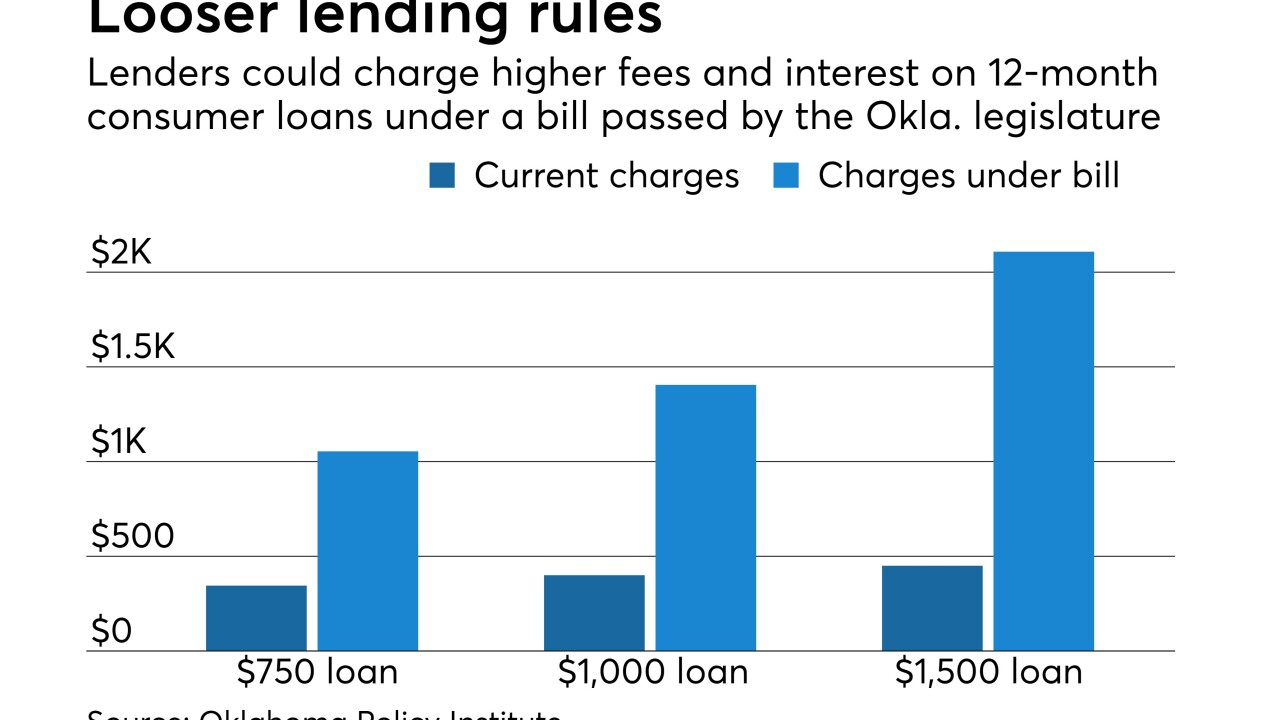

An industry-backed bill that is headed to the desk of Gov. Mary Fallin is seen by critics as an effort to minimize the impact of a potential CFPB crackdown.

April 28 -

The Consumer Financial Protection Bureau's prevailing mindset is apparently not affected by convincing evidence regarding options for borrowers looking for small-dollar credit.

April 17 Community Financial Services Association of America

Community Financial Services Association of America -

Elevate Credit in Fort Worth, Texas, debuted Thursday at half the price the company had been targeting. Investors may have been spooked by the possibility of rising losses.

April 6 -

Startups in the payday lending space say their use of artificial intelligence is allowing them to make better loans at lower rates with fewer defaults.

March 7 -

U.S. District Judge Gladys Kessler is set to rule next week on whether to halt the Justice Department's quest to force banks to cut ties to industries it considers to be at high risk for criminal activity.

February 16 -

Financial firms are going on offense in Washington, pressing a policy agenda that would have been unimaginable just a few months ago. Some proposals, like reforming the Consumer Financial Protection Bureau, have been floated before while others began to gain traction after Republicans swept the November elections. Here's a look at some of the industry's requests.

February 13 -

Jessica Rich, who joined the agency in 1991, is stepping down in mid-February, the FTC announced Tuesday.

February 7 -

The current single-director leadership structure of the Consumer Financial Protection Bureau is not a recipe for transparency and accountability. Creating a multimember commission to oversee the agency is the answer.

January 4

-

The state's highest court ruled that lenders affiliated with Native American tribes are not entitled to sovereign immunity and must comply with state interest rate caps. It marks the latest triumph for consumer groups and state governments that have sought to rein in high-cost consumer lenders.

January 3 -

The Consumer Financial Protection Bureau is facing renewed pressure by consumer groups and think tanks to move forward with a plan that would rein in overdraft programs.

December 20 -

The Consumer Financial Protection Bureau's contentious rulemakings on arbitration and payday lending may be in jeopardy with the change in administrations and continued GOP control of Congress.

November 13 -

To jawbone Mexico into paying for the wall, President-elect Trump has threatened to suspend remittances. Such a move would disrupt one of the busiest corridors of money in the world.

November 9 -

Voters in South Dakota on Tuesday overwhelmingly approved a measure to cap interest rates on payday, installment and auto title loans at 36%, while rejecting a competing amendment sponsored by a large payday lender.

November 9 -

Depending on the outcome of the election, the fight over two conflicting state ballot initiatives could provide a road map for the embattled payday lending industry or consumer activists seeking bans in other states.

November 4 -

The Consumer Financial Protection Bureau and the New York Attorney General filed a lawsuit Wednesday against two New York debt collectors for deceiving and harassing millions of consumers to pay inflated debts.

November 2 -

The piling on at Wells Fargo has reached an unprecedented level, even for a bank. Fifteen investigations are underway into Wells' phony account openings. Experts are quantifying the damage to Wells' reputation and what the bank can do going forward to repair it.

October 25 -

Two San Francisco supervisors on Tuesday introduced a resolution that would "end all business with Wells Fargo," in response to the fake account scandal and other practices that have harmed consumers.

October 18