-

Overdraft fees have been a reliable revenue source for decades, but the charges have fallen into disfavor amid regulatory scrutiny and competition from neobanks. Here's a look at the steps various large and midsize banks are taking to reduce or eliminate the fees, as well as their plans for what's next.

January 31 -

The Federal Reserve, FDIC, OCC and CFPB — increasingly under the leadership of Democratic appointees — are gearing up to regulate cryptocurrency, modernize the Community Reinvestment Act and give consumers more control of their personal data. Here's a look at the policy changes they're mulling.

January 27 -

Personalized advice, embedded finance and virtual branches are among the initiatives financial services companies have on their drawing boards for the coming year.

January 4 -

Industry leaders in the spotlight this year include Citi's Jane Fraser, TD's Bharat Masrani and several others who are making big moves in cryptocurrency.

January 2 -

Biden administration appointees moved quickly to highlight climate change risks and unwind Trump-era regulatory relief and housing finance measures. These regulators and lawmakers will have a seat at the table as the progressive shift in banking policy continues.

December 29 -

Card networks are poised to connect to nonfungible tokens, issuers are revamping rewards, and regulators are taking greater interest in installment loans. These developments and more bear watching in the year ahead.

December 26 -

These executives are adapting to changing customer demands amid rebounding M&A and coronavirus-related challenges.

December 22 -

The year's biggest storylines included an M&A revival, a reexamination of overdraft fees, a changing of the guard in Washington and the rise of new technologies. Here's a look back.

December 19 -

A new survey of industry executives finds substantial interest in cryptocurrencies and mergers but anxiety about competition from large technology companies.

December 13 -

The guessing game is over about President Biden’s pick for Federal Reserve chair, but several names are in the mix for three additional vacancies on the board, including vice chair for supervision.

December 5 -

President Biden's announcement that he is reappointing Jerome Powell as chair of the Federal Reserve suggests that not much will change regarding supervision, capital requirements and approval of merger applications. But the still-open position for vice chair of supervision could go to a more progressive nominee.

November 22 -

A focus on getting work done more efficiently has prompted these midsize banks to rearrange responsibilities, eliminate red tape and use technology to automate repetitive or tedious tasks. Some are also enhancing leadership development and increasing employee benefits amid an increase in turnover.

November 11 -

The Federal Reserve is mulling changes to a key capital measure for big banks, rulings on several merger applications and other actions. How it ultimately decides those matters will depend largely on whom President Biden appoints as head of the central bank and to other leadership positions.

November 9 -

The largest of the 2021 Best Banks to Work For, those with more than $10 billion of assets, are trying new recruiting tactics and ramping up diversity efforts.

November 9 -

The smallest of the Best Banks to Work For have figured out how to thrive in an environment where many employees are working fully or partly from home. Some are using flexibility as a tool to stave off burnout.

November 9 -

Executives at the 90 institutions that made the ninth annual ranking are boosting benefits to attract new employees, amid intense competition for talent. They're also rethinking how they approach recruiting and increasing their diversity efforts.

November 8 -

As installment lending becomes more popular, regulators in the U.S., Europe and Australia are considering new restrictions or taking action against lenders.

November 4 -

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

October 26 -

During third-quarter earnings calls, Bill Demchak of PNC raised concerns about stablecoins, while Jane Fraser of Citigroup pledged that there will be accountability for fixing her company's regulatory troubles and Jamie Dimon of JPMorgan Chase sounded downbeat about the Biden-era regulatory environment.

October 25 -

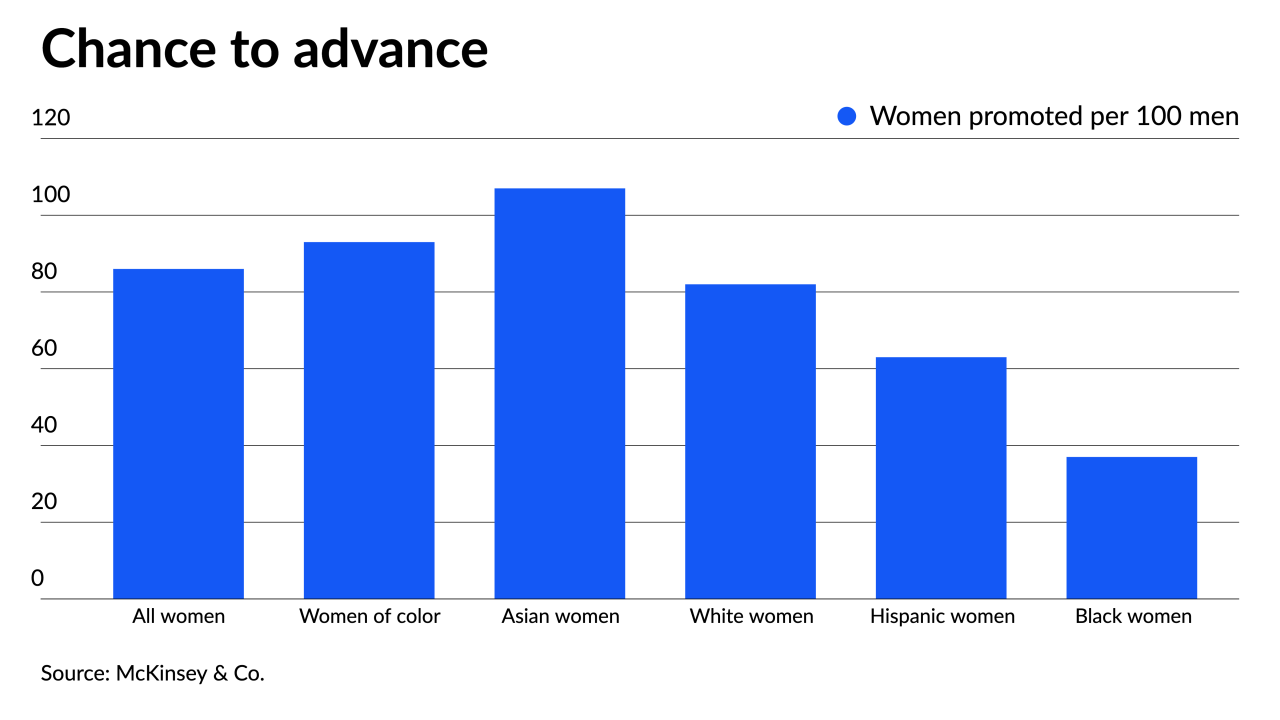

Women — especially Black and Hispanic women — remain underrepresented in banking leadership despite incremental progress because they receive less support than men do to advance beyond entry-level roles, a new McKinsey study says. Here's an overview of the findings.

October 21