-

Recent reports that counterfeit card fraud is markedly down in the U.S. since the introduction of EMV chip cards in 2015 is fantastic news, except for retailers that also sell goods sells online. In that case fraud has merely moved from an in-store payment attempt to a card not present (CNP) one. For e-commerce only stores the rise in payments fraud attempts has been a deluge.

October 2 -

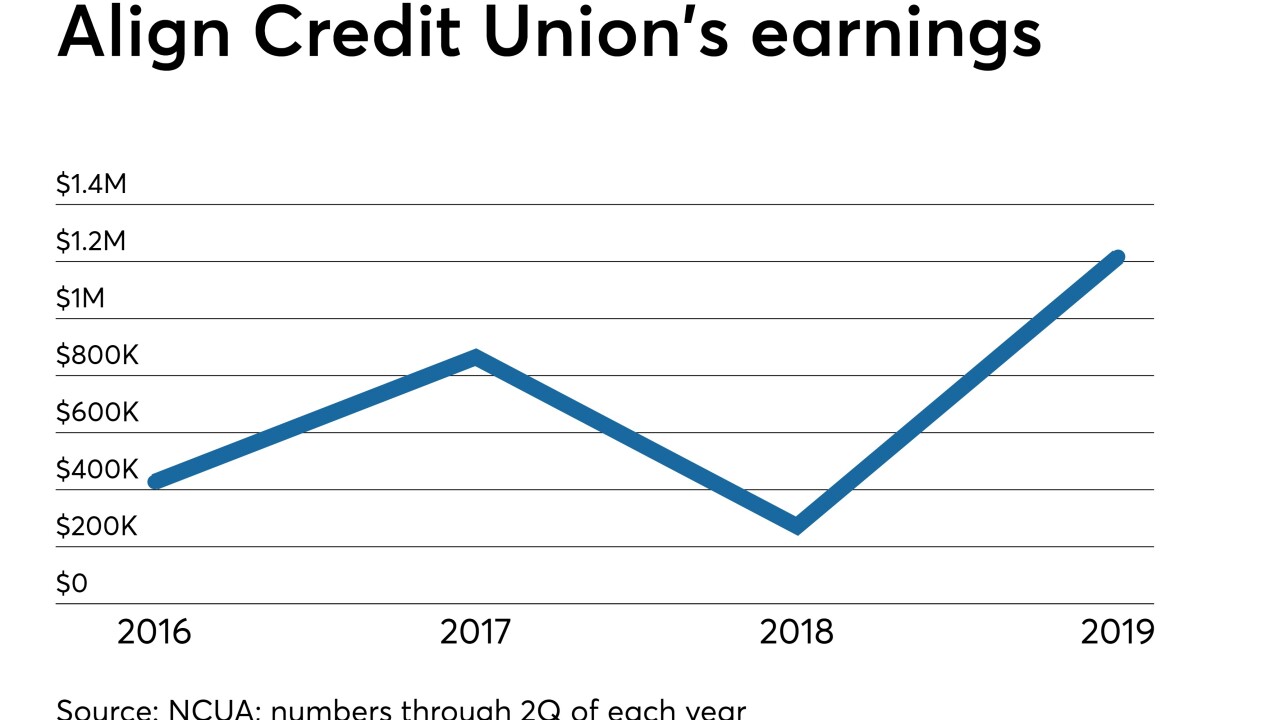

The San Diego-based institution changed its name in attempt to reach wider audience.

October 2 -

Some bank customers would consider switching banks for the status of having a metal card in their wallet. Others are willing to compromise by converting their cards to metal on their own.

October 2 -

Governments use varying methods for tracking the flow of money in and out of the country in order to deter fraud and money laundering, writes Nvoicepay's Alyssa Callahan.

October 2 Nvoicepay

Nvoicepay -

Julieann Thurlow says Reading Cooperative Bank in Massachusetts is well positioned to help immigrants and millennials. Technology is crucial to serving both groups, she says.

October 1 -

The Lowell, Mass.-based institution can now serve Norfolk and Suffolk counties, along with more than 150 cities across Massachusetts and New Hampshire.

October 1 -

Mastercard has developed a service called Threat Scan to help card issuers get ahead of fraudsters by running scans on their card authorization systems based on the latest evolving global card scams.

October 1 -

A shared cart that carries a consumer’s preferred form of payment throughout their purchase journey, regardless of which channel they begin and end with, can be a real differentiator for retailers.

October 1

-

Oak HC/FT is the lead investor in a $100 million round in Rapyd, a company that’s designed to serve a complex international supply chain.

October 1 -

The Montana company will pay $135 million for a bank with 10 branches in seven Arizona markets.

October 1