-

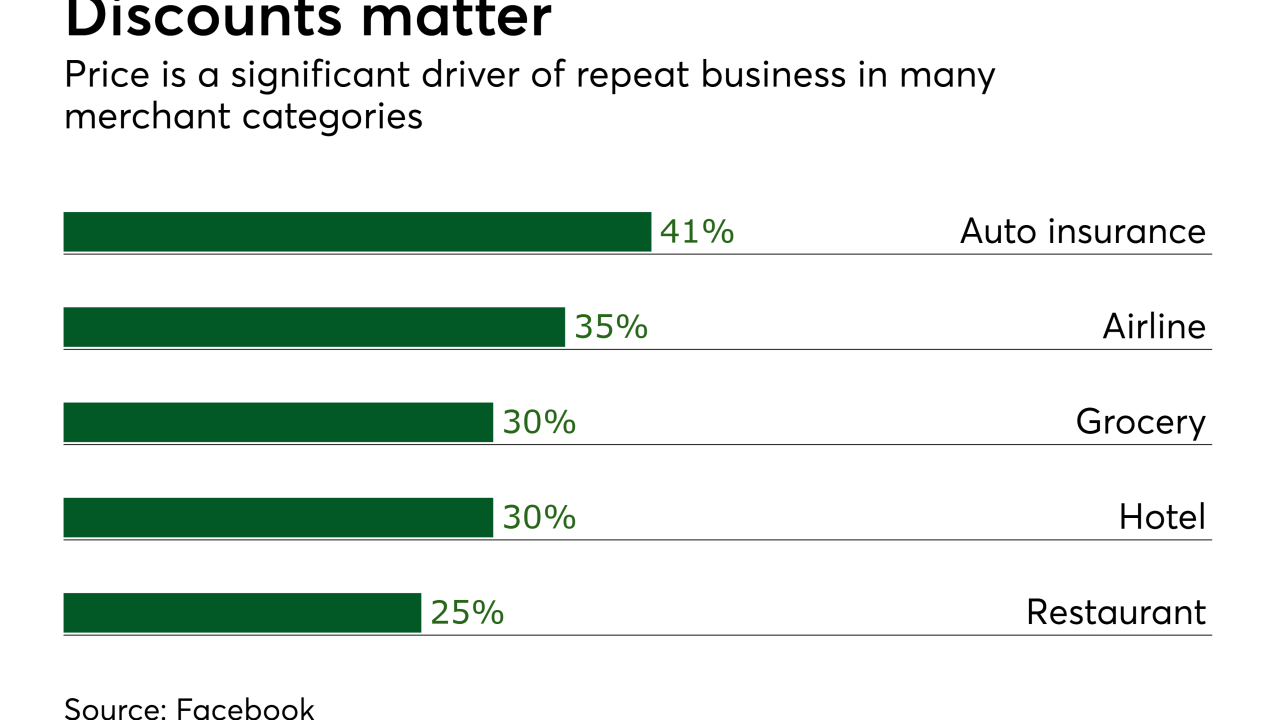

Enticements such as rewards, loyalty points and coupons seldom face pushback as a marketing concept, but there's been recent concern that these programs are devouring potential revenue from consumers who would be willing to pay full price.

August 3 -

Not long ago, self-checkout lanes were seen as an encroachment on traditional retail sales, depriving shoppers of the personal touch that comes with interacting with a cashier. Today, this model is under attack from mobile devices, which are both more high-tech and more personal.

August 3 -

Toronto-based Glance Technologies has introduced a new version of its Glance Pay mobile payments app that uses micro-location sensing technologies along with image recognition, an approach it says is easier for merchants to adopt than QR codes.

August 2 -

In recent years, companies have aggressively reinvented the card-reading dongle to fit their brands and absorb new technologies like EMV and NFC. But few have succeeded in doing away with the dongle entirely.

August 2 -

As a large furniture retailer in South Florida, City Furniture had to decide whether to move quickly to upgrade terminals and avoid the October 2015 EMV chip card liability shift, or stay on track with a process it was already engaged in for a mobile point of sale system in its showrooms.

August 2 -

Facebook, Twitter, YouTube, Instagram, Reddit and blogs create environments where like-minded users can connect, share opinions and cultivate a sense of camaraderie, creating an unprecedented number of distinct nano-segments, writes Steve Gilde, director of global payments for Paragon.

August 2 Paragon

Paragon -

Shopify is working to encourage more physical sales for merchants that don't have physical stores.

August 1 -

Subway is a classic example of an analog company that needed a digital upgrade.

August 1 -

Machine learning can allow customers to take control of their data-driven decision making, including fraud, writes Mark Goldspink, CEO of The ai Corporation.

August 1 The ai Corporation

The ai Corporation -

Large banks like Wells Fargo have started using "cyber ranges" and "red teams" to respond to real cyberattacks on virtual versions of their real systems.

July 31