-

Fintechs are facing unique challenges in the pandemic. There might be a resurgence in funding on the horizon, but startups are looking to see what they can do now to weather the storm.

July 31 -

The Main Street Lending Program is off to a slow start, while the PPP is extended five weeks to distribute the remaining $130 billion in loans; the European regulator is softening its stance to allow more deals.

July 2 -

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

April 2 -

With International Women's Day on Sunday, March 8, shining a spotlight on female leadership, it's a good opportunity to highlight the 42 dealmakers on Mergers & Acquisitions' 2020 Most Influential Women in Mid-Market M&A

March 5 -

In another rollback of the bank trading ban, the federal agencies unveiled a plan to allow financial institutions to invest in multiple companies through certain fund structures.

January 30 -

Regulators already finalized a rollback of the proprietary trading ban section of the rule but signaled then that their overhaul was not finished.

January 23 -

PE firms have made investments in only seven banks in 2019, compared with 21 last year. Here's what's driving the slowdown.

December 22 -

By turning to investors outside traditional banking, private-equity firms are finding it easier than ever to get loans to finance their buyouts of corporations that are nowhere close to being profitable.

September 20 -

The agencies handed banks a significant victory when they finalized revisions to the Dodd-Frank proprietary trading ban, but officials also plan to re-propose changes to the “covered funds” section of the rule.

August 25 -

A centerpiece of her “economic patriotism” bill is to transform private equity firms, which she said will buy a company and bleed it dry before “walking away enriched even as the company succumbs.”

July 18 -

Chime, Chart IQ, Starling Bank and several other startups have raised millions of dollars from venture capital and private-equity firms this year. Here's what they plan to do with their haul.

March 14 -

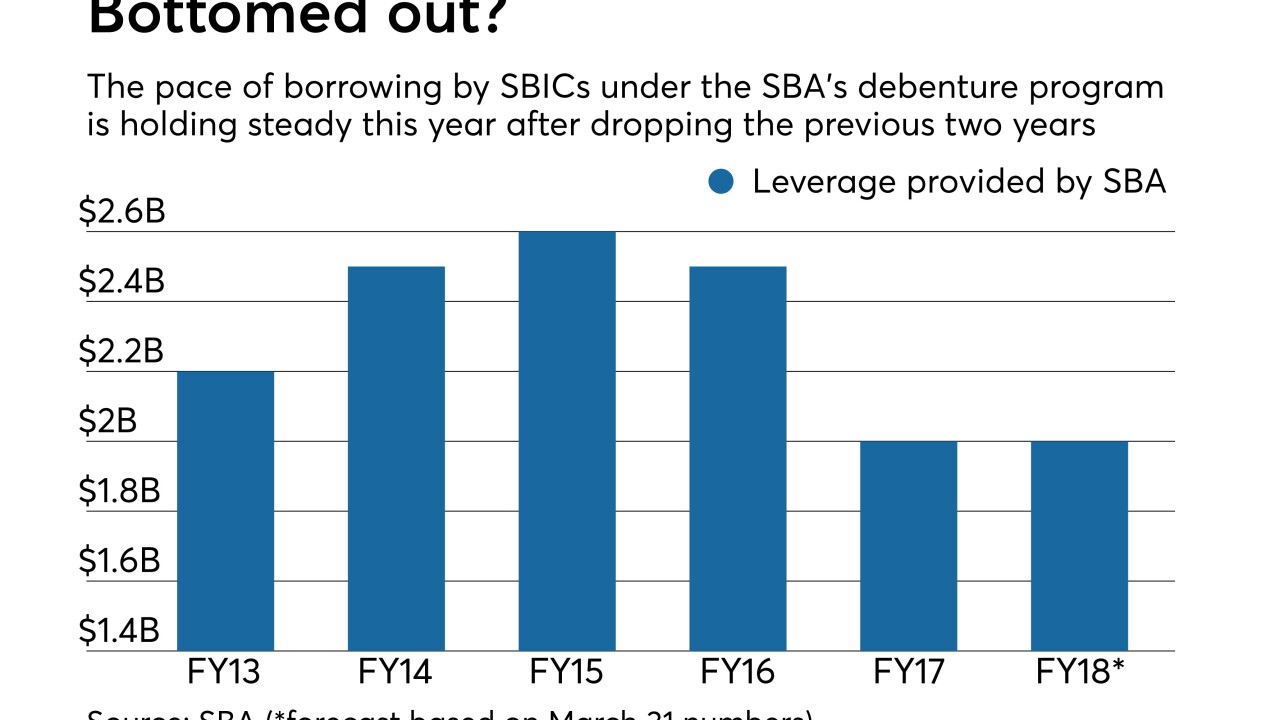

While the Small Business Investment Companies program has reported disappointing results since its 2015 peak, participating funds are getting more looks from curious bankers.

July 12 -

Tech-focused private equity firm Francisco Partners is leading a take-private deal of Verifone Systems Inc., a world leader in payment and commerce solutions.

April 9 -

Independent Bank Group said the firms had become shareholders after it bought Carlile Bancshares last year.

March 16 -

The company could use proceeds from the planned offering to add branches and make bigger loans.

February 20 -

The company has registered shares that three private equity firms have held since early 2010.

December 21 -

Deutsche Bank and Commerzbank have held talks before, and now they have a common shareholder — the U.S. PE firm Cerberus — in a position to broker a deal.

November 16 -

The private-equity firm Cerberus Capital Management has taken a 3% stake in Deutsche Bank four months after buying a 5% stake in another German lender, Commerzbank.

November 15 -

CircleUp is offering lines of credit to early-stage consumer brands, which can often only get financing at high interest rates.

July 26 -

Arizona, Nevada, Florida and North Carolina have lost more banks than other states, based on the percentage decline since 2010. Each has a unique set of reasons that goes beyond regulation and a dearth of de novo activity.

April 5