-

The announcement follows a news report that said it routinely and without notification charged higher rates than it initially quoted.

July 30 -

The company defended its prices for currency conversions after a report said employees boosted rates for some business customers without notifying them.

July 30 -

In addition to leading the company’s national business banking efforts, Peter Sefzik will also oversee small-business banking. Brian Foley, the chief credit officer for the Texas market, will succeed him as market president.

July 25 -

The Boston bank said the digital lending platform has cut down the time it takes to deliver loan decisions by roughly 40%.

July 23 -

Avidia Bank in Massachusetts collaborated with Exhibit 'A' Brewing to produce and sell an IPA as part of a plan to boost marketing to small businesses and millennials.

July 20 -

The New York-based online lender is turning to two European banks to fund loan growth in its overseas markets.

July 18 -

On Mar. 31, 2018. Dollars in thousands.

July 16 -

Member Business Lending is a Utah-based provider of commercial, small business lending origination for credit unions.

July 11 -

The Oakland company has hired Colleen Atkinson, a former manager at HSBC, to oversee its new professional banking business line.

June 29 -

It usually costs small businesses a lot of time and money to calculate their own value. TD Bank is offering them a free digital tool that performs the task quickly.

June 28 -

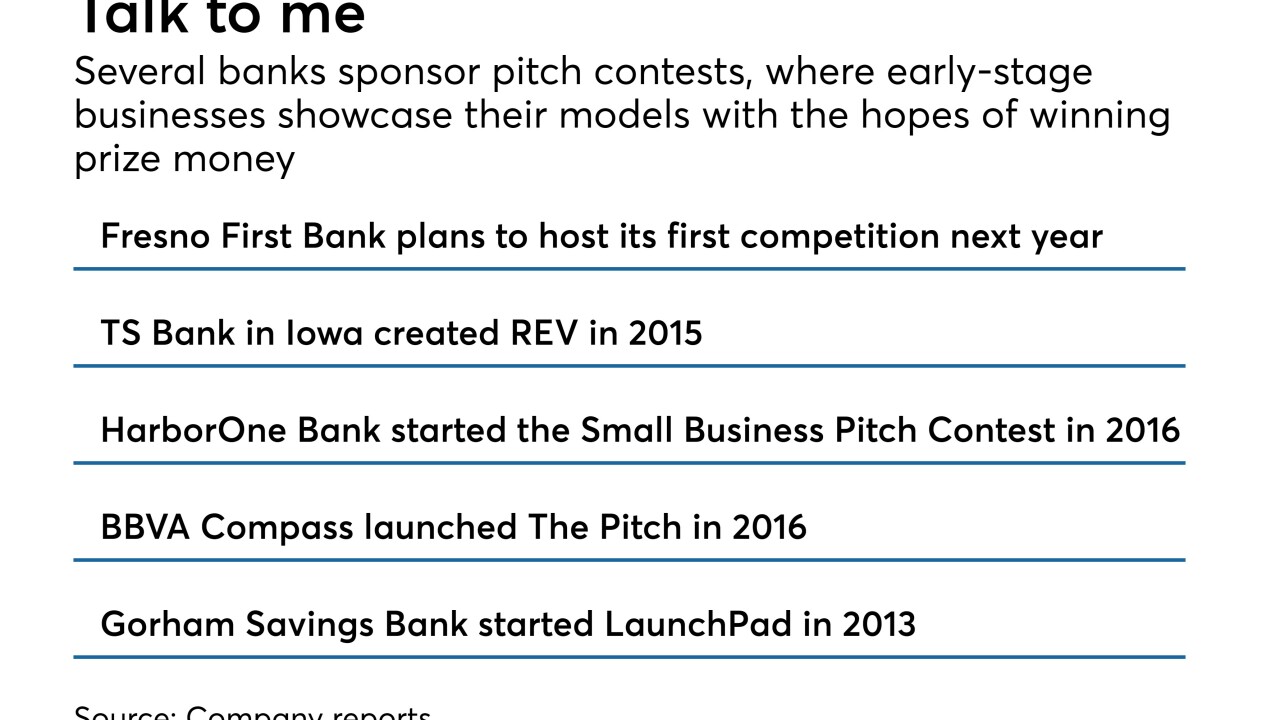

Sponsoring so-called pitch competitions helps lenders gain Community Reinvestment Act credit and gather deposits.

June 28 -

A number of banks are upgrading technology and hiring more lenders to better reach small-business owners, who are becoming more confident in their outlooks.

June 27 -

Denver-based P2Binvestor plans to use the new funds to expand its bank partnership program.

June 21 -

The explosion in construction of self-storage facilities is being backed by banks hungry for commercial loans. Some market participants fear a glut is in the making and the credits could sour.

June 20 -

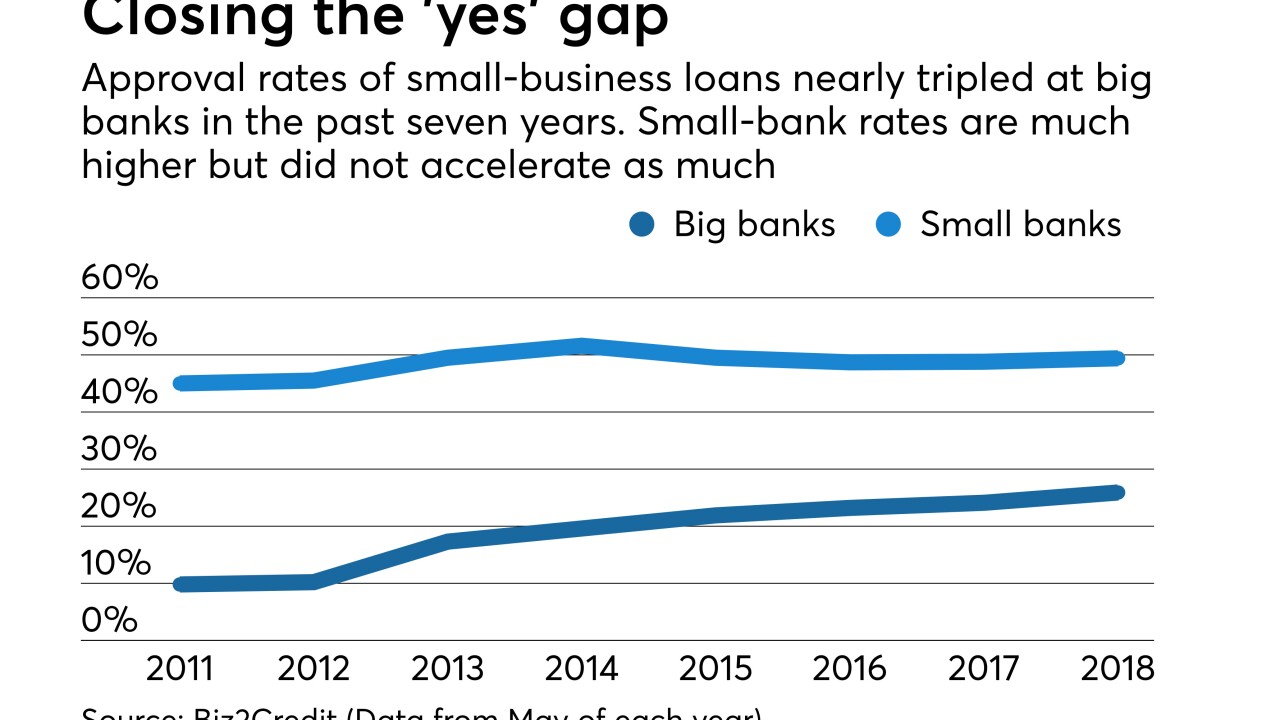

Approval rates for small-business loan applications were up at small and larger financial institutions as the labor market continued to improve.

June 15 -

A bill moving through the California Legislature seeks to tame the largely unregulated world of online small-business lending. If passed, it would be the first of its kind nationally, but so far it has failed to satisfy either the industry or its critics.

June 12 -

Live Oak is the latest bank to jump into this niche lending area. But some warn they are beginning to see cracks in credit quality.

June 7 -

The bill is one of two SBA-related measures the Senate approved late Tuesday and sent to President Trump to sign into law.

June 6 -

The bill is one of two SBA-related measures the Senate approved late Tuesday and sent to President Trump to sign into law.

June 6 -

Credit unions in Tennessee and Ohio were singled out by the U.S. Small Business Association.

June 4