-

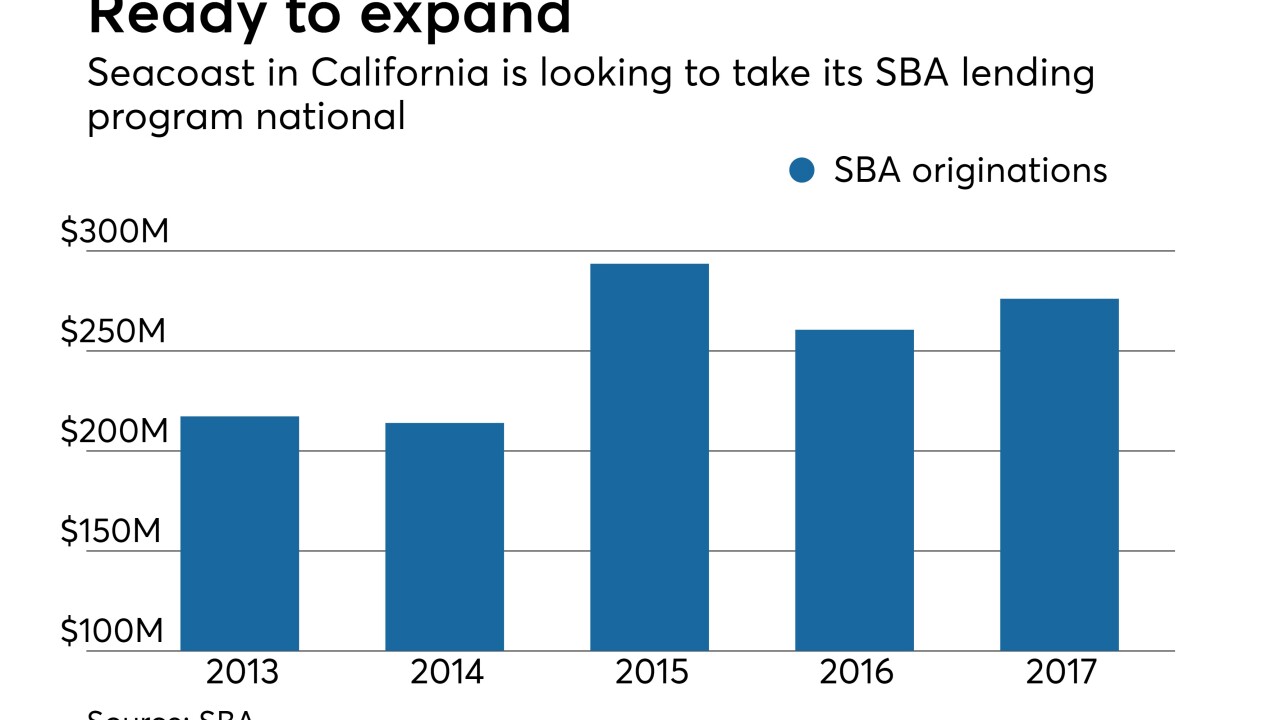

Seacoast Commerce is San Diego is already one of the biggest Small Business Administration lenders — half the loans on its books are tied to SBA programs. But will its underwriting hold up outside its traditional markets?

February 2 -

The tool runs the numbers and tells small-business people if they would qualify for an SBA loan, and if not, what they need to do to become eligible.

January 31 -

The cloud-based vendor was formerly a division of Live Oak Bank.

January 31 -

The credit union’s members want products to help with cash flow, working capital and business expansion

January 30 -

The online lender to small businesses is expanding its business deeper into traditional banks’ territory with larger loans.

January 30 -

The proposed legislation would give the agency authority to increase funding for the 7(a) program — with several caveats designed to manage exposure.

January 26 -

The proposed legislation would give the agency authority to increase funding for the 7(a) program — with several caveats designed to manage exposure.

January 26 -

StreetShares seeks to tap into the loyalties of military veterans, bringing together borrowers and savers through an online platform.

January 24 -

The online lender is integrating itself with several popular software programs to provide lending as a service. It’s an open-banking road map for skeptical banks.

January 22 -

The Minneapolis bank is the first bank to join Community Reinvestment Fund's online service that matches small-business borrowers who don’t qualify for bank loans with community development financial institutions.

January 8 -

A number of banks, especially those with extra real estate on their hands, are trying to capitalize on the co-working craze to appeal to fledgling companies that could become success stories — and their customers.

January 8 -

Intrust Bank has agreed to purchase $20 million worth of Funding Circle's small-business loans in what could just be the beginning of a long-term relationship.

January 4 -

With so much uncertainty, the only thing that's clear is how different the sector may look a year from now. Here's an overview of the leading trends in technology that will impact payments and banking in 2018.

December 29 -

With so much uncertainty, the only thing that's clear is how different the sector may look a year from now. Here's an overview of the leading trends in technology that will impact banking in 2018.

December 28 -

Some were sold at discounted prices, while others were shut down by their acquirers or quietly ceased doing business.

December 25 -

Though Marlene Caride has no direct experience in the banking industry, she could play a key role in carrying out Governor-elect Phil Murphy’s pledge to create a public bank in the Garden State.

December 21 -

The Fed’s rate hike on Tuesday will raise bank's funding costs, serving as a stark reminder that a return to strong, broad-based business loan demand can’t come soon enough.

December 13 -

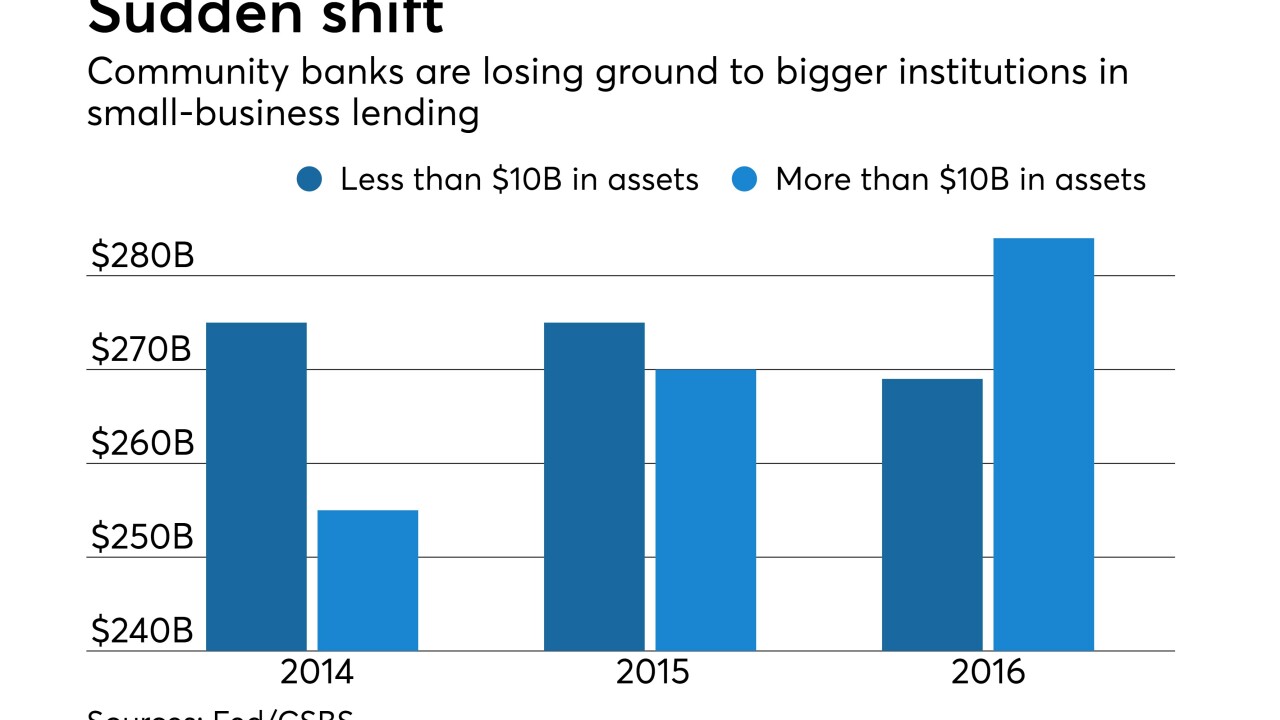

Bigger rivals are making inroads into small banks' bread-and-butter business line, yet the leaders of three community banks say they just need to keep doing what they do best — personal service — but work harder at it and incorporate new technology.

December 6 -

Women are not only less likely to be approved for loans than men, they are less inclined to apply for loans in the first place. Among the reasons: aversion to debt and fear of rejection, according to a new report.

December 6 -

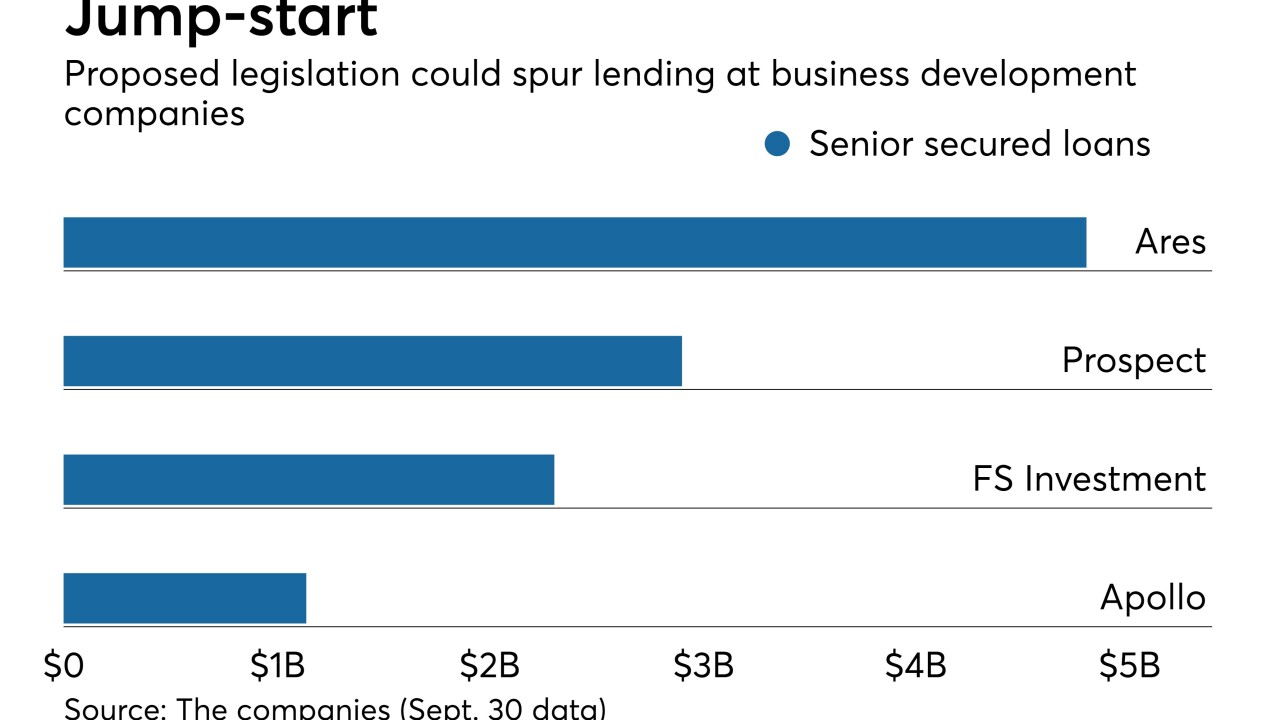

The Small Business Credit Availability Act aims to double the debt-to-equity ratio for business development companies. Increased leverage could spur more lending to small and midsize borrowers.

December 4