-

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

Universal Commerce Protocol is an open standard that establishes a common language for AI agents and systems to work together, and will allow consumers to purchase products from retailers directly through Google's AI Mode in the browser or the Gemini app.

January 11 -

Acting CFPB Director Russell Vought agreed to request $145 million in funding from the Federal Reserve, yielding to a court order to avoid a contempt citation.

January 9 -

Jelena McWilliams, former chair of the FDIC, is joining data sharing fintech Plaid as its new president of corporate and external affairs.

January 9 -

Prosperity Bancshares is fast-tracking bank acquisitions; PNC closed its acquisition of FirstBank Holding Company; BrightBridge Credit Union finalized its merger with Arrha Credit Union; and more in this week's banking news roundup.

January 9 -

The Senate allowed the nomination of a permanent director of the Consumer Financial Protection Bureau to lapse, giving acting Director Russell Vought more time to lead the agency on a temporary basis.

January 9 -

A recent fraud case shines a spotlight on the many communication disconnects caused by disjointed software systems common at larger banks. Here's what happened to one American Banker editor.

January 9 -

Significant regulatory, legislative and business developments could shape the industry this year, putting pressure on banks to respond.

January 9 -

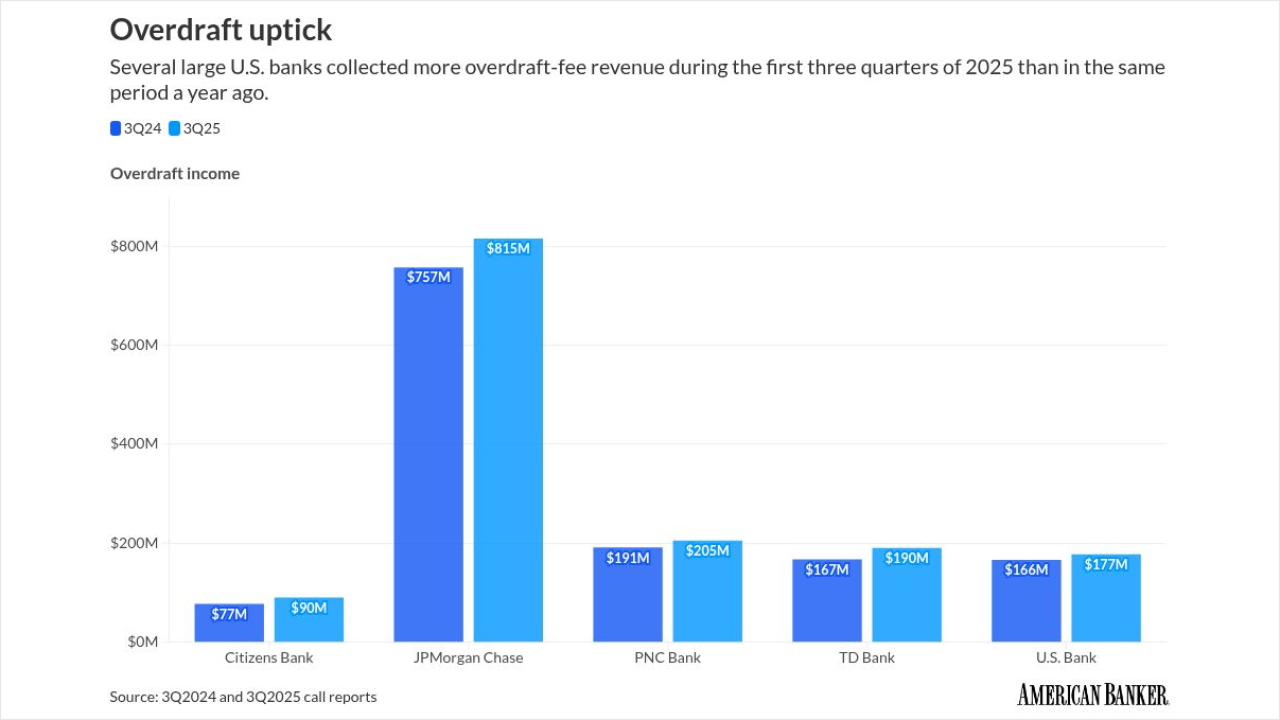

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

As the Federal Reserve's quantitative tightening efforts fade into history, the major engine of economic growth in the U.S. will be bank lending. Regulators should keep a close eye on where those dollars are going.

January 9

-

Employers added 50,000 jobs in December, with gains in service industries while broader sectors remained mostly flat, supporting the Fed's cautious stance on further rate cuts.

January 9 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

The proposed rule codifies the ability for trust companies to conduct non-fiduciary activities, something banks say Congress never intended, but that OCC says has long been the case.

January 8 -

The Federal Reserve will resume accepting pennies from banks and credit unions at all commercial coin distribution locations beginning Jan. 14. The central bank had ceased accepting pennies at some distribution centers late last year, but bankers praised Thursday's reversal.

January 8 -

Banking experts say World Liberty Trust's application for a trust charter with a regulatory body directed by the White House creates inherent conflicts of interest, while the Office of the Comptroller of the Currency said the application will be considered on its merits.

January 8 -

The bank fired a manager for originating suspicious loans but later asked the SBA to forgive them, prosecutors say. The case ended in a $7.7 million settlement.

January 8 -

The Netherlands-based digital bank Bunq filed its second U.S. charter application this week after successfully receiving a broker-deal license late last year.

January 8 -

Investors in alternative assets like private equity, private capital and venture capital often lock their money in for years, but Pluto's founders say its marketplace matches these wealthy investors who need cash with banks and investment firms willing to lend against those illiquid assets.

January 8 -

Noelle Acheson questions the optimistic forecasts of global dollar stablecoin adoption, pointing out that they overlook the friction of local politics.

January 8 -

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8