-

The Pew Charitable Trusts has released a set of 10 standards for banks and credit unions that want to offer small loans to subprime customers. Among its ideas: keep monthly payments at or below 5% of the borrower’s paycheck and make loans available quickly through digital channels.

February 15 -

After reporting its fourth-quarter earnings, the subprime auto lender said it expects the new tax law to enable more car owners to stay current on their loans.

January 31 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

The Stamford, Conn.-based credit card issuer saw improvement in late payments by its customers, but the pace of loan growth also slowed during the fourth quarter.

January 19 -

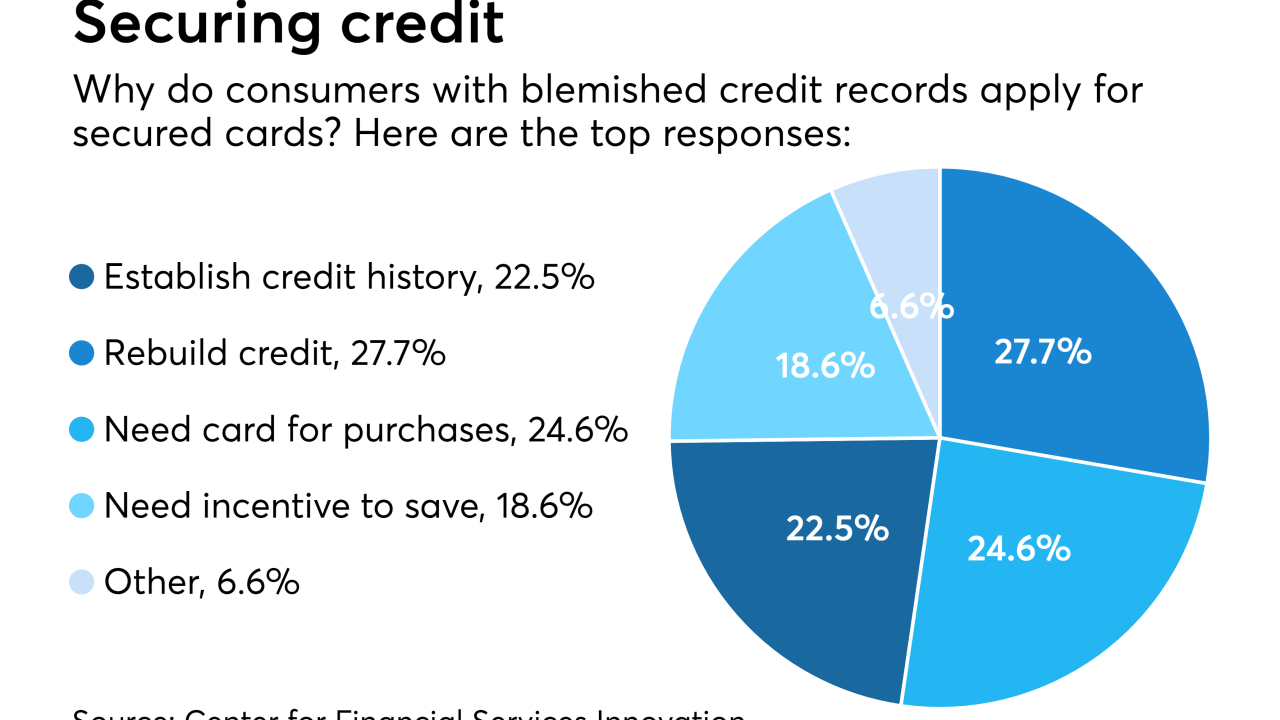

The Kennesaw, Ga.-based company, which targets borrowers with blemished credit records, has acquired LoanHero, which specializes in loans at the cash register.

January 11 -

This year has been very good to regional banks, bitcoin investors and several bank CEOs who pulled off big deals or successfully refined business models.

December 19 -

Franklin Codel reportedly made “disparaging remarks” about regulators; Zions may seek to have “too big to fail” label removed.

November 20 -

The subprime auto lender late Friday provided the final details of its separation agreement with Thomas Dundon, who stepped down two years ago in a leadership shake-up.

November 17 -

Evidence that the credit characteristics of online installment borrowers at the time of repayment are consistently worse than at the time of borrowing should be a sobering thought for lenders that have not been fully tested in a credit downturn.

November 15

-

More stringent underwriting is the likely reason banks and credit unions are seeing relatively low levels of delinquencies on car loans to high-risk borrowers.

November 14 -

The Dallas consumer lender says it plans to boost subprime originations again after retooling its portfolio and taking stock of the economy.

October 27 -

In a new book, Mehrsa Baradaran argues that the same forces of poverty that African-American banks were supposed to alleviate are now holding them back.

September 25 -

LendingPoint, which caters to borrowers with damaged credit records, believes that traditional credit scores are overly pessimistic about the likelihood that certain borrowers will repay.

September 20 -

Powell downplayed fears about subprime auto lending, saying he aims to improve Santander Consumer's compliance culture, beef up customer services and expand its relationship with Chrysler Capital.

August 28 -

Scott Powell will lead the auto lender while continuing to serve as CEO of Santander Holdings, the U.S. division of the Spanish banking giant Banco Santander.

August 28 -

Bank earnings rose nearly 11% in the second quarter, according to the FDIC; Goldman lobbying to kill or weaken the rule to boost its bond trading performance.

August 23 -

Auto, personal and credit card originations have fallen as delinquencies have risen, but researchers called the slowdown a temporary rebalancing by lenders.

August 16 -

The new Explore Visa card is seen as a "bridge" to more traditional banking services, said Regions' head of retail products and payments.

July 26 -

TCF executives were peppered with questions about the quality of $345 million in auto loans recategorized as held for investment in the second quarter, as a result of the company’s recent move away from loan sales and securitizations.

July 24 -

The McLean, Va., lender, which has substantial exposure to subprime consumer loans, also added to its provision for credit losses.

July 20