-

The breaches at large retailers and other companies are continuing, making it time to fully embrace a new authentication method.

January 25 HYPR Corp.

HYPR Corp. -

Some vendors have begun offering authentication platforms through which biometrics and other authentication tools can be plugged into any or all channels. TD Bank is sold on this concept, but others are not completely sure.

January 12 -

Artificial intelligence is moving from science fiction to practical reality fast, and it's in banks' best interest to gear up now for the changes ahead. Here are some strategies to consider.

January 8 -

The time banks have to investigate red-flagged credit payments has shrunk from several days to a few hours and fraudsters have already taken notice.

December 29 -

Banks have used biometrics for about a decade, but there are a number of hurdles that banks, device makers and customers need to overcome before passwords are history.

December 27 -

The decision to rewrite the regulation came two days after a hearing in which New York bankers unleashed a litany of complaints about the regulation to Empire State lawmakers.

December 22 -

Had Wells Fargo simply complied with regulatory guidelines on multifactor authentication across all channels, there would have been substantially less fraud.

December 22 Open Identity Exchange

Open Identity Exchange -

With identity management now established as a distinct industry, it needs an organization to nurture its practitioners like those that exist for the privacy and security sectors.

December 21 Kantara Initiative

Kantara Initiative -

The tech firm behind USAA's digital assistant has introduced an authentication tool that identifies customers by the sound of their voice or by their facial features.

December 14 -

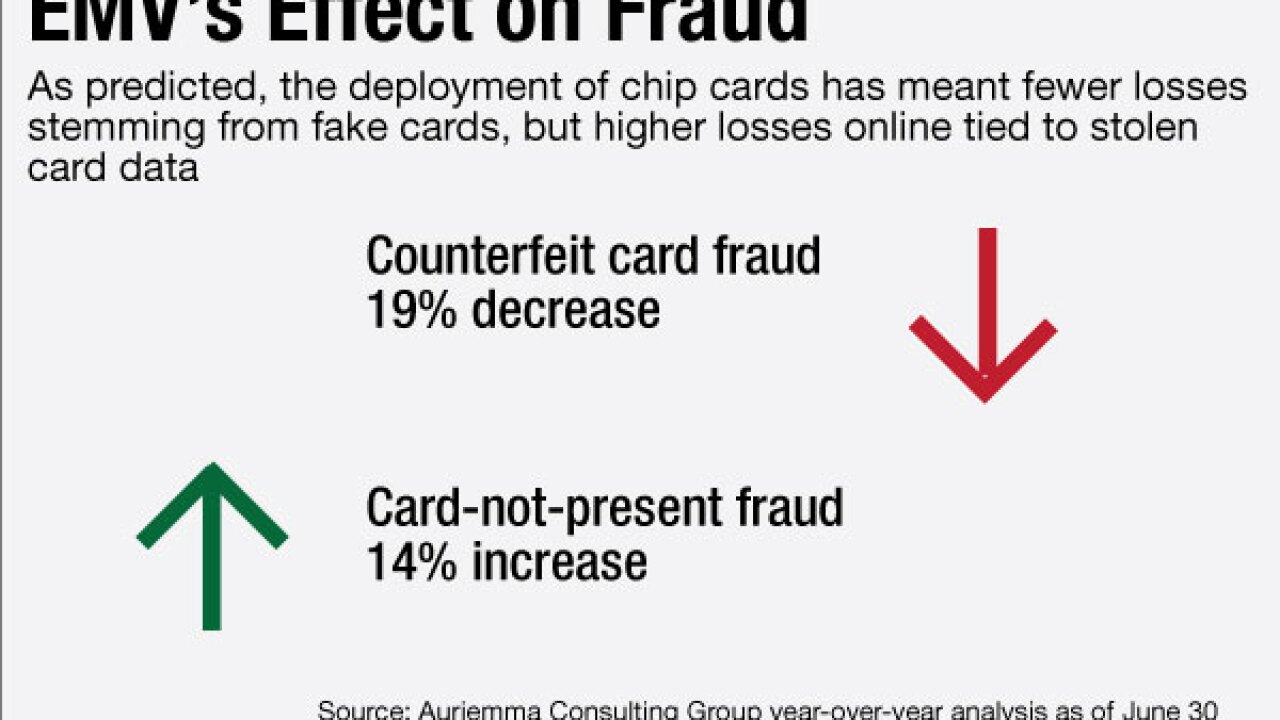

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

When BankMobile, the brainchild of Jay Sidhu and his daughter Luvleen, relaunches on a new platform in January, security especially for the onboarding process will be completely redesigned.

December 8 -

The Secure Keys dongle has worked well to vet internal staff at Google, and the search giant sees a number of other uses for the hardware.

December 7 -

Large financial services firms are right to fight data-aggregation access, but they'll lose this fight to arguments based on innovation and "inclusion" if they do not quickly enhance their own value proposition.

December 6

-

Behavioral biometrics has already stopped several million dollars worth of online banking fraud at National Westminster Bank in London.

November 17 -

KeyCorp integrated First Niagara just a couple of months after the deal closed. CIO Amy Brady says coordination between business leaders and the tech team paved the way.

November 14 -

Stats show young people like to use smartphones to take photos of themselves, a key element of Mitek's payments security strategy.

November 14 -

Mobile phones are only going to become a bigger part of how banks interact with their customers, so several institutions are looking to enhance that experience. They are focusing on better ways of opening accounts, verifying identities, interacting with customers and offering new services and features. Here are some of the improvements announced this year.

November 11 -

Designed for Japan's automotive industry in the 1990s, QR codes remain a common feature in the latest mobile wallets. They have pros and cons that banks need to carefully consider.

November 8 -

Santander Bank is offering commercial customers their own mobile banking app. Businesses owners can use the app to deposit up to $15,000 per day without visiting a branch as well as to transfer funds between work and personal accounts.

November 3 -

The Spanish bank has launched a new online onboarding feature, which allow customers in Spain to open an account on a mobile device and verify their identity via a photo snapped from their mobile device, it announced Thursday.

November 3