-

The digital personal financial management company is eyeing Europe as it expands its geographic footprint.

February 7 -

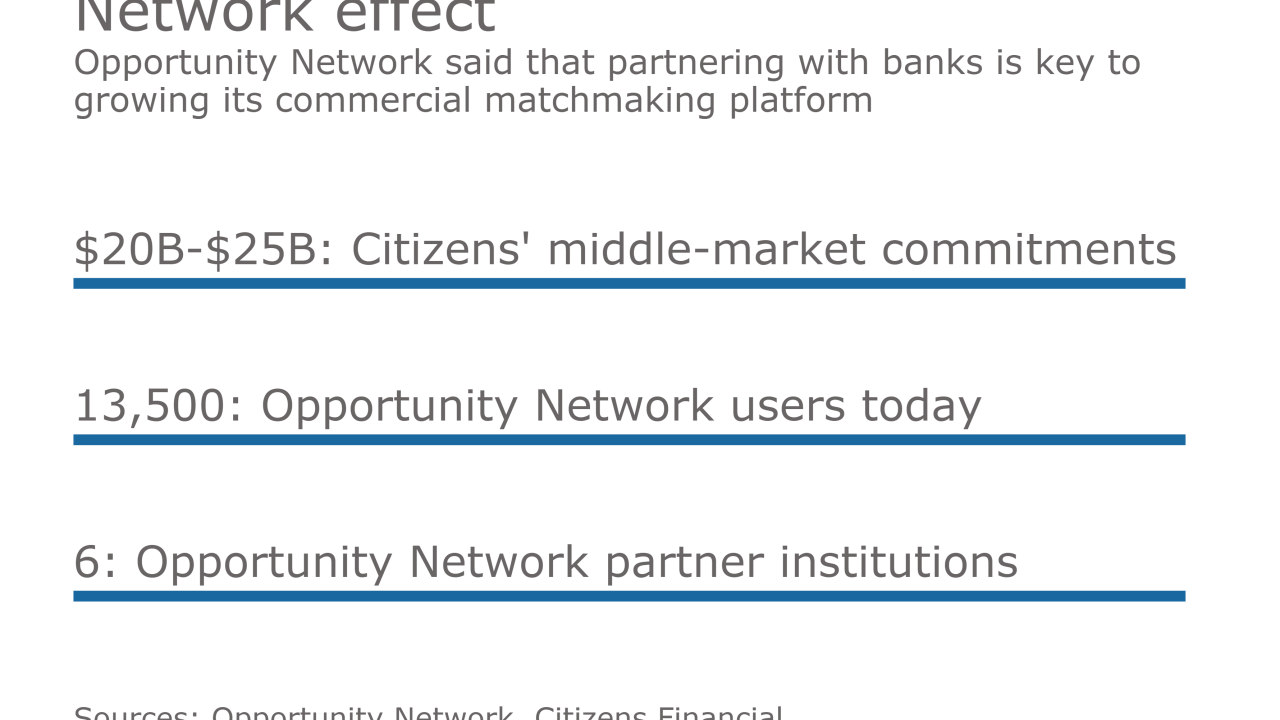

By partnering with the matchmaking platform Opportunity Network, Citizens will be able to better connect corporate clients to deals worldwide.

February 7 -

The information giant agreed to buy two data businesses from the DTCC as regulators' demands for transparency fuel calls for shared industrywide solutions.

February 6 -

In an newly created role, Deborah Guild, the bank’s current chief technology officer, will lead a revamped security unit.

February 6 -

With another $60 million in writedowns, BBVA Compass has taken $90 million in goodwill impairment charges related to its $117 million acquisition of the neobank Simple.

February 3 -

The unit of Customers Bancorp considers the visualization and animation features of its new app, which will show users if their money is dwindling or growing and where it's going, special enough to apply for a patent.

February 3 -

Home improvement lender EnerBank USA expects half of its loans will be originated on the app it built *in-house*, which promises near-instant approvals.

February 3 -

Hong Kong and Singapore have long been economic crossroads. China and India are economies with vast populations. And Shenzhen is bursting with innovative creativity. All of these contribute to the Asian fintech market being far ahead in adoption and ecosystem creation.

February 3 -

The delay has analysts worried that Customers Bancorp will also postpone the sale of BankMobile, which was slated to take place during the first quarter.

February 3 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

February 3