-

Vinny Lingham, founder and CEO of Civic, discusses the froth in cryptocurrency markets, the mania for "initial coin offerings," the right way to do token sales, the future of digital identity and the banking system's security failings.

June 21 -

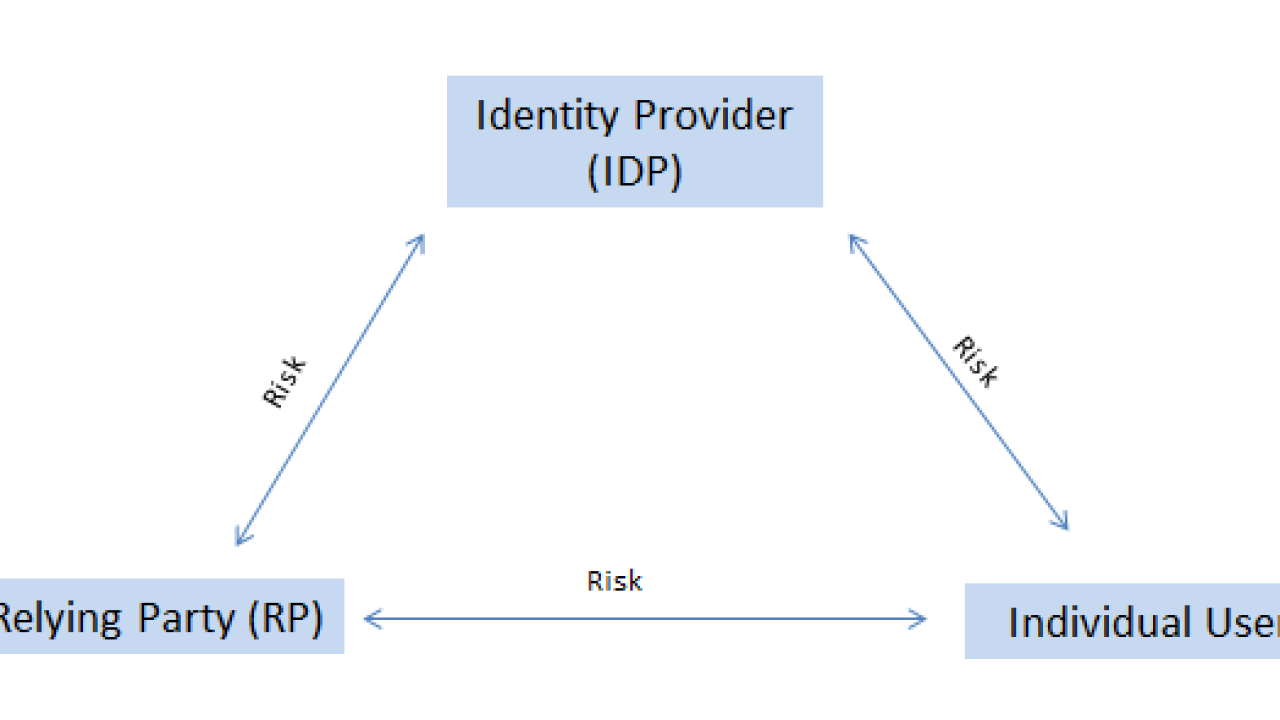

Portable digital identities could improve customer experience, cut costs and generate revenue for banks. But who’s on the hook when something goes wrong?

June 21 -

The fintech startup OpenFin now has 40 Wall Street firms building applications for its operating system, which promises security and interoperability.

June 21 -

Customers of the Pittsburgh company were unable to access their accounts via online and mobile channels for several hours on Tuesday.

June 20 -

The image of traditional custody banks is as stodgy as it gets, but some are using machine learning to help their clients and their own research teams glean insights from massive amounts of data.

June 20 -

Next month, credit bureaus will have to drop information about tax liens and civil judgments from credit scores unless they can independently verify the data. Eva Wolkowitz of the Center for Financial Services Innovation and Sarah Davies of VantageScore discuss.

June 20 -

The chatbot at DBS’s digital bank in India handles most customer service questions but can also sense when it is time to hand something off to a real person.

June 19 -

Microsoft and Accenture have unveiled a blockchain-based digital-identification system in connection with the ID2020 international initiative.

June 19 -

Zack Gipson, USAA’s chief innovation officer, also discusses the challenges of bringing a human touch to digital channels in a brief but candid Q&A.

June 16 -

The announcement follows the completion of the merger of D+H and Misys by their owner, Vista Equity Partners.

June 16 -

IBM's Marc Andrews discusses AI and compliance; Dave Birch, Charlie Shrem and Anthony Di Iorio debate bitcoin and all that it's spawned.

June 16 -

The initiative comes as the bank is carving out a niche in the market for midsize companies.

June 15 -

The most innovative projects shared at Digital Banking 2017 involve embedding banking in popular devices and apps like Facebook Messenger and Amazon Echo.

June 15 -

The eight winners of an annual fintech competition will receive $250,000 in capital and resources.

June 15 -

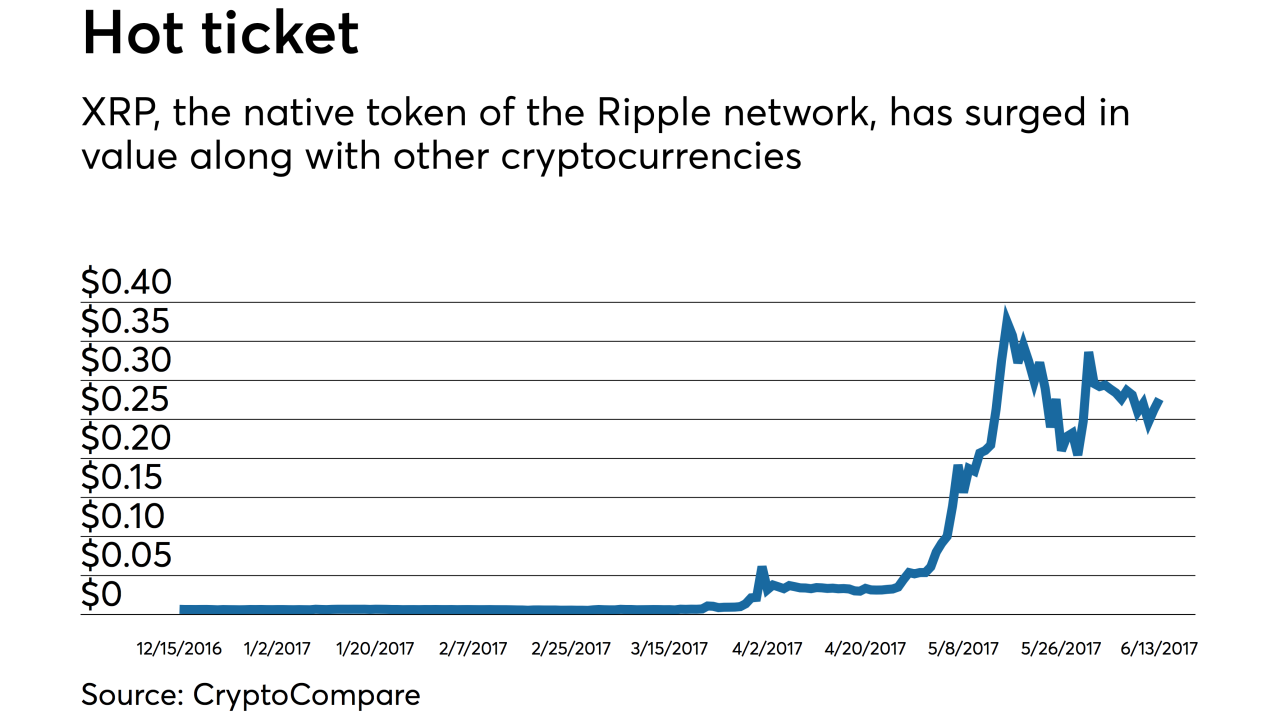

Most fintech startups fall into one of two camps: those that want to compete with banks and those that want to save banks from themselves. Ripple is the rare exception that wants to do both.

June 14 -

Centana Growth Partners has raised $250 million for investment in what it describes as financial services startups with innovations that can be turned into real products.

June 14 -

Private companies incorporated in Delaware could start issuing and tracking shares of stock on a distributed ledger this summer.

June 13 -

Digital banking services should solve consumers' problems and offer them advice, and they must rely on artificial intelligence and other cutting-edge technology, bankers from TD, RBC and Bank of the West said.

June 13 -

It also plans to deploy the startup’s technology that analyzes data and offers predictive advice.

June 13 -

While banks are in various stages of development when it comes to distributed ledger technology, the industry is further along than many would assume, big-bank technology executives say.

June 13