-

A consortium of fintech companies have formed a new industry group to advocate for better data sharing via open APIs.

January 19 -

FIS is forming a network for the inaugural class of its VC Fintech Accelerator program.

January 17 -

HSBC has formed an advisory board to guide it on fintech, cybersecurity and IT infrastructure issues.

January 17 -

For banks, which stake their business on being trustworthy and reliable, there's a certain amount of risk to putting a chatbot out there that could make embarrassing or serious gaffes.

January 17 -

Corporate clients are increasingly asking their banks to help digitize back-office processes. Such a move can help both parties save time and money.

January 13 -

Some vendors have begun offering authentication platforms through which biometrics and other authentication tools can be plugged into any or all channels. TD Bank is sold on this concept, but others are not completely sure.

January 12 -

Larry Mazza, MVB’s chief executive, joined the board at BillGO.

January 11 -

The growth of digital channels is changing bank M&A values, forcing buyers to focus less on branches and more on the volume of customer data.

January 10 -

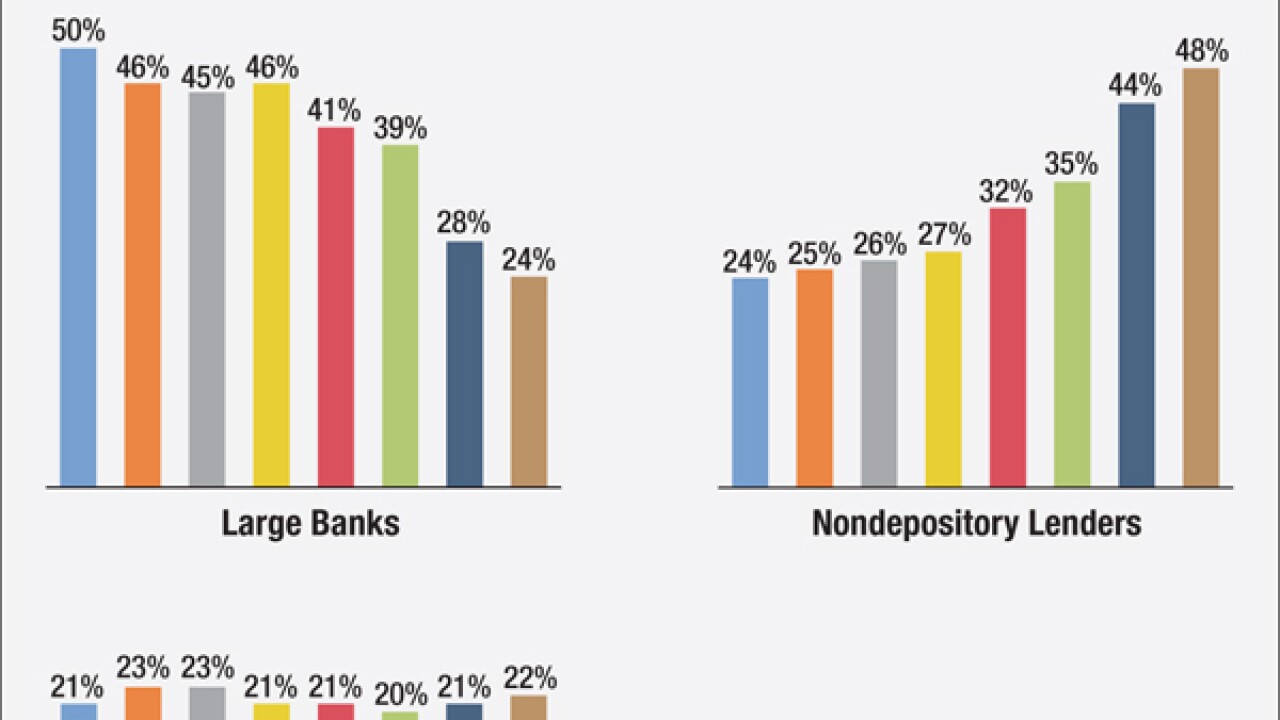

Nondepository lenders are beating their bank competitors when it comes to both digital innovation and market share in the mortgage industry. As interest rates rise, banks will need to move toward electronic closings and adopt other innovations if they want to stay competitive.

January 10

-

Joint accounts sometimes seem stuck in another era. Here's how to modernize them.

January 10 -

Though banks are bigger in peer-to-peer payments overall, Venmo is better at functionality and branding and millennials love it. Now banks are launching Zelle with high hopes and the advantage of real-time speed. Can they catch up? Should they even bother?

January 9 -

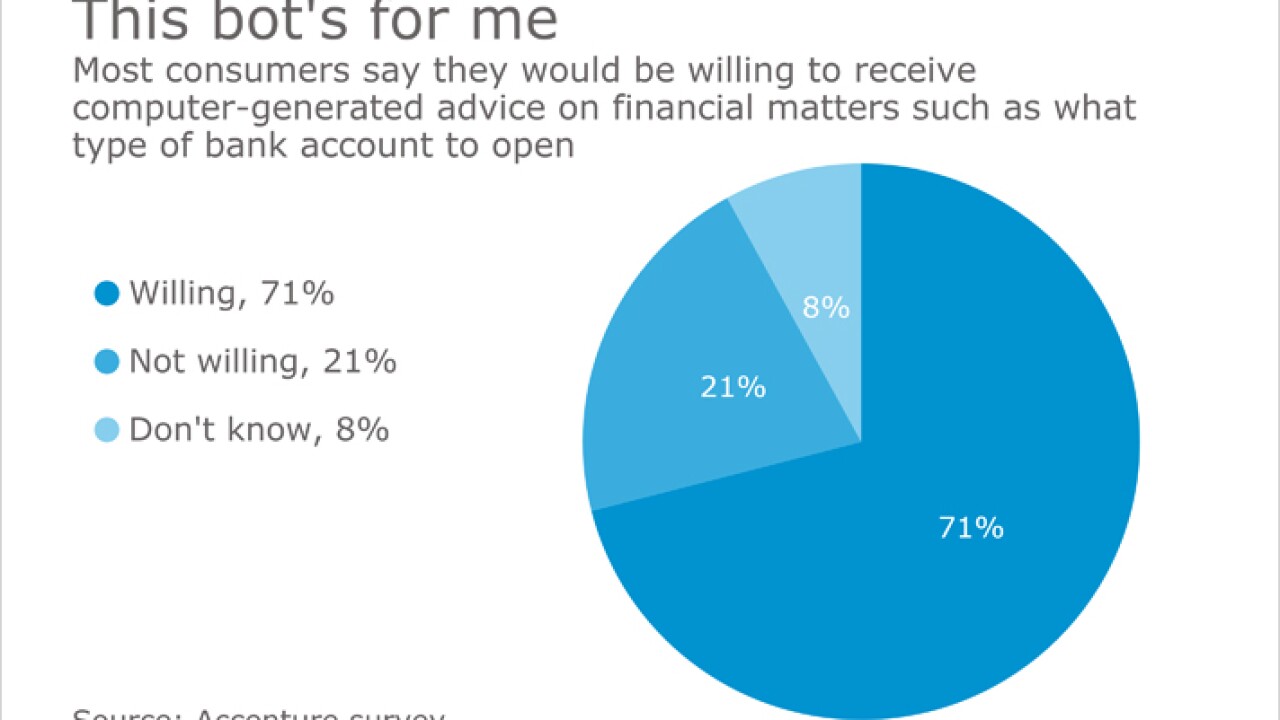

Artificial intelligence is moving from science fiction to practical reality fast, and it's in banks' best interest to gear up now for the changes ahead. Here are some strategies to consider.

January 8 -

Regulators here made strides to encourage innovation in 2016, while Brexit cast doubt on the London fintech boom. Yet the cross-Atlantic payments battle is just beginning.

January 6 K&L Gates

K&L Gates -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

January 6 -

For years, there's been a lot of talk about personal information as an unalloyed asset. But by now it should be clear that the more information a company has about its customers, the bigger a target it is for hackers.

January 5 -

One of the designers who worked on Kasisto's chatbot Kai argues that technologists are perpetuating female stereotypes; SoFi has some unusual ideas about how to get to know its customers better; and Fidelity gives in to the ETF trend. Also, Cathy Engelbert, Barbara Boxer and Megyn Kelly.

January 5

-

The jobs of chief investment officer departments and financial advisers are likely to change as banks and stand-alone wealth managers adopt artificial intelligence to inform the advice they give clients.

January 5 -

2016 was very good to these financial services executives, who succeeded where others failed, sold their businesses for large sums, felt the love of regulators or could finally breathe a sigh of relief.

January 5 -

Banks are grappling with new challenges in trying to work with voice assistants like Alexa in Amazon's Echo to allow customers to check balances and perform other tasks. But with voice banking on the horizon, banks cannot afford to stall their efforts.

January 4 -

Wells Fargo's innovation group has appointed Peggy Mangot for the newly created position of senior vice president of its design and delivery leadership team.

January 4