-

Coming out of the pandemic, traditional banks will have just two years to update their business models or they risk falling behind more innovative peers and aggressive upstarts, the consulting giant warns in a new report.

December 3 - AB - Technology

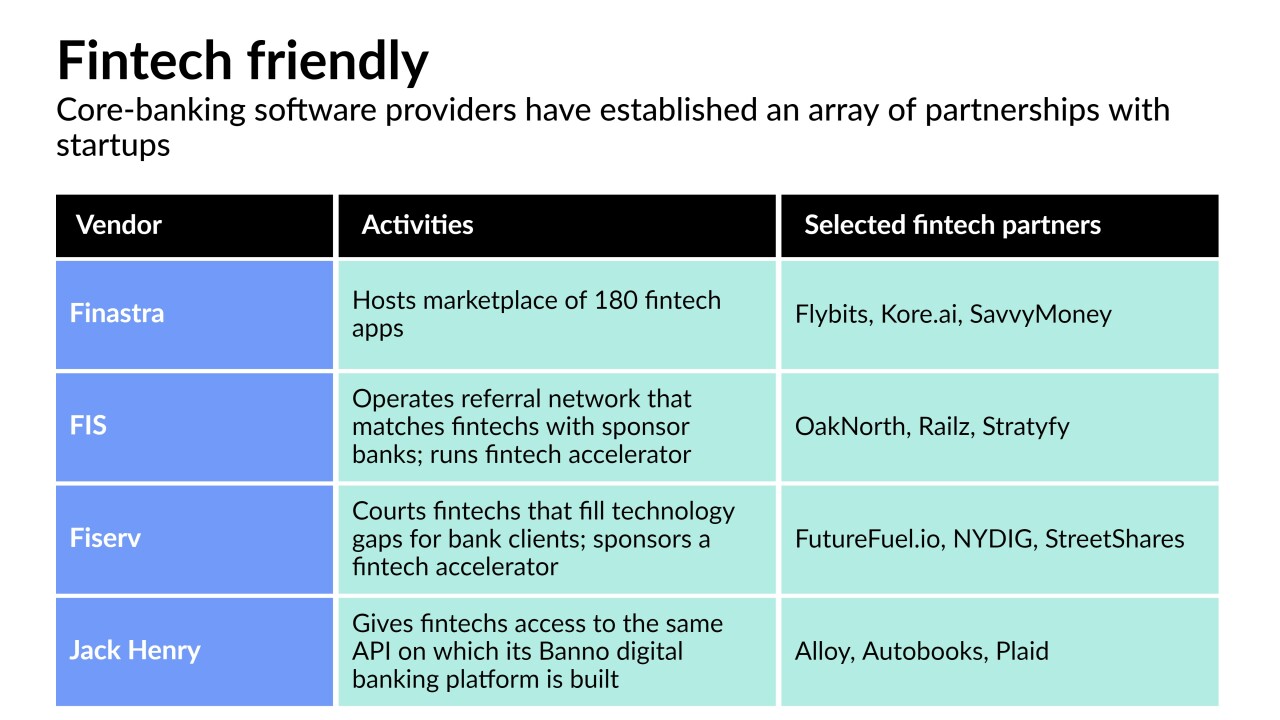

Fiserv, FIS, Jack Henry and Finastra, the top U.S. core banking software providers, are stepping up efforts to let banks plug innovative technology from younger fintechs into their legacy systems.

December 2 -

Bankers were given a chance to weigh in on a new breach notification proposal, and federal regulators apparently took their comments to heart before issuing the final rule.

November 30 -

Its goals are twofold: to be a financial intermediary between buyers and sellers on the Provenance blockchain and to use the technology to bring speed and efficiency to loans and other products.

November 29 -

A new report finds that financial companies are the most targeted by fraudsters seeking to steal usernames and passwords. They're fighting back with specialized tracking technology, special domain names and other increasingly sophisticated techniques.

November 23 -

-

The regional banks are moving past old-school collection calls, instead using emails, texts and on-screen messages to urge delinquent customers to repay debt. Modern communications are said to be more efficient and in keeping with Consumer Financial Protection Bureau debt-collection rules set to take effect Nov. 30.

November 22 -

N26 and Monzo halted or delayed expansion plans here largely because competition for customers was already intense and obtaining a banking license proved difficult.

November 19 -

Wilson created an app from scratch in the middle of a large merger, he's setting up “client journey rooms” where customers co-create technology with technologists, and he's moving the bank forward into cloud computing.

November 18 -

-

The firm's global head of transaction banking says practicing meditation helped him manage a team that built a new corporate banking platform. His leadership of the project was one reason Moorthy was selected as a finalist for American Banker’s Digital Banker of the Year.

November 17 -

-

-

-

The data aggregator assembled a group of technology companies that has developed a set of security standards for startups. It is open for comment ahead of an anticipated implementation in the second half of next year.

November 16 -

The company’s software analyzes banks’ loan programs and rejections for signs of discrimination.

November 15 -

The way merchants handle payments is becoming just as important as the actual business they're in, says Jeremy Balkin, global head of innovation and corporate development at J.P. Morgan Payments.

November 12 -

First Busey Corp. is investing in software to eliminate the drudgery of some tasks. But this Best Bank to Work For will judge the success of the tech initiative by employee engagement more so than just efficiency. The goal is to boost morale.

November 11 -

Criminals are finding weaknesses in the complex network of applications on banks' sites and exploiting them to launch attacks.

November 10 -

The company, whose software is used by four of the top five U.S. banks, says it will use the money to improve its identity verification and fraud detection technology.

November 9