-

The Berlin company hopes to shake up the U.S. market with real-time, mobile-first, millennial-friendly banking, and the new infusion of cash from Allianz and Tencent will help.

March 20 -

The bank will enable customers to access its 2,500 ATMs via mobile banking.

March 19 -

The main problem is that Amazon's Alexa, Apple’s Siri and Google Assistant can’t yet verify a person’s identity. But there are already workarounds for that issue — and the tech giants may solve it soon.

March 19 -

The bank’s distributed ledger for private equity deals can now provide nodes to auditors, so they can easily access documents and data for their annual reviews.

March 19 -

Banks should adopt a more collaborative process to usher in innovation and refine digital strategy, says SunTrust CIO Scott Case.

March 16 -

Legacy financial firms like the big credit bureau are seeking out financial technology to diversify themselves, bring new products to market faster and meet the needs of global customers.

March 15 -

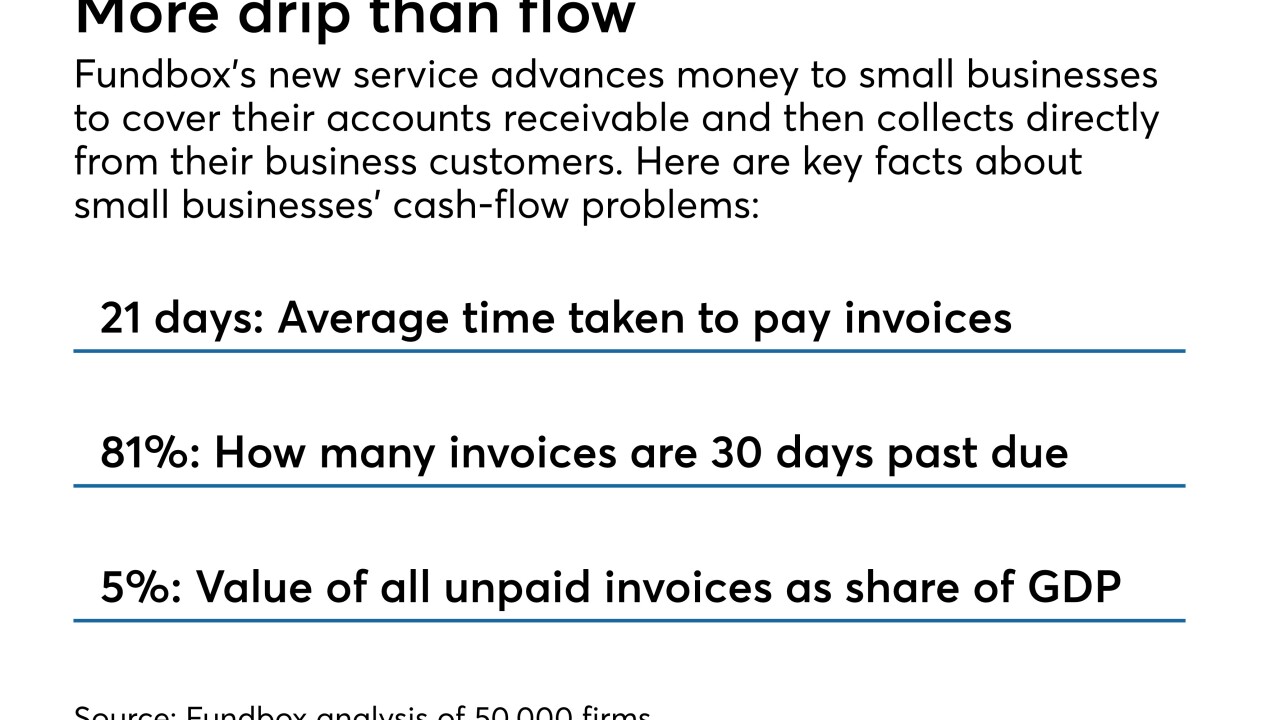

Fundbox is testing a payments and credit network for small businesses and their business clients that may offer an alternative to traditional lenders, credit card issuers and supplier financing.

March 14 -

American Express Ventures has become an investor in the startup EverCompliant, which helps financial institutions root out e-commerce websites backed by terrorists and drug cartels that are laundering money through payments-processing networks.

March 13 -

OCBC Bank in Singapore has seen a 35% reduction in false positives in its tests of artificial intelligence-based anti-money-laundering software. Other banks could follow its lead, though there are regulatory and customer-protection questions.

March 12 -

Franklin Synergy and MidFirst both plan to deploy the online lending platform, which according to its creator can render loan decisions in just under three minutes.

March 12 -

Many of the companies in our inaugural Best Fintechs to Work For ranking share a willingness — even an eagerness — to involve rank-and-file staff in decisions about how the company is run.

March 12 -

The retail lending unit of Marlette Funding meets regularly to make sure all employees are invested in its quarterly goals.

March 8 -

The venture capital firm Anthemis seeded 21 fintech startups in its first discretionary fund, which raised $106 million. It favors management teams made up of people from all walks of life who have fresh ideas about shaking up banking and insurance.

March 8 -

Disruptors would get a powerful new competitor if Amazon began offering checking accounts, but such a move would also validate the notion that fintechs are the future.

March 8 -

TransUnion’s analysis of credit card applications and transactions finds fraudsters continue to steal more, but the rate of increase is slowing.

March 8 -

Banks increasingly avoid crypto, but Grainne McNamara at PwC has come up with a framework banks could use to participate in the digital currency world.

March 8 -

With the U.S. military in mind, the Texas banking product provider's CEO, Gabe Krajicek, created a corporate culture where employees name themselves after the legendary warriors and operate under a mission to "win the war."

March 7 -

The Golden Contract Coalition, formed in mid-2016 to get community banks better deals with the “big three” core systems vendors, said banks need help with buying from fintech sellers as well.

March 7 -

Paddleboarding in the morning, assigned mentors, passion projects: How firms on our inaugural ranking of the Best Fintechs to Work For attract (and keep) top talent with Silicon Valley perks.

March 7 -

The online lending platform takes corporate culture seriously but encourages employees not to take themselves too seriously.

March 6