-

The real test of the value of investments in artificial intelligence and other tech upgrades is the generation of measurable value across a bank's lines of business.

June 28

-

Large and regional banks again proved their resiliency in the Fed's annual exams. But analysts noted that a few lenders faced some negative surprises — a development that may scuttle investor hopes for share buybacks by those banks.

June 27 -

VersaBank plans to use the one-branch Stearns Bank Holdingford in Minnesota as a platform to expand a lucrative niche business acquiring loan and lease receivables from point-of-sale lenders.

June 27 -

Leaders that have created virtual "branches" weighed in at American Banker's Digital Banking conference on how to approach implementation and what results have been like.

June 27 -

When TD Bank launched an audio brand identity across its communication channels early this year, the new jingle triggered a surprising reaction from consumers using the firm's ATMs.

June 27 -

Banks and financial institutions face a barrage of lawsuits from consumers alleging they failed to investigate inaccurate information on a credit report. Industry blames the uptick in litigation on social media sites and the proliferation of credit repair companies.

June 26 -

Eras come and go, but the ongoing investments in developing, empowering, leading and retaining superior personnel will remain the highest priority of top-performing financial institutions.

June 26

-

General Motors' financial arm has halted its quest for an industrial loan company charter from the FDIC, but is signaling that it will try again. Observers said the automaker may wait until after the presidential election to decide how to move forward.

June 25 -

Funding Circle US fought to win a coveted license to make SBA 7(a) loans only to see its London-based parent company agree to a sale before it could make its first government-guaranteed loan

June 25 -

The Consumer Financial Protection Bureau extended the deadline for lenders with the highest volume of small-business loans to July 18, 2025, and will not assess penalties for reporting errors for a year.

June 25 -

The head of data and digital at Ally Bank came up with protective measures governing the use of generative AI and organized "AI Days" for employees to learn about Ally's progress.

June 25 -

By adopting more inclusive lending practices and actively seeking to support minority-owned businesses, banks can help bridge the financing gap that often stifles the growth of these businesses.

June 25

-

Later this week, the Federal Reserve will release the results of its annual check-up on larger banks' balance sheets. Experts say there are always surprises, but that pending capital rules may have a bigger impact than the stress-test results on banks' dividend and buyback decisions.

June 24 -

There were 27 bank acquisitions worth $5.45 billion announced in the second quarter as of mid-June. That was more than the $5.2 billion combined value of deals announced over the previous five quarters.

June 24 -

The former head of Square Banking at Square is one of American Banker's 2024 Most Influential Women in Fintech.

June 24 -

These 20 bankers and fintech executives are helping banks go digital in new ways.

June 24 -

The managing director and head of treasury solutions at Texas Capital Bank is one of American Banker's 2024 Innovators of the Year.

June 24 -

This year Texas banks dominated American Banker's annual list of the top-performing larger community banks. See which institution came in at No. 1 for this asset class.

June 23 -

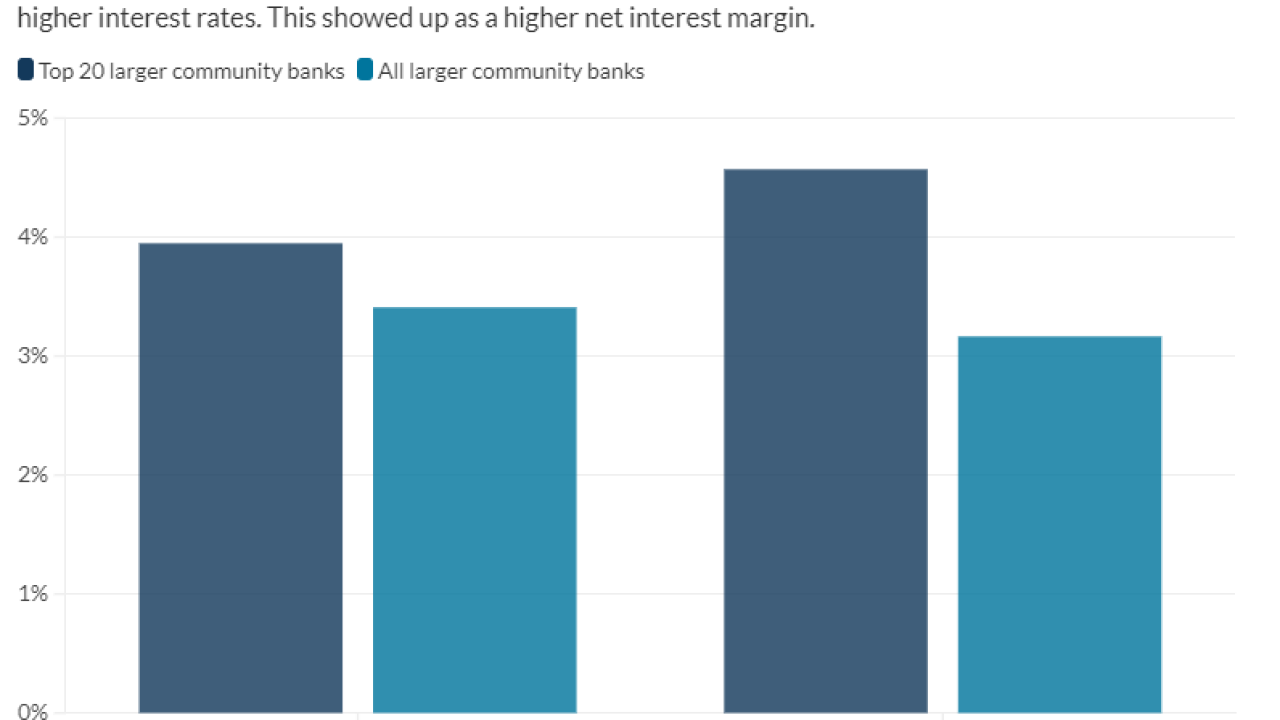

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

The head of digital product management, platforms and innovation at BMO Bank is one of American Banker's 2024 Innovators of the Year.

June 21