-

The agency has a relatively new program designed to quickly get funds into disaster-stricken areas. The problem is that many bankers don't know it exists.

August 30 -

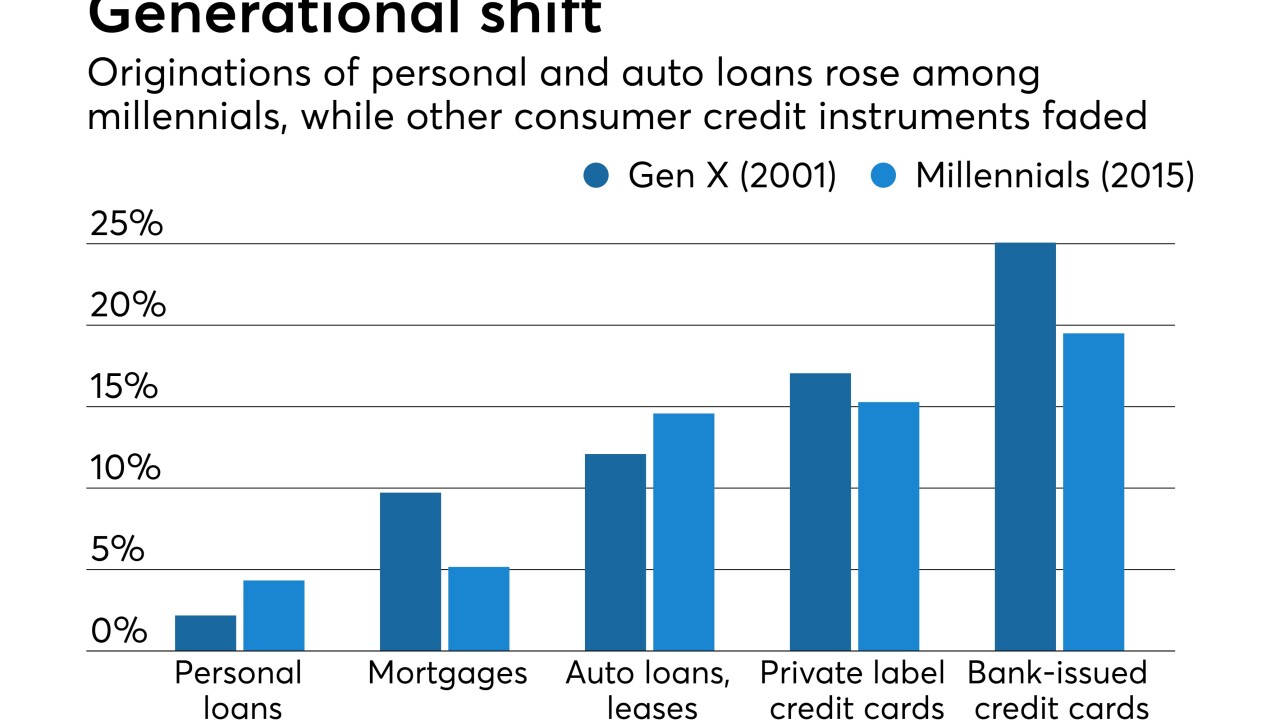

Sure, personal loans have a long way to go to catch up in market share with other forms of consumer credit, but millennials are relying more heavily on them than their Gen X predecessors while paring back on credit cards and mortgages. Online lenders are a big reason, and banks are exploring ways to adjust to changing habits.

August 30 -

The Canadian bank blamed flat profits at its U.S. business, which includes Chicago-based lender BMO Harris Bank, partly on Washington gridlock that has stalled pro-business reforms.

August 29 -

The startup, which offered credit lines of up to $1,000, hoped to tap into the millennial generation's frustration with overdraft fees.

August 29 -

The designation allows the $1 billion credit union to process SBA loans within 36 hours and to approve them without sending them to the agency first.

August 29 -

Federal Reserve Chair Janet Yellen defended post-crisis reforms but allowed that further adjustments may be necessary to reduce adverse effects on small businesses and subprime borrowers.

August 25 -

With the deadline for a federal-debt-limit renewal nearly a month away, bankers are dreading the prospect of higher funding costs, strained liquidity, weaker commercial loan demand and other ramifications if Washington does not act.

August 24 -

Austin, Texas-based CU has seen growth in auto, mortgage and commercial lending.

August 24 -

Bank earnings rose nearly 11% in the second quarter, according to the FDIC; Goldman lobbying to kill or weaken the rule to boost its bond trading performance.

August 23 -

The National Association of Federally-Insured Credit Unions defended the credit union tax exemption and called for other financial reforms during a meeting Tuesday with Treasury Secretary Steven Mnuchin.

August 22