-

An uptick in lending helped to offset declines in both service charges and mortgage banking fees at the Cincinnati company.

July 19 -

The Cleveland company reported higher investment banking income and kept many expense items in check during the second quarter.

July 19 -

The Dallas bank reported sizable growth in business and mortgage lending in the second quarter, but it more than doubled its provision for loan losses to cover four credits that went into nonaccrual status.

July 18 -

Paul Watkins served as chief counsel for the Arizona AG's 150-person civil litigation division and also headed up the office's fintech initiatives.

July 18 -

Credit unions in the Silver and Golden states saw strong increases in growth and deposits during the first quarter of 2018.

July 18 -

The New York-based online lender is turning to two European banks to fund loan growth in its overseas markets.

July 18 -

The appointment of David Solomon, who will take over for retiring CEO Lloyd Blankfein, has not altered the bank's aggressive plan to build a mobile phone-based bank for consumers in the U.S. and beyond.

July 17 -

The company, which is dealing with a lawsuit from the Federal Trade Commission tied to certain fees, hired Ronnie Momen from GreenSky as its chief lending officer.

July 17 -

The New York bank, which is part of Leumi Group in Israel, is entering a new business line after spending years improving its infrastructure.

July 16 -

On Mar. 31, 2018. Dollars in thousands.

July 16 -

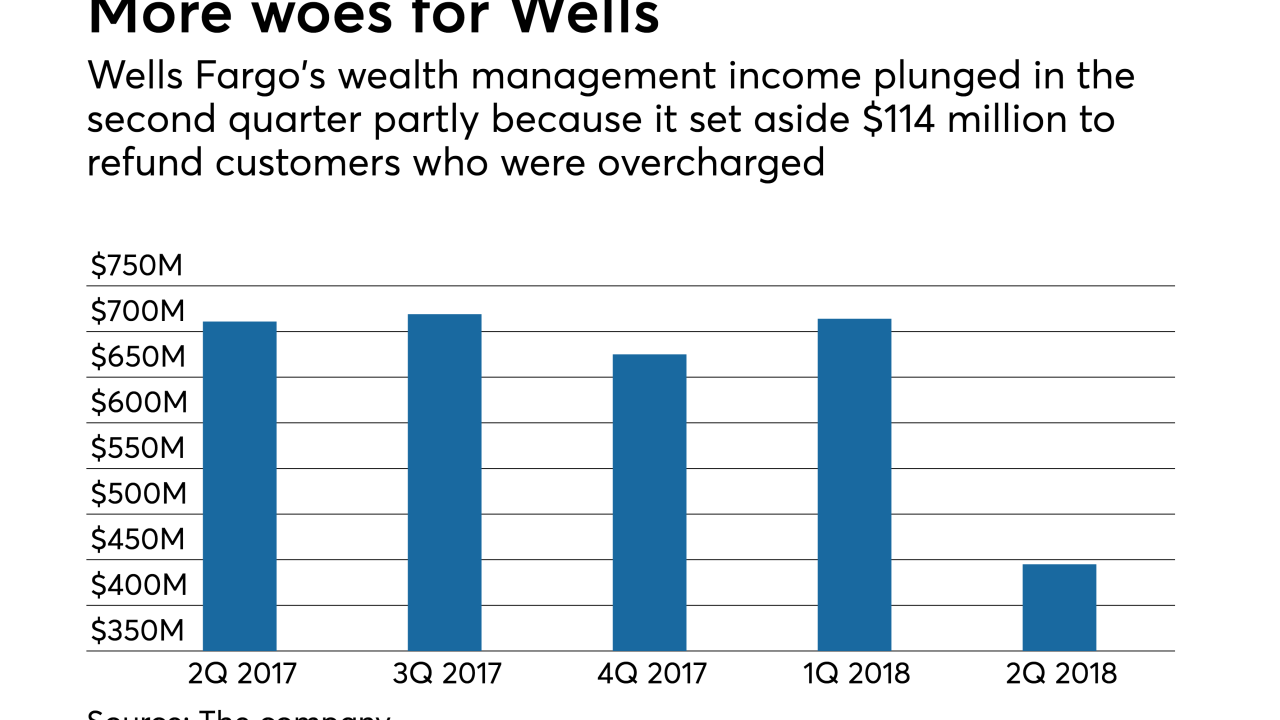

The unit’s profits plunged in the second quarter as the company contended with the fallout from overcharging wealth management clients. Was it a one-off or the beginning of a long-term problem?

July 13 -

Strong demand for business and multifamily loans, combined with double-digit growth in wealth management revenues, more than offset rising expenses.

July 13 -

The Senate bill, designed to close a loophole in the state's interest rate cap and was closley monitored by the Ohio Credit Union League, must still be reconciled with a similar measure that was passed by the Ohio House of Representatives.

July 11 -

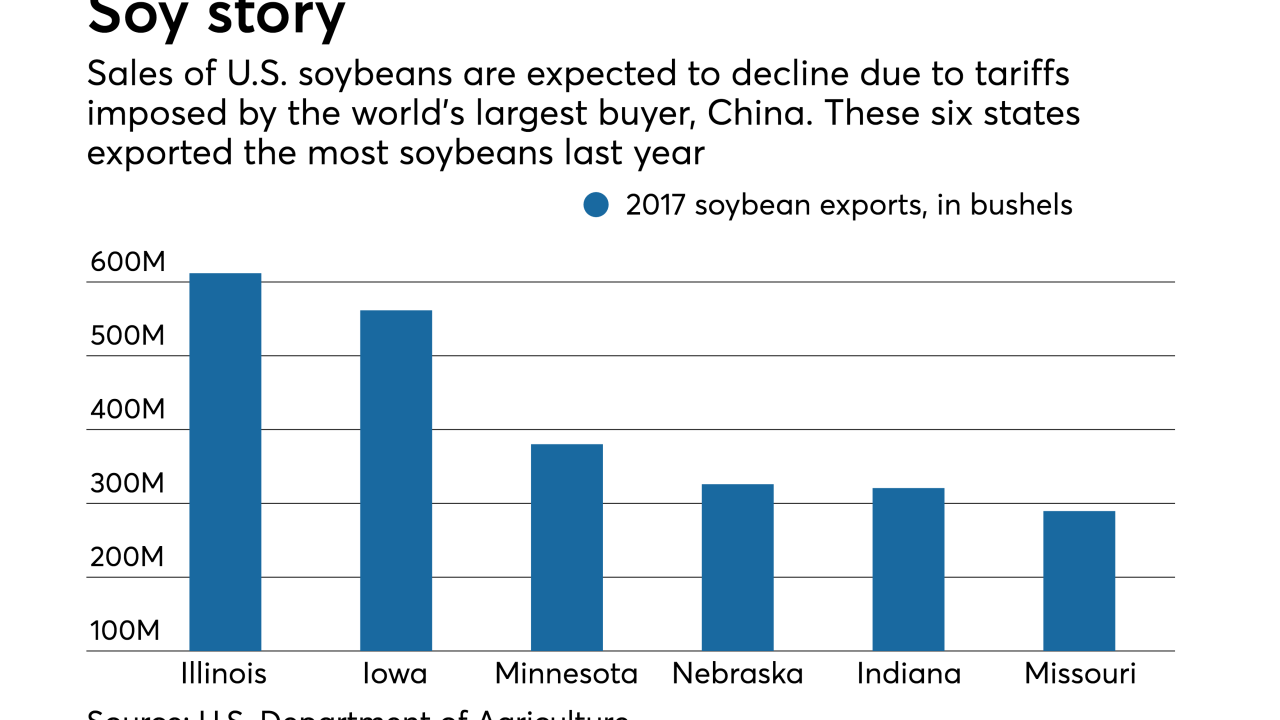

Banks are adjusting loan terms, making use of federal loan guarantees and working with farmers to find new markets, all in an effort to mitigate the damage from a likely drop in soybean exports.

July 11 -

The New York State Department of Financial Services report recommended putting online lenders on a more equal playing field with traditional firms.

July 11 -

Member Business Lending is a Utah-based provider of commercial, small business lending origination for credit unions.

July 11 -

Financial institutions are beginning to get on board with the global fight against climate change, but they are still trailing pension funds and insurance companies in putting these concerns into action.

July 11 -

The Orlando, Fla., bank has bought Allied Affiliated Funding in Dallas in an effort to branch out beyond traditional commercial and consumer lending.

July 10 -

The Senate bill, designed to close a loophole in the state's interest rate cap, must still be reconciled with a similar measure that was passed by the Ohio House of Representatives.

July 10 -

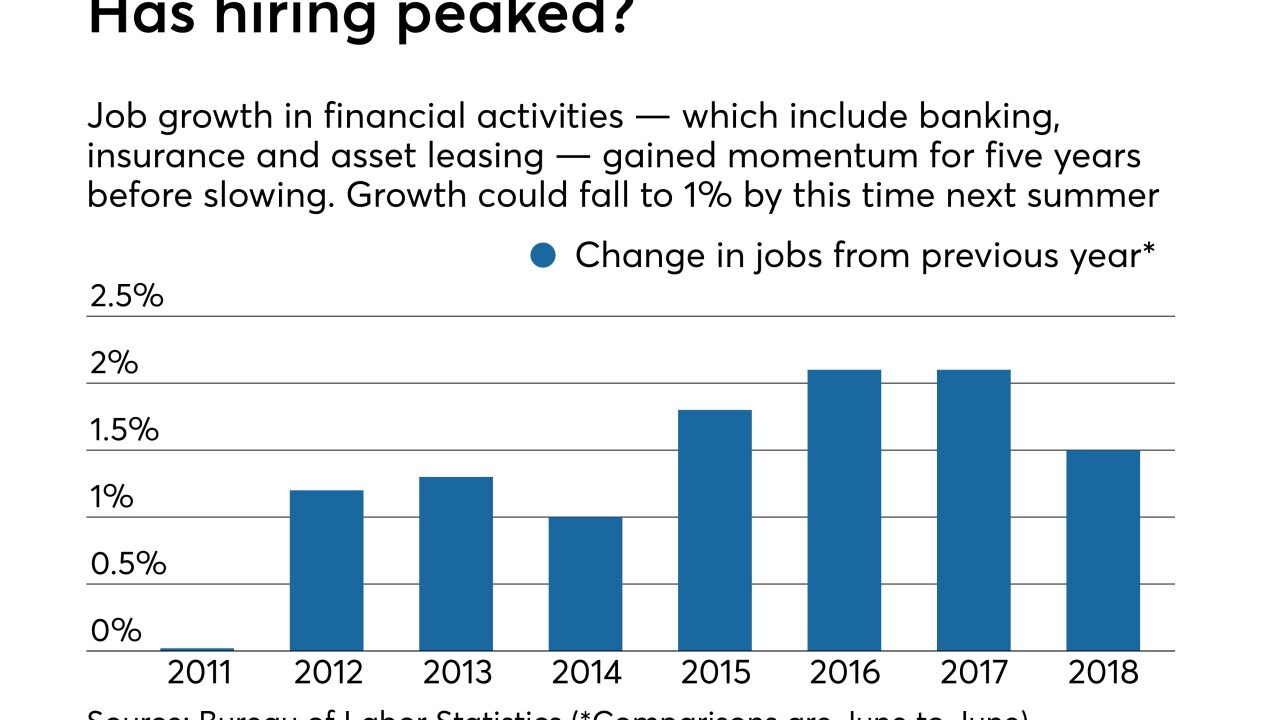

A tighter labor market and declining demand for compliance employees are expected to slow down hiring at banks in the coming year.

July 9