-

The move allows the New York multifamily lender to make more loans without having to raise capital.

November 15 -

Sen. Elizabeth Warren said regulators are failing to respond to what she thinks could be a new meltdown in the making: the trillion-dollar market for leveraged loans.

November 15 -

Tepid loan and deposit growth has been a persistent theme in 2018, but that could soon change for community and regional banks in the New York and Washington markets.

November 14 -

The FDIC is seeking comment on how to encourage small-dollar lending at banks, signaling a course change from guidance it issued five years ago restricting such loans.

November 14 -

The online lender will roll out its first new product in 12 years, a home equity line of credit. But it's taking a different approach than with its original offering.

November 14 -

While they won’t be in position to enact legislation, House Democrats could use their newfound power to spotlight issues that Republicans have largely ignored, including the exploding levels of corporate debt.

November 13 -

Entrepreneurship among veterans has been declining over the past 20 years, according to a report by the SBA and the New York Fed.

November 12 -

What the Democrats' House takeover means for banks; Synchrony has a lot to lose in fight with Walmart; should industry fear Waters-led banking panel?; and more from this week's most-read stories.

November 9 -

Entrepreneurship among veterans has been declining over the past 20 years, according to a report by the SBA and the New York Fed.

November 9 -

Readers sound off on the 2018 midterm election results, OCC's Otting defending his agency's right to charter fintechs, and predictions the plastic credit card is nearly dead.

November 8 -

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks and credit unions rally and fend off the insurgents?

November 8 -

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks rally and fend off the insurgents?

November 7 -

Reversing a previous order, the Texas judge granted part of the bureau's request to stay the effective date and allow time for the agency to work on changes to the rule.

November 7 -

The head of the agency developing the special-purpose federal license said the process is moving forward “independent” of legal challenges mounted by state regulators.

November 7 -

The San Francisco company, which has racked up big losses over the last two and a half years, signaled Tuesday that it is on a path to profitability after resolving a series of longstanding regulatory problems.

November 6 -

The Atlanta-based consumer lender, which partners with both retailers and banks, cited a higher-than-expected cost of funds as one reason for its less rosy forecast.

November 6 -

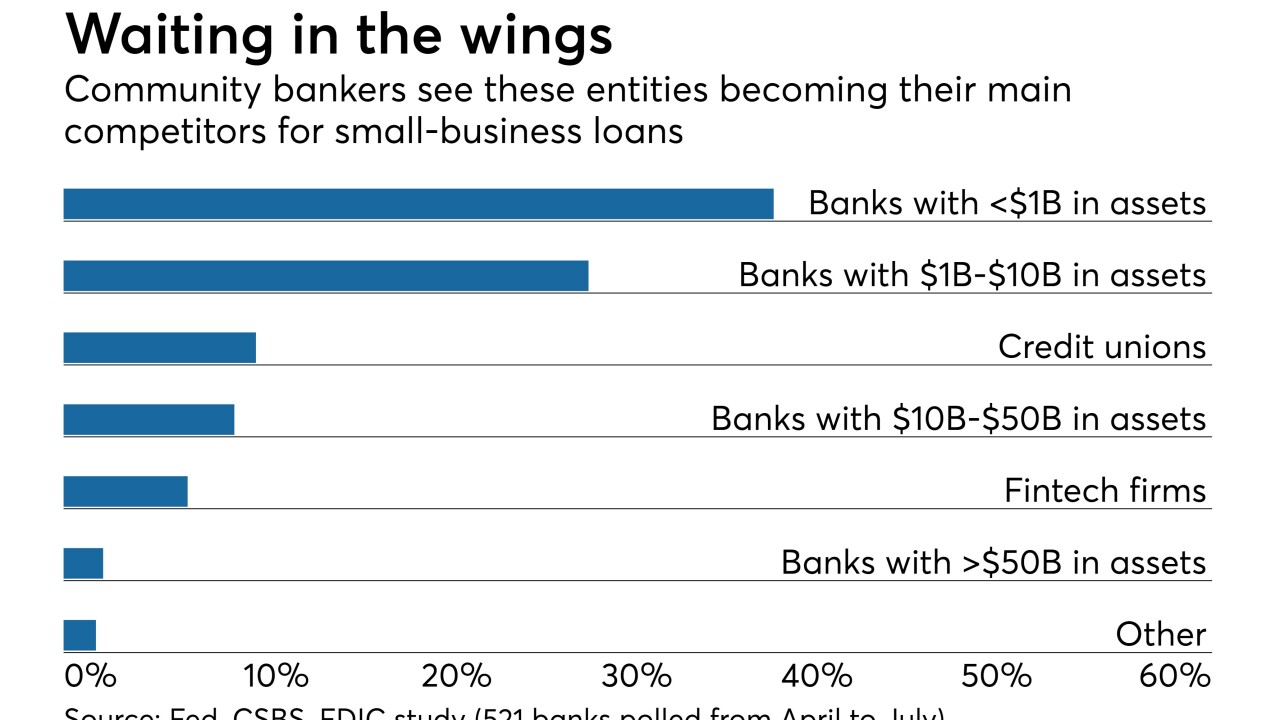

Big banks and fintechs are aggressively adding digital capabilities to process applications quickly, creating a sense of urgency for community banks.

November 6 -

The New York-based online lender plans to spend an additional $15 million next year, largely on bank partnerships and international expansion.

November 6 -

Can farmers — and the banks that lend to them — survive Trump's trade war?

November 5 -

Heightened competition from nonbanks, the rise of populism and the uncertainty surrounding Libor’s demise are just some of the short- and long-term threats facing big banks, risk executives say.

November 2