-

The $487 million deal would be OceanFirst's fourth, and largest, acquisition in its home state since 2015.

June 30 -

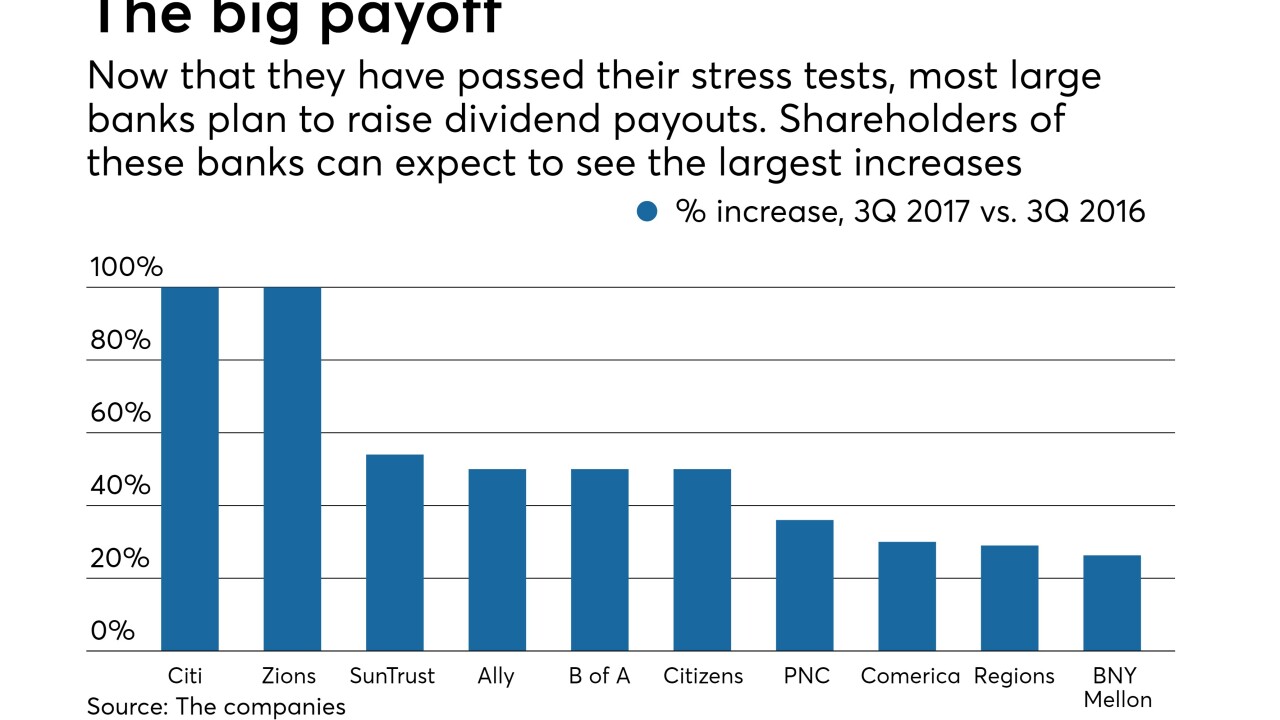

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

Despite the digitization of transactions, customers still need personal bankers. But financial institutions must adapt to specialize in problem-solving instead of sales.

June 1 Resurgent Performance

Resurgent Performance -

Thanks to the Federal Reserve's unwinding of post-crisis policies, the next wave of mergers will be driven in part by a drop in deposits.

May 26 Adjoint

Adjoint -

JPMorgan Chase has some advice for regional banks: A deposit drain is coming, so merge while you can.

May 9 -

The biggest bank M&A agreement of the year might not have happened if the buyer, Sterling Financial, had refused to prove to Astoria Financial that it had thoroughly vetted the deal with regulators.

April 26 -

The number of U.S. banks has fallen by 24% since the end of 2010, a result of mergers, failures and a dearth of de novo activity. Here are the 10 states with the biggest declines as a percentage of total banks headquartered in the state, according to Federal Deposit Insurance Corp. data.

April 13 -

It took several offers for First Busey to seal a deal to buy First Community Financial Partners, and the details in a recent public filing of the back and forth between the two Illinois banks show how patience in merger negotiations is a must.

March 23 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

March 10 -

Regulators ought to make it easier for smaller institutions to merge, the CEO of the country's largest said Tuesday.

February 28 -

The failure of Seaway Bank, once the nation's biggest black-owned bank, cost the FDIC $57.2 million.

January 27 -

The New York company may struggle with profitability as it decides whether to find a new buyer.

January 26 -

The phrase “it is what it is” came up several times as CEO Joseph Ficalora addressed analysts’ questions about nixing plans to buy Astoria and the challenges of getting another deal done.

January 25 -

The company wants a big deal to help push it over $50 billion of assets, at which point it will be considered systematically important.

January 25 -

First Merchants in Muncie, Ind., has agreed to buy Arlington Bank in Upper Arlington, Ohio.

January 25 -

Heritage Oaks in California ended talks with an unnamed institution when it couldn't get a response on a regulatory concern.

January 24 -

Why one small credit union in Wisconsin thought its best option was to seek out a much larger credit union to with which to merge.

January 23 -

To succeed, the Tennessee company must build on momentum created by BNC, the bank it just agreed to buy.

January 23 -

CEOs at several regionals have decided to sit on the sidelines so they can digest recent big acquisitions, while others are contemplating going for more deals provided they find lower-risk opportunities.

January 19 -

The Cleveland company also had a record quarter for its investment banking business.

January 19