-

Rather than jump right away into lending to car buyers, Access National will start by offering CRE and M&A financing to dealerships.

January 5 -

The people-helping-people model proffered by LendingClub and others quickly foundered, but several startups aim to bring it back with the help of distributed ledger technology.

January 4 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

Credit unions make strategic hires, promotions to beef up their loan departments and other professionals in the news.

January 3 -

Helping young employees pay down student debt is a more meaningful benefit than pingpong tables at work or free beer.

January 3 -

Fannie Mae's serious delinquency rate climbed to a high not seen since March 2017, but remained lower than it was 12 months prior.

January 2 -

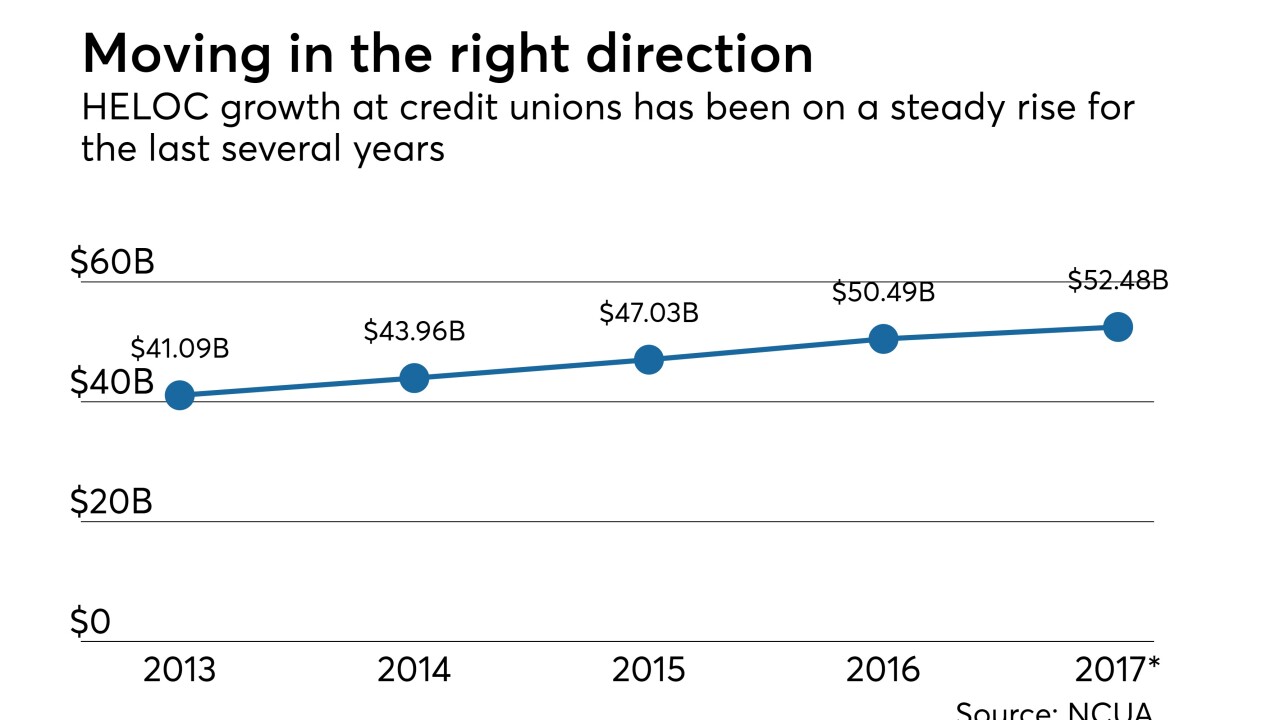

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing the risk for banks and credit unions.

January 2 -

The digitally savvy lender MyBucks, which has lent money through a smartphone app and chatbots on WhatsApp and Facebook Messenger, could be a good role model for U.S. banks thinking of using AI in credit decisions.

December 28 -

State and federal regulators finally approved the Mississippi bank’s acquisitions of Ouachita Bancshares and Central Community after anti-laundering and CRA matters were resolved. BancorpSouth’s CEO says he may pursue more deals.

December 28 -

They aren't creating new products, but some lenders are advising cash-strapped customers in high-tax states to tap home equity or other credit lines to prepay property taxes before the new tax law kicks in.

December 28 -

Credit union examiners will be focused on cybersecurity, BSA compliance, fraud prevention and more.

December 27 -

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing banks’ risk.

December 26 -

Both in dollar and transaction volume, credit card use is growing at a faster pace than debit use, but one industry group predicts that overall credit union lending could decline in 2018

December 26 -

Some were sold at discounted prices, while others were shut down by their acquirers or quietly ceased doing business.

December 25 -

Both in dollar and transaction volume, credit card use is growing at a faster pace than debit use. Much of the growth is coming from affluent consumers who value rewards like 2% cash back on purchases.

December 22 -

Though Marlene Caride has no direct experience in the banking industry, she could play a key role in carrying out Governor-elect Phil Murphy’s pledge to create a public bank in the Garden State.

December 21 -

Holiday loans are up significantly at Blue Federal Credit Union this year thanks to improvements to the CU's mobile and online banking apps that allowed members to apply for -- and fund -- loans in a matter of minutes.

December 21 -

Regional and community banks will offer low-cost or no-cost financial products through Bank On, which has already reached agreements with Regions Bank, Wells Fargo and SunTrust.

December 20 -

BankMobile, the digital-only subsidiary of Customers Bank in Wyomissing, Pa., is planning to use software by Upstart to offer its first credit product to graduates and other young consumers with little to no credit history.

December 20 -

This year has been very good to regional banks, bitcoin investors and several bank CEOs who pulled off big deals or successfully refined business models.

December 19